Why Auto Sales Are Up

Increased sales of both cars and light trucks have been supported by improvements in both the labor market and financing conditions.

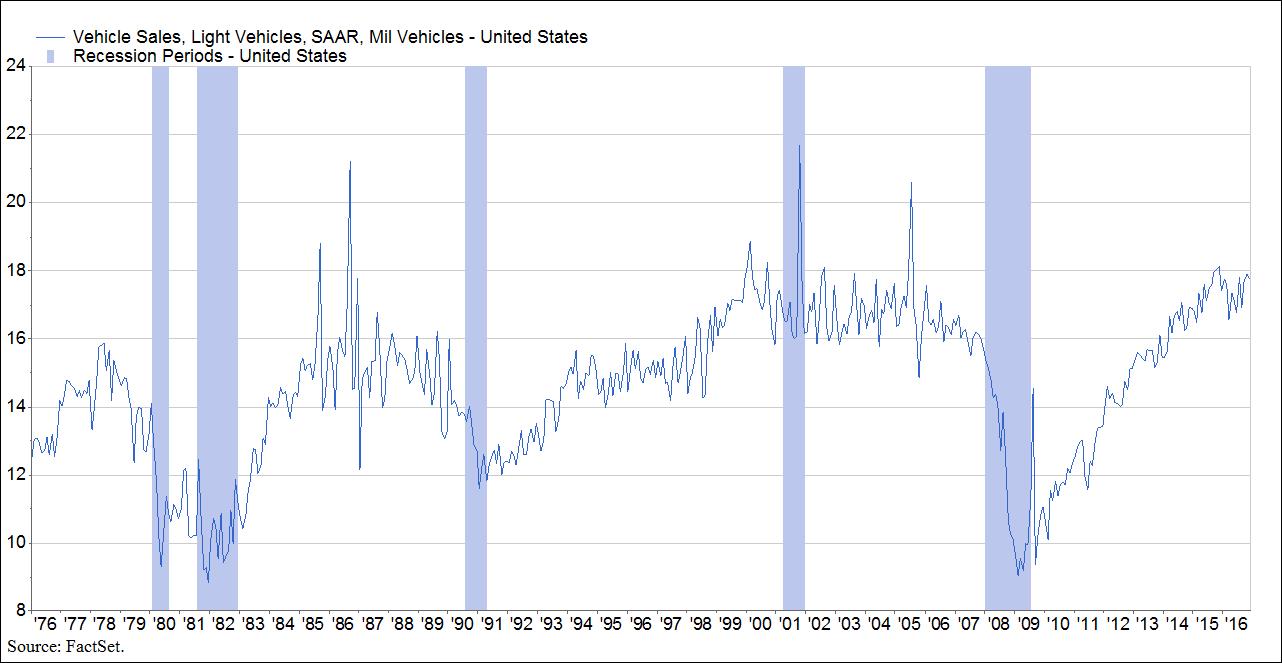

Cars and light trucks in the U.S. sold at an annual rate of 17.7 million in November, according to information released by Autodata last week. That marks a solid increase from the spring, when vehicles sold at an annual rate of 16.5-17.1 million.

The U.S. economy has added an average of 188,000 jobs each month over the past year. Even with brisk hiring, data on job openings released this morning remains elevated, suggesting continued job gains. Layoffs are subdued, with initial claims for unemployment insurance as a share of employment are at an all-time low. The unemployment rate fell to 4.6 percent in November, its lowest point since the recession. Solid employment prospects have helped some consumers qualify for auto loans.

According to the Federal Reserve’s Senior Loan Officer Survey, auto financing conditions have improved. Over the past three months, loan officers reported that credit score requirements and down payment requirements for auto loans are little changed. Loan officers also reported that maturities for auto loans were lengthened. Loan officers at small banks reported offering lower interest rates. Auto loan delinquency rates have been stable at 3.4 percent, markedly improved from the 5 percent rate in recent years.

Click here to sign up for the Daily Economy weekly digest!