Mixed Signals In the Revised GDP Report

The economy grew faster at the end of 2015 than we previously thought, but a deeper look at the data uncovers a mix of good and worrying signs.

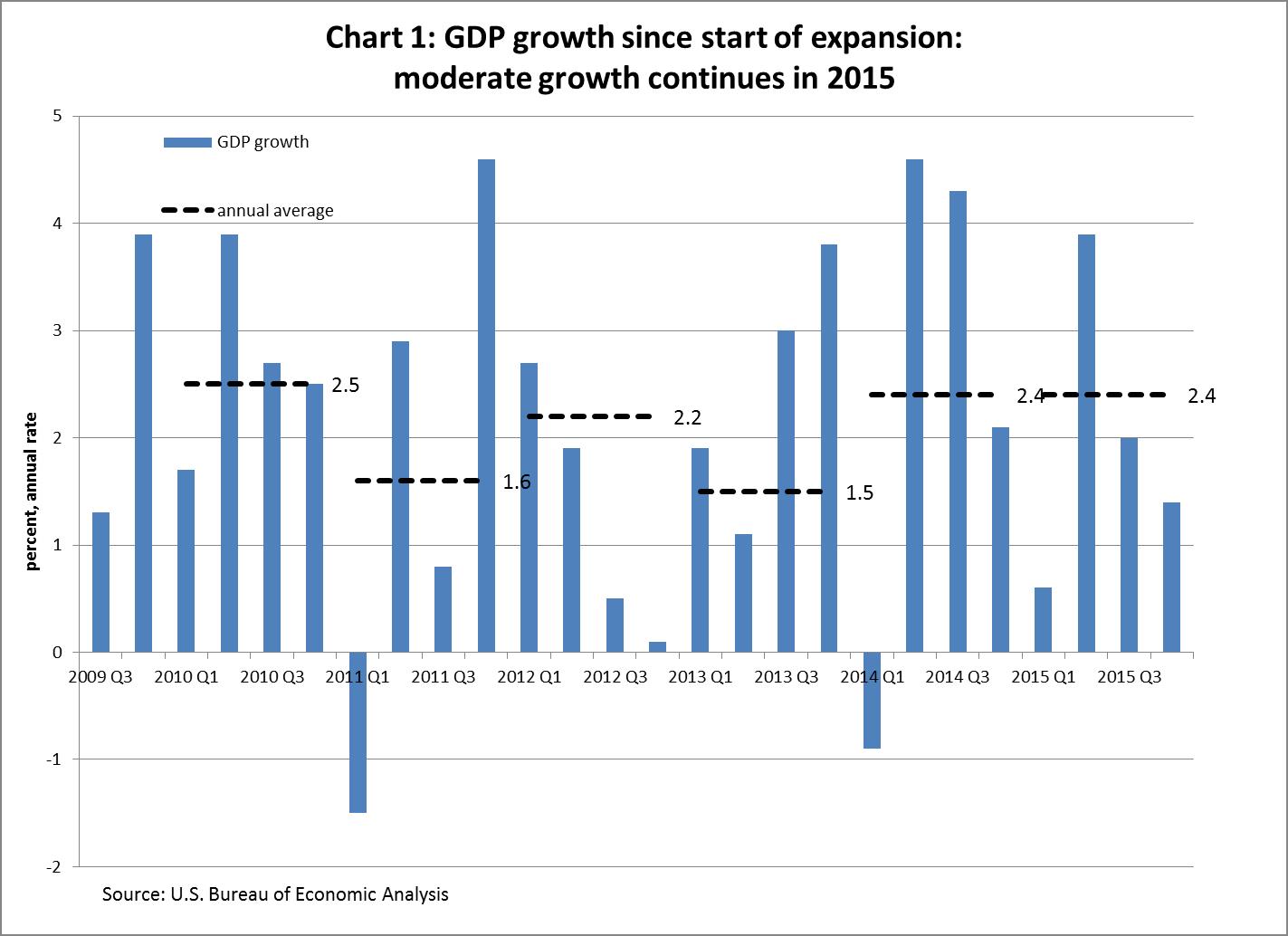

According to the revised estimates, released today by the Bureau of Economic Analysis, the U.S. gross domestic product rose 1.4 percent (annual rate) in the fourth quarter of 2015, up from the previously reported 1 percent. The average GDP growth for all of 2015 remains at 2.4 percent, same as in 2014. (See chart 1).

A look at the major components of GDP lets us see what drives the growth.

The growth rate of personal consumption expenditures, which account for about two thirds of GDP, was revised upward – from 2 percent in the earlier estimate to 2.4 percent (annual rate). This was primarily due to faster growth in the consumption of services. Spending on services is usually quite stable, unlike spending on durable goods, for example. Thus a faster growth is likely to indicate a longer-lasting trend of increased spending – a positive sign. At the same time the growth in the consumption of nondurable goods (like food, apparel, footwear and gasoline), also a fairly stable component of consumption, slowed – a worrying sign.

The revised numbers indicate that gross private domestic investment, which includes business spending on equipment and structures as well as residential construction, fell more than we previously thought. In the fourth quarter of 2015 it declined 1 percent (annual rate), compared to an earlier estimate of a 0.7 percent decline. Investment in business equipment and especially in intellectual property products was weaker than the earlier estimates indicated. But, on a positive note, investment in residential structures grew faster than was previously believed, adding 10.1 percent (annual rate) in the last quarter of 2015, up from an earlier estimate of 8 percent.

The revised data also show that exports did not shrink as much as we thought and imports shrunk more than we thought. In the fourth quarter of 2015, exports fell 2 percent (annual rate) instead of the previously reported 2.7 percent, and imports fell 0.7 percent instead of 0.6 percent reported earlier. Both are good signs for the U.S. economy, implying stronger demand for U.S. products than the earlier estimates suggested. As a result, net exports (exports minus imports) did not subtract as much from U.S. GDP growth as we originally thought.

While the negative contribution of net exports to GDP growth is fairly standard for the U.S. (this country tends to import more things than we export), the negative contribution from investment is worrying. An essentially zero contribution from government spending is not helping either. (See chart 2).

Finally, the revised data show slower growth in real disposable personal income, which represents the funds people have available to spend (income after taxes have been paid and government transfers, if any, received). The latest data show that disposable personal income rose 2.3 percent (annual rate) in the fourth quarter of 2015, slower than the previously reported 2.5 percent growth. But even after this downward revision, for all of 2015 personal disposable income grew faster, at 3.4 percent, than it did in 2014 (2.7 percent). This growth is also faster than in any year since the start of the current business-cycle expansion in the middle of 2009. If people see steady and improving growth in their disposable income, faster growth in spending, and thus in GDP, is likely to follow.