June Business Conditions Monthly

Our index of leading indicators rebounded nicely in May, rising to 64 following three months at the neutral 50 level. Combined with a stronger 84 reading from our score of cyclical leaders (up from 79 in April), the results suggest a receding risk of recession. The improvement comes as the Bureau of Economic Analysis (BEA) said the U.S. economy shrank at a 0.7 percent annual rate in the first quarter. Amid few positive signs, our analysis has pointed to temporary factors for the winter weakness. We expect moderate expansion to resume.

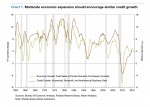

A return to moderate growth would build on sound fundamentals for key components of demand: consumer spending, business investment, and to a lesser degree, residential housing. If these areas meet expectations, the economy should expand at a moderate pace, spurring growth in private nonfinancial-sector credit (Chart 1). This rise is normal in an expanding economy, providing opportunities for borrowers to manage balance sheets. It also gives credit investors an option for lower-risk returns and broadens business and profit growth opportunities for commercial lenders.

Next/Previous Section:

1. Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix

[pdf-embedder url=”https://www.aier.org/wp-content/uploads/2015/06/BCM_June2015.pdf“]