Which Inflation Rate Is Relevant For You?

The Federal Reserve Bank of Atlanta offers a customized price index based on demographic characteristics. But for households planning a budget, AIER’s Everyday Price Index may prove more useful.

Prices rise over time – this has been the fact of life for most of our lifetimes. But not all prices rise at the same pace. To get a sense of the overall pace of price increases, multiple prices are usually combined into a single measure, a price index.

The most widely used such measure, the Consumer Price Index (CPI) compiled by the Bureau of Labor Statistics, combines prices of hundreds of goods and services purchased by urban American households. According to the CPI, in April 2015 prices rose 0.1 percent, and during the 12 months ending in April they had fallen 0.1 percent.

But the experience of any given person can be quite different from these numbers, because the CPI averages prices of a vast number of goods and services. To give just one example, CPI captures the cost of housing by averaging the cost of owning a home and the cost of renting one. The weights in this average reflect approximately the proportion of Americans who rent and the proportion of those who own their home. In reality, of course, any given person either owns his or her home or rents one, so only one component of this average applies.

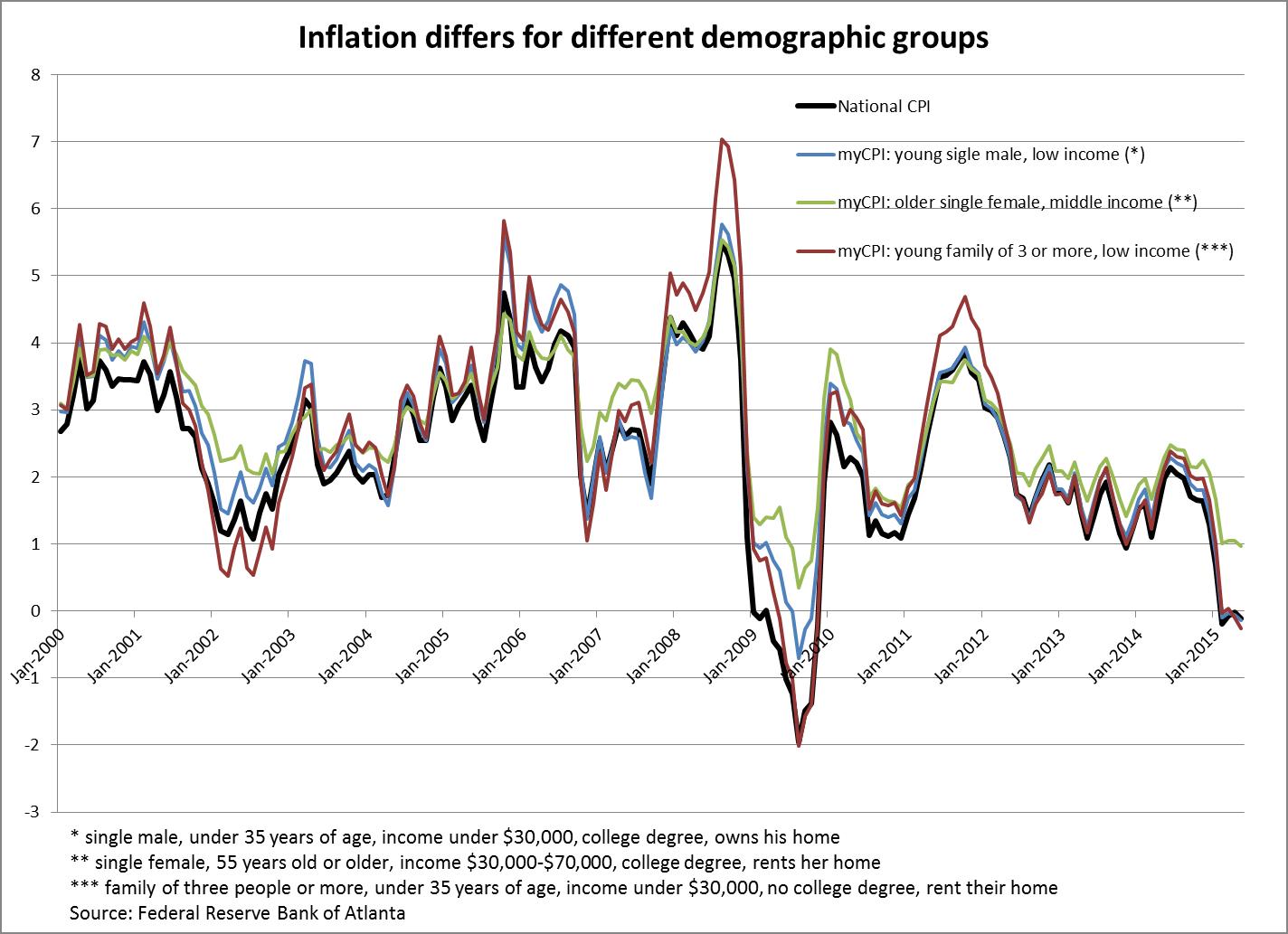

To account for this and other differences between people, the Federal Reserve Bank of Atlanta created myCPI – a tool that customizes the national CPI by taking into account six characteristics: size of the household, gender, age, income, education level, and renter/homeowner status. The chart below shows the inflation rate (12-month percent change) based on the national CPI and three sample myCPI indexes for various demographic groups.

As the chart shows, various groups experience inflation rates that are quite different. This has to do with different spending patterns. For example, people older than 55 tend to spend more on medical care than younger people, and medical costs tend to rise faster than other prices. This helps explain why myCPI shows higher inflation for a single female aged 55+ than it does for the other categories.

The more personalized price index given by myCPI might be a better measure than the standard CPI of the overall price changes faced by certain groups. But it might not be the measure most helpful in budgeting for one’s necessary expenses. AIER has suggested a different measure, the Everyday Price Index, which we have published since 2012.

Not all expenditures are created equal. Some purchases, such as buying a new smartphone or a piece of furniture, can be planned for, or postponed if need be. Other expenses can be made predictable by long-term contracts, such as rent or mortgage payments.

But there are purchases that are difficult or impossible to postpone, and prices that cannot be fixed by a long-term contract. These are what we may call everyday goods and services – food, gasoline, utilities, housekeeping supplies, personal care products, and the like. People have to buy these things on a regular basis and pay whatever the price happens to be on the spot.

Price increases in these everyday products are particularly painful for household budgets since they have to be absorbed when they happen. Knowing the trend in these prices may be more helpful for people in planning their budgets.

To capture the trend in the everyday prices, AIER’s Everyday Price Index (EPI) includes only the prices of goods and services that are purchased frequently and whose prices cannot be fixed by a long-term contract. It excludes prices of big-ticket items, such as cars, appliances or furniture, and excludes the cost of housing (rent or mortgage), which is usually contractually fixed. (See here for more on the EPI methodology and the detailed list of its components.)

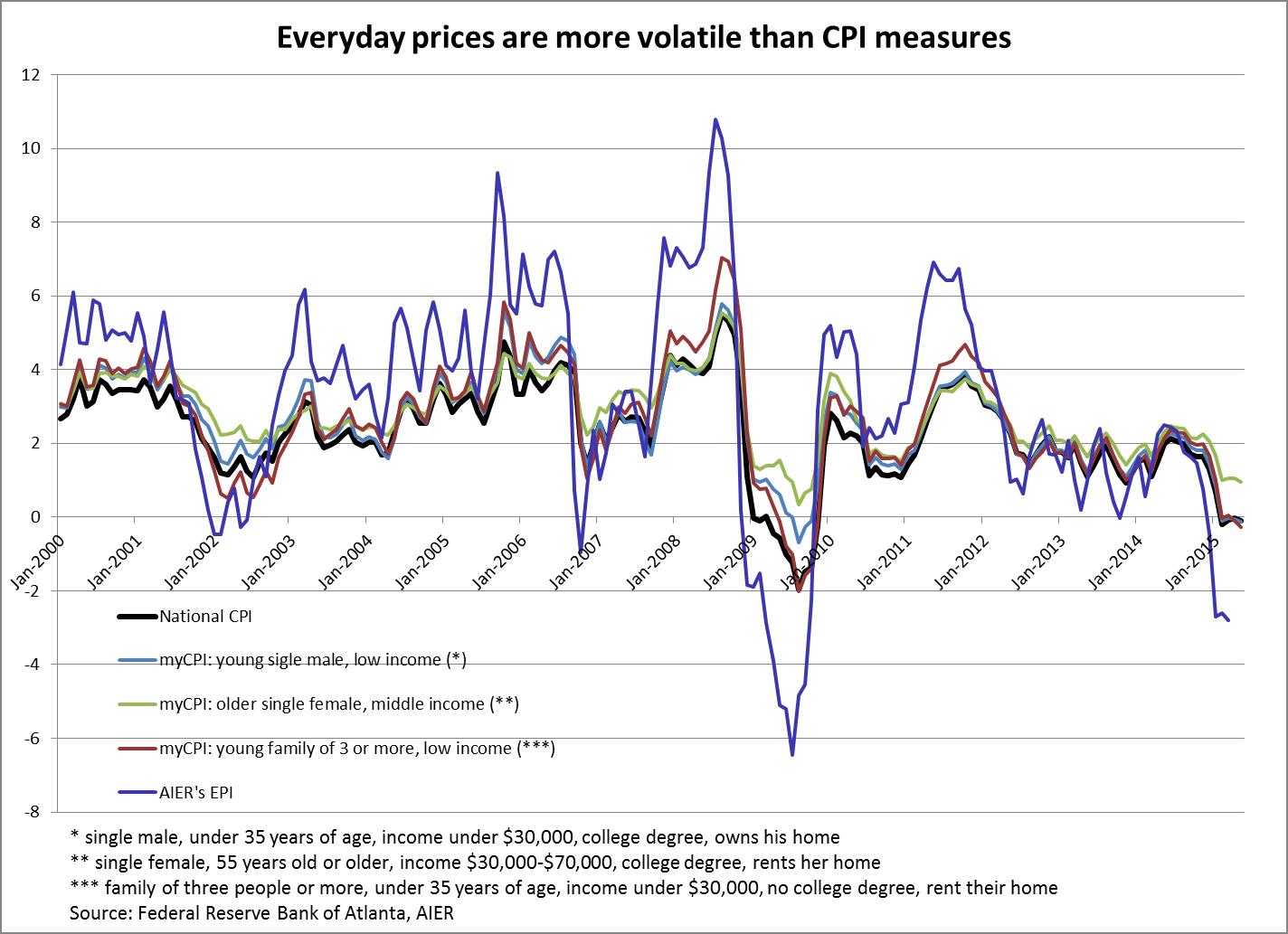

The chart below adds the inflation rate based on the EPI to those shown on the previous chart.

As we can see, the everyday price inflation, as reflected in the EPI, is more volatile than the CPI-based inflation for any demographic group. This means that planning household budgets for meeting the everyday expenses is considerably more difficult than the CPI, however refined, leads one to believe.

There is more than one way to combine the prices of the many things we buy into an index. Which index is preferred depends on one’s purpose.

The standard CPI does a good job of capturing the price trends for the overall economy, but may not be best for evaluating one’s own experience with prices. AIER’s Everyday Price Index, in contrast, does not aim to capture the trend in the overall price level, but instead focuses on the prices that may be more important for people in planning their household expenses.