Durable-Goods Orders May Signal A Rebound in Capital Spending

New orders for durable goods, items intended to last three years or longer, rose 0.7 percent in March, the third monthly increase in a row. Durable-goods orders tend to be volatile from month to month, but the details in the report provide some optimism for capital investment and economic growth in general.

Over the first three months of 2017, durable-goods orders rose at an 8.1 percent annualized pace compared to a 6.8 percent pace in the final three months of 2016. The biggest driver of the acceleration was nondefense aircraft which rose 7 percent in March and increased at a 95.4 percent annual rate in the first quarter compared to a 5 percent annualized decline in the fourth quarter. Computers and electronics, machinery, and the catchall other durables categories all had strong annualized gains in the first quarter and faster gains than in the fourth quarter.

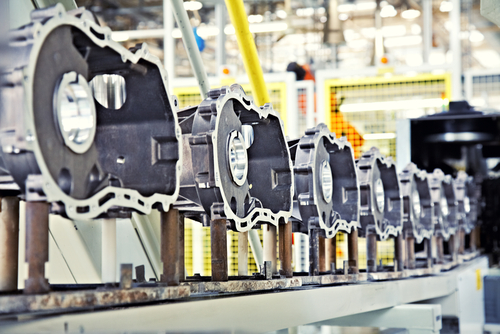

Primary metals and fabricated metals orders decelerated in the first quarter compared to the fourth quarter but were still rising at a solid pace. Among the major categories, only electrical equipment and appliances showed significant weakness in the first quarter, falling at a 4.8 percent annualized pace.

Orders for capital goods (durable goods considered to be investment) rose 2.5 percent in March and were up 4.7 percent for the first quarter. Excluding defense-related items, capital goods rose 1.2 percent in March and surged at a 16.4 percent annual rate in the first quarter, up from a 7.6 percent pace in the fourth quarter. Nondefense capital-goods orders benefitted from the strong performance of new nondefense aircraft orders. When aircraft are excluded, new orders for nondefense capital goods, an input into the calculation of gross domestic product and a key indicator for business investment, rose 0.2 percent in March and increased at a 6 percent annual rate in the first quarter, faster than the 5.5 percent pace in the fourth quarter.

On balance, the details of this report send a positive signal ahead of tomorrow’s release of first quarter GDP. The data also confirm the recent positive performance of the real new orders for capital goods excluding aircraft indicator in the AIER Leaders index. That indicator recently turned to a positive trend suggesting business investment overall may be heading in a more favorable direction. The change to a positive trend also helped boost the Leaders index, pushing it to a reading of 83 in March, the highest level in 2-1/2 years. The April update of the AIER Leaders index will be released later this month.