Easing Restrictions Helps Boost Retail Sales in May

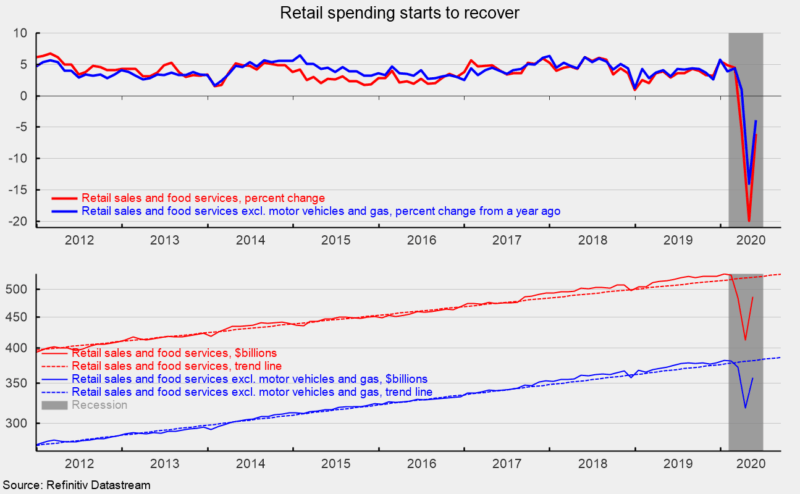

Retail sales and food-services spending posted a record gain in May, rising 17.7 percent from the prior month following a 14.7 percent drop in April and an 8.2 percent decline in March. The gains likely reflect the easing of restrictions on many businesses across the economy. Excluding the volatile motor vehicle and gas categories, core retail sales and food services were up 12.4 percent in May after a fall of 14.4 percent in April. Over the past year, total retail sales and food services were still down 6.1 percent in May while core retail sales and food services are 3.9 percent below year ago levels (see top of first chart). The May gains still leave total retails sales 7.3 percent below the eight-year trend while core retail sales are 6.3 percent below trend (see bottom of first chart).

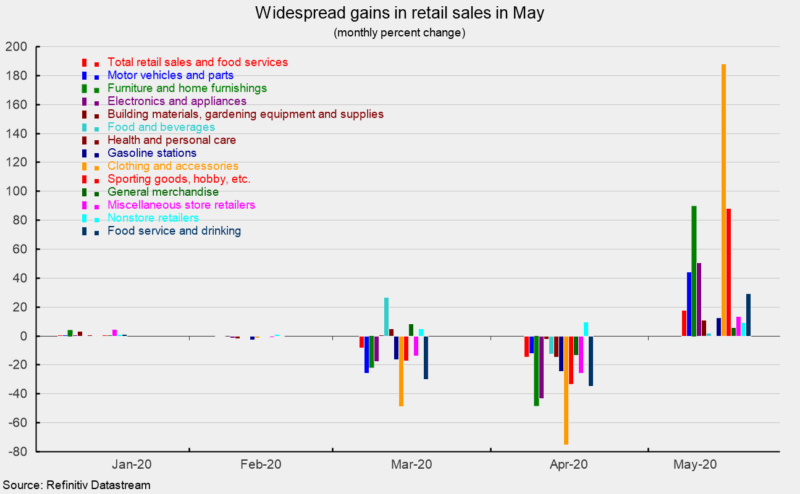

Gains were broad-based across industries led by a 188.0 percent surge for clothing and accessory stores, followed by an 89.7 percent rise in furniture and home furnishings, an 88.2 percent jump in sporting-goods, hobby, musical-instrument, and bookstores, a 50.5 percent leap for electronics and appliance stores, a 44.1 percent increase for motor vehicle and motor vehicle–parts dealers, and a 29.1 percent gain for food services (see second chart).

Nonstore retail sales rose 9.0 percent for the month and along with building materials, gardening equipment and supplies dealers, food stores, and sporting goods, are the only major categories to show a gain from a year ago, rising 30.8 percent, 16.4 percent, 14.5 percent, and 4.9 percent, respectively.

Retail sales rebounded sharply in May as the effects of widespread quarantines and lockdowns were eased. Businesses and consumers are coming out of the policy-induced economic coma but a full return to pre-pandemic conditions is likely many months, and possibly many quarters, away though some industries and sectors of the economy will recover more quickly than others.