Pulling It All Together/Appendix

The Economy…

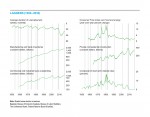

A strong dollar and slow global growth have reduced U.S. exports’ share of GDP to 12 percent, down from 13.5 percent. In terms of GDP growth, exports have contributed less than 0.5 percentage points to growth in five of the past seven quarters, including two quarters where exports subtracted from GDP growth. The U.S. economy’s already reduced dependence on exports for growth should cushion the impact of future declines.

Our Leaders index fell slightly in the latest month, with 46 percent of our leading indicators trending upward. The small decline to below the neutral 50 percent threshold once again raises concern over the durability of the current expansion. AIER researchers judge the risk of recession to be somewhat elevated but do not see a recession as likely.

…Inflation…

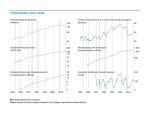

The outlook for inflation remains neutral, according to the AIER’s Inflationary Pressures Scorecard. Slightly more than half, or 13 out of 23 indicators tracked, support upward pressure on inflation, up from 10 in the previous month. The remaining 10 indicators point to downward inflationary pressure.

The Consumer Price Index (CPI) advanced 0.2 percent in May from April, slower than the 0.4 percent growth in our previous reading. The slowdown was due to falling food prices and a smaller monthly increase in energy prices.

Core CPI, which excludes volatile food and energy prices, has exhibited a much more stable trend over time. It grew 0.2 percent in May, the same pace as April, driven mostly by strong growth in the prices of services, which was also the case in the previous month.

…Policy…

The Federal Open Market Committee kept interest rates unchanged when it met on June 14–15 and lowered its outlook for the path of rate increases for the rest of the year. Events since the June meeting make it unlikely that the Fed will want to raise rates soon.

The U.S. dollar appreciated following the British referendum on EU membership, putting additional pressure on U.S. exporters, who were already struggling. The Labor Market Conditions Index, a broad measure used by the Federal Reserve, has been stuck in negative territory since January. These developments present threats to economic growth. The Fed would almost certainly not want to raise rates in July and may not do so even later in the year.

…Investing

Investors sought out safety following the Brexit vote results. Equity markets sold off as money flowed into bonds, driving prices up and yields down. Gold prices also continued the upward trend that began around the end of 2015.

On a relative basis, the U.S. still appears to be in better shape and offers better opportunities, both in equity appreciation and fixed-income yields, than most other markets around the world.

Next/Previous Section:

1.Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix