Initial Claims for Unemployment Benefits Drop Below One Million

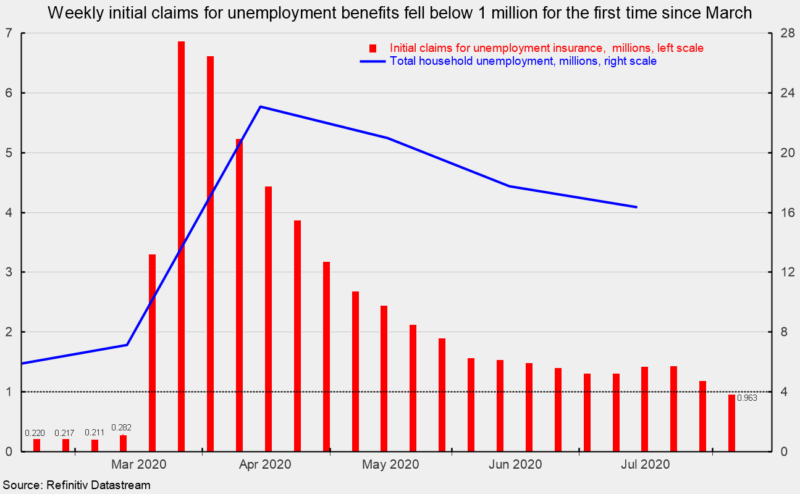

For a second week, initial claims for unemployment benefits maintained a downward trend that was interrupted by two weeks of slight increases in July. The latest drop pushes the total number of initial claims below the one million level for the first time since March 14 (see chart). Despite the mild downtrend, there are lingering concerns and a high level of uncertainty about the labor market recovery and economic growth overall. The longer restrictions on economic activity are in place, the higher the uncertainty regarding economic recovery.

Initial claims for unemployment insurance totaled 0.963 million for the week ending August 8, a fall of 228,000 from the previous week’s 1.191 million. The results end a run of twenty consecutive weeks of historically massive claims above one million following the implementation of business and consumer lockdowns intended to fight the COVID-19 pandemic. Prior to the lockdowns, initial claims were running around 230,000, less than one-fourth of their current level.

The number of ongoing claims totaled 15.5 million for the week ending August 1, down 604,000 from the prior week. The insured unemployment rate was 10.6 percent, down from 11.0 percent in the prior week.

The national Employment Situation report for July was released on Friday, August 7 and showed a gain of 1.8 million jobs. The total number of officially unemployed fell to 16.34 million in July, a drop of 1.4 million from the 17.75 million in June (and from 21.0 million in May and 23.1 million in April – see chart). The number of officially unemployed in February before lockdowns were implemented was just 5.8 million, as reported in the household survey portion of the report. For comparison, the peak number of unemployed during the last recession, The Great Recession, was 15.4 million.