Warren Buffett’s Portfolio is Irrelevant to Us

I was recently at a lecture about investing and the inevitable question was posed to the lecturer at the end of his presentation: “So, how are YOU invested?”

The question came from a good place. The attendee just wanted to know how the lecturer applies his knowledge to his actual investments. The problem is that the lecturer’s answer is probably irrelevant to the attendee.

If the lecturer had said that he was 100 percent invested in stocks, you might think that was a pretty risky position. But what if I told you that the lecturer was 30 years old and had no children? Or what if the lecturer was going to get a $100,000 annual pension from his employer in retirement? In either of those cases, a 100 percent stock allocation for his investments might not seem so far-fetched.

How about if the lecturer responded that he was only 30 percent invested in stocks, with the rest in bonds and cash? That might seem pretty conservative. But if he was risk averse and 75 years old, that might be a perfectly reasonable asset allocation for his situation.

The point is that any individual’s asset allocation is irrelevant to you and me without context, regardless of their level of intelligence or wealth.

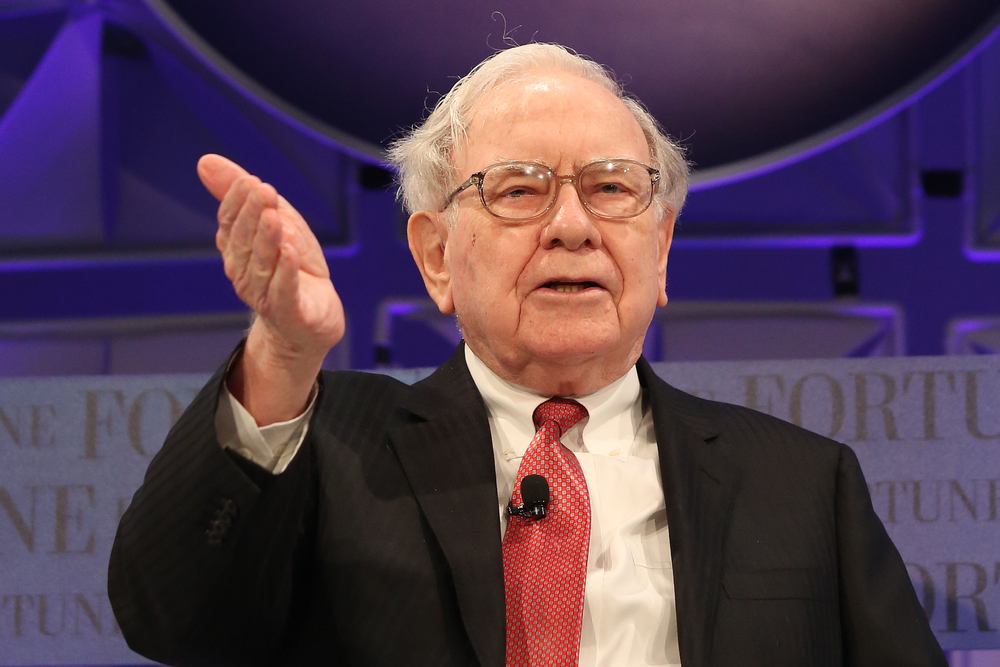

That brings me to Warren Buffett, the well-known investor who is worth billions as a result of his investing acumen. The financial media is constantly reporting on what Buffett is doing with his money. For instance, in 2011 when bank stocks were depressed, Buffett bought $5 billion worth of preferred stock from Bank of America. This is certainly newsworthy, but how is it relevant to you and me as investors?

Buffett is worth so much money that he had $5 billion sitting around ready to invest. Most people aren’t in such a position. Buffett has massively increased his wealth as a result of this savvy trade, but it was hardly something that you or I could have replicated.

Financial columnist Barry Ritholtz recently wrote an article titled “Invest Like a Billionaire (If You Are One).” The title says it all. If you’re a billionaire, perhaps Buffett’s investments are relevant to you. Otherwise, you have to look at your own situation and assess the right investments for you.

Another example involves Michael Dell, founder of Dell Computers. When the share price of Dell Computers was struggling in the early 2000’s, he bought $70 million worth of the stock. That’s a huge investment for most anyone in the world, but not for Michael Dell or Warren Buffett. In fact, Mr. Dell had a net worth of about $20 billion at the time, meaning that his $70 million investment was less than half a percent of his wealth. That’s like the average investor throwing $1,000 into the market. People lose more than that in a weekend in Las Vegas.

All of these examples are simply meant to convey the idea that how you invest should be based on your situation. If you’re young, have no children, and you have lots of years of earnings in front of you, a more aggressive portfolio of stocks may be prudent. If you’re retired and reliant on your portfolio for a fixed income, a more conservative portfolio of bonds and cash may be prudent.

Focus on how your investments fit in with your own situation and try to ignore the noise about what Warren Buffett is doing.

Click here to sign up for the Daily Economy weekly digest!

**Past performance is no guarantee of future results. This information should not be considered personal investment advice.**