Producer Prices Rise in August

The Producer Price Index for final demand rose 0.2 percent in August following a 0.1 percent decline in July. Over the past year, the total PPI is up 2.4 percent. The PPI measures prices at various stages of production for a broad range of goods and services produced in the U.S. economy. The coverage is more comprehensive than the personal-consumption-expenditure price index or the Consumer Price Index. Personal consumption accounts for about 66 percent of the PPI.

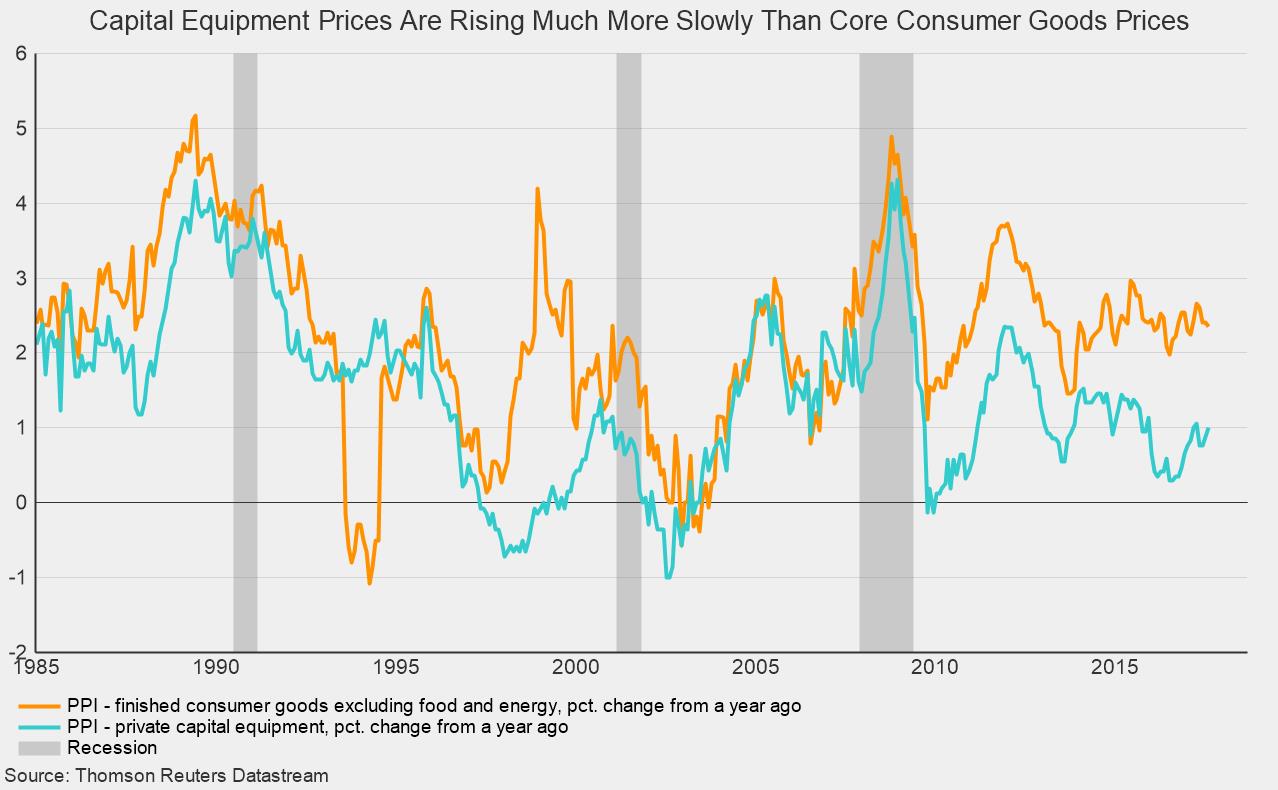

The personal-consumption portion of the PPI rose 0.2 percent in August and is up 2.3 percent from a year ago. Within the personal-consumption category, goods prices rose 0.6 percent for the month while services prices were unchanged. Energy prices were a major factor in the monthly increase as finished consumer energy prices surged 3.0 percent in the month. Excluding energy, consumer-goods prices fell 0.3 percent and are up 2.2 percent from a year ago. Finished consumer foods prices partially offset the rise in energy, falling 1.0 percent in August. Excluding both food and energy, the prices for finished core consumer goods rose 0.1 percent in August and are up 2.4 percent from a year ago. The PPI for finished core consumer goods has been increasing in the 2 to 3 percent range since the second quarter of 2014 (see chart).

Price increases for private capital equipment have been much more restrained compared to consumer goods. Those prices rose 0.1 percent in August and are up a very mild 0.9 percent over the past year. Since the end of the last recession, in 2009, the PPI for capital equipment has risen at a significantly slower pace than the PPI for finished core consumer goods (see chart again).

Many factors feed into producer prices, but with consumer spending getting support from a robust labor market, demand for consumer goods is likely to remain healthy. Conversely, capital investment has been one of the weaker areas of the current economic expansion despite low financing costs, healthy profits, and good cash flow. The tight labor market may result in more upward pressure on labor costs, incentivizing business to boost investment in order to accelerate productivity growth and offset labor-cost pressures, but for now investment demand remains tepid. Finally, the catastrophic damage from recent hurricanes may provide a temporary surge in both consumer-goods demand and capital-equipment demand, but those impacts are difficult to predict.