Manufacturing Output Retreated in January as Vehicle Production Plunged

Industrial production fell 0.6 percent in January, following a 0.1 percent gain in December. Over the past year, industrial production is up 3.8 percent. Total capacity utilization decreased 0.6 percentage points to 78.2 percent as capacity posted a 0.2 percent gain for the month.

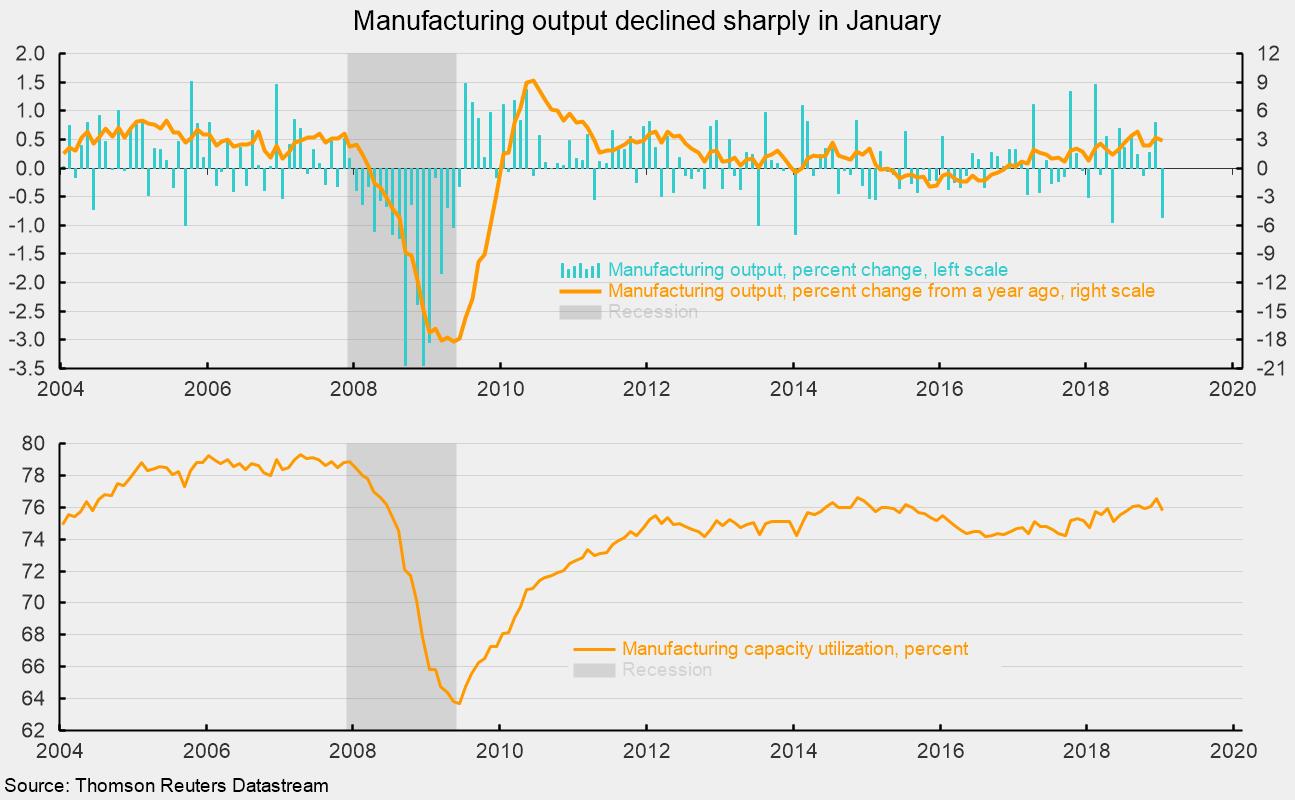

The drop in industrial production was driven by the manufacturing sector, which accounts for about 74 percent of total industrial production. Manufacturing output sank 0.9 percent for the latest month, the largest monthly drop since May 2018 (see chart). Over the past year, manufacturing output is still up 2.9 percent, roughly in line with the slow acceleration in growth since 2016 (see chart). Mining output posted a modest gain for the month, rising 0.1 percent, while utilities output rose 0.4 percent in January. Over the past year, mining output is up 15.3 percent while utilities output is down 5.6 percent.

Manufacturing-sector weakness was led by a sharp fall in production of motor vehicles and their parts. Total production was down 8.8 percent for the month as vehicle assemblies fell 13.7 percent to 10.59 million at a seasonally adjusted annual rate. All segments of vehicles showed declines for the month with automobile assemblies falling 15.0 percent to 2.61 million, light trucks falling 13.0 percent to 7.66 million, and medium and heavy trucks dropping 20.0 percent to 0.32 million.

The drop in motor vehicle production dragged total durable-goods production down 1.7 percent while nondurable-goods production was unchanged for the month. Within durable-goods production, only fabricated metals and furniture posted gains, rising 0.4 percent and 1.0 percent, respectively. Among nondurable-goods producers, petroleum and coal products rose 1.5 percent and plastics and rubber products gained 0.3 percent while apparel and leather goods fell 1.1 percent, chemicals dropped 0.4 percent, and food-products production declined 0.1 percent.

Measured by market segment, consumer-goods production was down 0.7 percent in January, with consumer durables off 4.5 percent and consumer nondurables up 0.4 percent. Business-equipment production fell 1.5 percent in January while construction supplies decreased 0.4 percent for the month.

Materials production (about 46 percent of output) lost 0.4 percent for the month but is up 6.3 percent from a year ago. The energy component has been a major source of volatility in this category, particularly following the collapse of energy prices in mid-2014. The non-energy component fell 0.9 percent for the month but is up 4.2 percent from a year ago.

Manufacturing capacity utilization dropped to 75.8 percent in January, down 0.7 percentage points from 76.5 percent in December.

Weak industrial output for January continues a string of disappointing economic data and justifies a cautious outlook. However, a robust labor market, reasonably high levels of consumer confidence, generally solid balance sheets for the private sector, and a neutral Fed outlook suggest continued economic expansion remains the most likely path. The major risks are primarily associated with trade policy and global economic uncertainty.