Nonresidential Construction Weighed Down by Private Sector

Total construction expenditures fell 0.8 percent in October with residential construction declining 0.9 percent and nonresidential spending falling 0.7 percent. From a year ago, total expenditures are up 1.1 percent with residential up 0.5 percent and nonresidential up 1.4 percent.

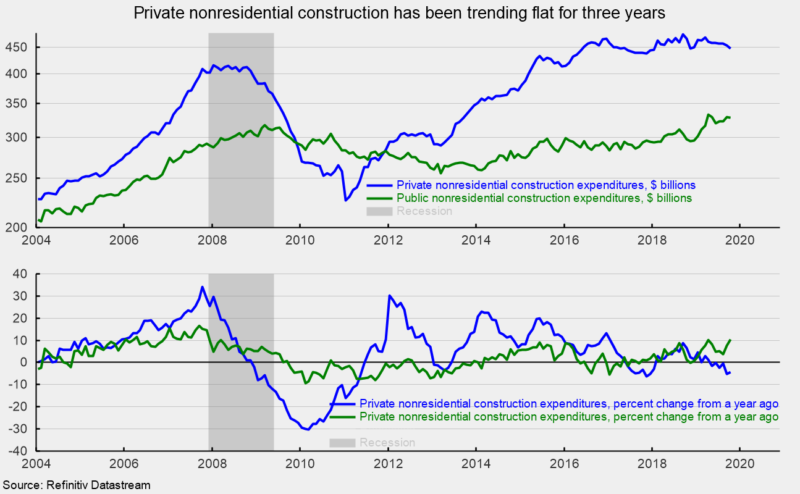

Within the nonresidential segment, private-sector expenditures were off 1.2 percent to $448.1 billion in the latest month (see top chart) and are down 4.3 percent since last October (see bottom chart). Private nonresidential construction expenditures have been essentially flat since mid-2016, though they are holding near record-high levels (see top chart again).

Within the private nonresidential segment, the weakest expenditure category was amusement and recreation, down 4.1 percent for the month and 18.3 percent from a year ago. Commercial structures, educational structures, and religious structures all have double-digit percentage declines from a year ago. The strongest performances were for power structures and health care structures, up 3.6 percent and 2.4 percent from a year ago, respectively.

Public nonresidential expenditures totaled $328.5 billion in October, down 0.1 percent from September but a robust 10.4 percent ahead of 2018 levels. Among the public construction expenditure categories, every category shows a gain from a year ago except for health care (down 3.3 percent for the period). In total, seven of the 12 categories show double-digit growth from a year ago, four had single-digit growth and just one showed a decline. Leading the gains were power structures (up 22.4 percent from a year ago), commercial structures (up 19.7 percent), sewage and waste disposal (up 19.4 percent), water supply (up 17.8 percent), office structures (up 16.5 percent), and transportation (up 13.0 percent).

Overall, nonresidential construction continues at a high level though the broader trend is essentially flat. Concerns about the economic outlook may be restraining private-sector expenditures. Offsetting the softness are solid gains in public-sector expenditures, supported by infrastructure spending.