Manufacturing Survey Less Negative in May

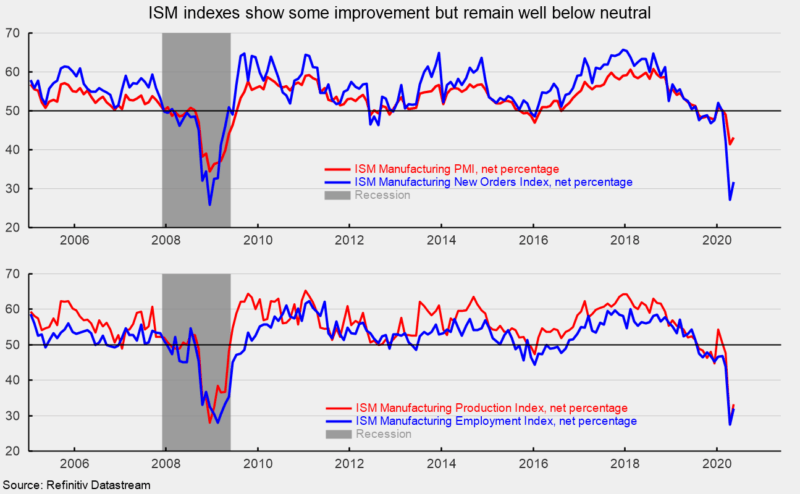

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index improved slightly, registering a 43.1 percent reading in May, up from 41.5 percent in April. The May result is the third month in a row below the neutral 50 threshold (see top chart) but the first improvement following three consecutive declines and 11 declines in the last 14 months. Overall, the report notes, “Three months into the manufacturing disruption caused by the coronavirus (COVID-19) pandemic, comments from the panel were cautious (two cautious comments for every one optimistic comment) regarding the near-term outlook. As was the case in April, the PMI indicates a level of manufacturing-sector contraction not seen since April 2009; however, the trajectory improved…May appears to be a transition month, as many panelists and their suppliers returned to work late in the month. However, demand remains uncertain, likely impacting inventories, customer inventories, employment, imports and backlog of orders.”

Many of the key components of the Purchasing Managers’ Index remained near levels not seen since the lows of the Great Recession in 2008-09. The New Orders Index came in at 31.8 percent, up from 27.1 percent in April (see top chart). The results suggest production as measured by the Federal Reserve’s industrial production for manufacturing index may show steep declines in the coming months. The New Export Orders Index came in at 39.5 percent in May, up 4.2 percentage points from a 35.3 percent result in April.

The production index was at 33.2 percent in May, up from 27.5 percent in April (April was at a new record low since the survey began in 1948, see bottom chart). The backlog-of-orders index came in at 38.2 percent in May, up from 37.8 percent in April and suggesting a third month of decline in backlogs.

The employment index rose 4.6 percentage points to 32.1 percent in May, versus 27.5 percent in April (the lowest reading since June 1949, see bottom chart). Despite the gain, the below-neutral result suggests employment in manufacturing likely fell again in May. The Bureau of Labor Statistics’ Employment Situation report for May is due out on Friday, June 5. Consensus expectations are for another large loss, estimated at around 8 million nonfarm-payroll jobs including a drop of 400,000 jobs in manufacturing. The unemployment rate is expected to jump to 19.7 percent from 14.7 percent in April.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, eased back, falling to 68.0 percent from 76.0 percent in April. Slower supplier deliveries are usually consistent with stronger manufacturing activity. However, the slower deliveries in recent months has been more a result of supply chain and logistical constraints. According to the report, “Suppliers continue to struggle to deliver, although at a weaker rate compared to April. Though some dynamics improved as the month closed, suppliers continue to be impacted by plant shutdowns, transportation challenges and the continuing difficulty in importing parts and components. The slowing in the index can also be attributed to demand weakness by panelists’ companies; this makes it easier for suppliers to meet those companies’ production schedules.”

The prices index rose 5.5 percentage points to 40.8 percent in May from 35.3 percent in April. Weaker prices were reported for chemicals, plastics, steels, aluminum, copper, and distillates. Customer inventories in May are still considered too low, with the index remaining below 50 at 46.2 percent versus 48.8 percent in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 44 consecutive months.