Initial Claims Fall for the Fifth Consecutive Week

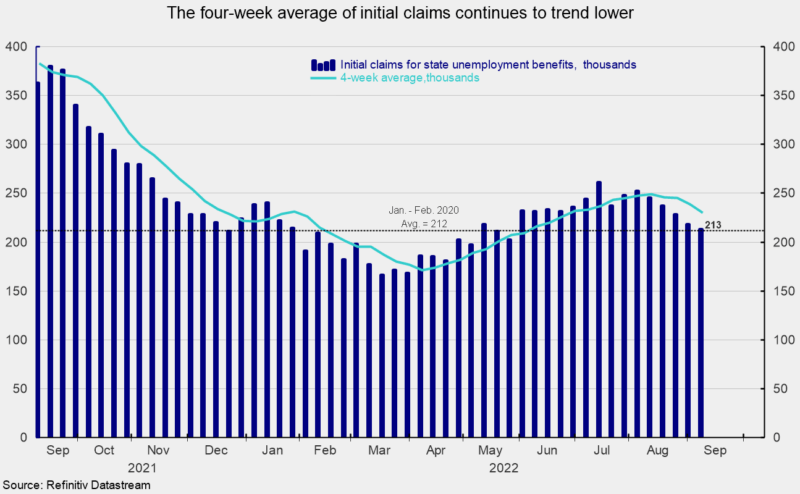

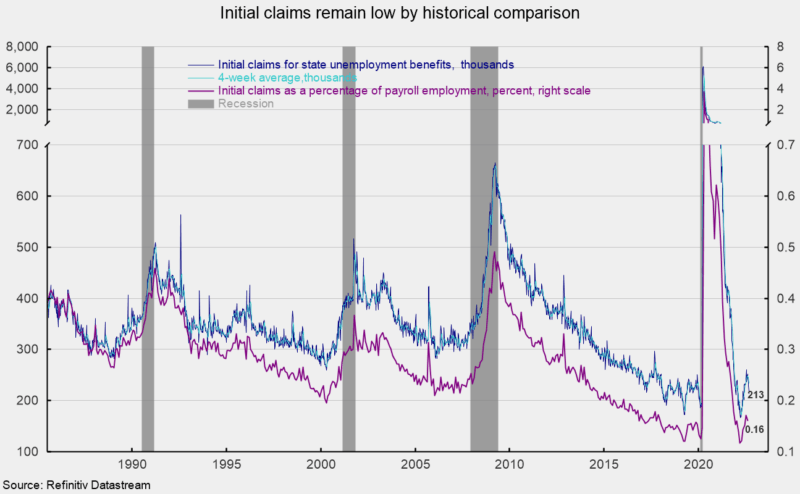

Initial claims for regular state unemployment insurance fell by 5,000 for the week ending September 10th, coming in at 213,000. The previous week’s 218,000 was revised down from the initial tally of 222,000 (see first chart). Claims have fallen for five consecutive weeks and are at their lowest level since May 28th but remained slightly above the pre-pandemic average of 212,000 for the fifteenth successive week. When measured as a percentage of nonfarm payrolls, claims came in at 0.160 percent for the month of August, down from 0.171 in July but still above the record low of 0.117 in March (see second chart).

The four-week average fell to 224,000, down 8,000 from the prior week. After showing a sustained upward trend since a recent low in early April, the four-week average has started to trend lower again. Overall, the data continue to suggest a tight labor market. However, continued elevated rates of price increases, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine represent risks to the economic outlook.

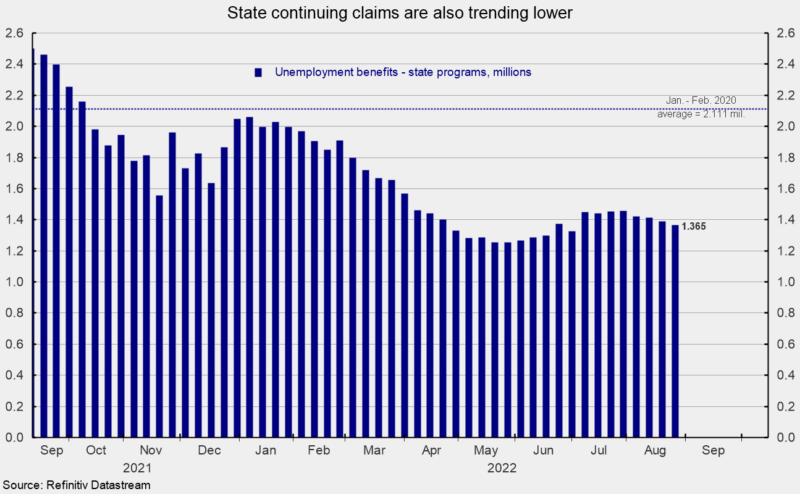

The number of ongoing claims for state unemployment programs totaled 1.365 million for the week ending August 27th, a drop of 22,533 from the prior week (see third chart). State continuing claims had been trending higher but are now trending lower again (see third chart).

The latest results for the combined Federal and state programs put the total number of people claiming benefits in all unemployment programs at 1.391 million for the week ended August 27th, a decrease of 23,420 from the prior week. The latest result is the twenty-ninth week in a row below 2 million.

While the overall low level of claims combined with the high number of open jobs suggests the labor market remains solid, both measures have recently shown some periods of weakness. The tight labor market is a crucial component of the economy, providing support for consumer spending. However, persistently elevated rates of price increases already weigh on consumer attitudes, and if consumers lose confidence in the labor market, they may significantly reduce spending. The outlook remains highly uncertain.