There Will Be No Recovery Without Production

Through most of the coronavirus crisis, those who have made the case for stay-at-home, reduce or stop work, and narrow the range of retail shopping to assure “social distancing” to reduce the spread of the virus have accused their critics of being more interested in preserving livelihoods than “saving lives.” But there is no preservation of any lives if people are not able to produce and work, without which none of the necessities and other wants of any members of society can be fulfilled.

Listening to many politicians and political pundits, and even some “economists,” you could easily think that 250 years of economic understanding had never happened. One of the oldest of economic fallacies is that money is wealth; that is, the notion that if you create pieces of paper, put some kind of government stamp on it announcing that it is “money,” and spread it around among the members of society, you thereby conjure up from nothing actual material and other forms of wealth.

Money is a medium of exchange, some commodity or other useful thing that is found widely advantageous to use as a convenient intermediary to better facilitate the exchange of other goods and services one for the other when more direct barter transactions are found to be impossible to arrange or more costly to carry out.

Printing Money Does Not Magically Create Goods

But increasing the number of units of the particular item used as money does not, in itself, increase the physical quantities of all the other goods that people want to acquire through exchange to satisfy their wants and desires. These other goods that people actually want must be produced, manufactured, transported and made ready in the forms and at the places desired by members of society. They do not fall from the sky and do not miraculously appear by waving pieces of paper money (or their electronic and computer equivalents) above your head after offering some incantation to the “manna from heaven” god.

This was all understood and even popularized for the general public by political economists in the early 19th century, when “economics” was the trendy and “in” subject about which any publicly minded and intelligent member of British and American society wanted to be knowledgeable and informed. Yes, there was a time, in spite of Thomas Carlyle’s famous quip, when economics was not considered to be the “dismal science.” It was the subject essential to any thinking and thoughtful person to understand the social world in which he lived, and the political and institutional circumstances most conducive to the betterment of the human condition, especially the improvement of the poor.

For instance, Harriet Martineau (1802-1876), a leading British classical liberal-oriented feminist, abolitionist, social critic, novelist, and historian, successfully popularized the fundamental ideas of economics in a 9-volume series offering, Illustrations of Political Economy (1834), in the form of narrative stories of ordinary people through whom the principles of economic theory and practice were made real and relevant to millions of readers on both sides of the Atlantic.

In the first volume, for instance, a group of settlers in a faraway land are pillaged and plundered by a marauding band, leaving them with nothing to start over with other than their physical strength, the knowledge inside their heads, and whatever raw materials and wild animals were in their immediate vicinity. From this, she shows that the “ultimate resource” is the human being himself with the creative potentials inside people’s minds, combined with resolute determination to work, save, invest, and produce to create through time the prosperity and well-being that we call civilization.

A Sack of Gold is Not the Same as a Stock of Desired Goods

Shortly after the initial disaster has struck and the little band has tried to get through their first day with nothing left to help themselves with other than their own heads and their own hands, two of the group reflect on their misfortune and circumstances, including that just having money is not to have wealth. One of them says,

“I wish that the people of England, who think that wealth consists in gold, and silver, and bank notes, would come here and see how much their money is worth in our settlement. A thousand sovereigns would not here buy a hat, nor a roll of bank notes a loaf of bread. Here, at least, money is not wealth.”

His companion replies:

“Nor anywhere else, as we may see by putting a very simple case. Put a man with a bag of gold into an empty house, in England, or anywhere else, and he will starve in a week, unless he is allowed to give his gold in exchange for what will supply his wants. But give a man, who has not a shilling, a room well stocked with meat, and bread, and beer, and he has wealth enough to maintain him for a week, or a fortnight, as long as his provision lasts. And this is a test which holds good all the world over . . .

Wealth is made up of many things – of land, of clothes, furniture, food and of the means (whether gold and silver or anything else) by which these things may be obtained . . . Poor as we are, we are richer than if we were in the midst of the sandy desert to the north of us, with a wagon full of gold in our possession. We have what gold and silver could not buy in such a place, food and shelter.”

They go on to ruminate on the fact that though their situation is better than in a desert because there are edible plants, raw materials useable in various productions, and wild animals that may be eaten or harnessed to assist them in their work, none of these are, as yet, directly useful things until they have applied their knowledge and human labor to transform them into either the productive tools (capital) with which their work may be made possible or easier and more productive, or into the consumable and useable finished consumer items to satisfy their actual wants.

The first reminds his friend that, “Even the manna in the wilderness would have been of no more use to the Hebrews than the carp in the pool to us, if they had not exerted themselves to gather it up. Food was never yet rained into the mouth of any man.” To which his companion adds, “And if it had been, he must have troubled to hold back his head and open his mouth. So, you see what conclusion we come to, even in an extreme case.”

Forgetting that Production Comes Before Consumption

Maybe because two hundred years ago so many more in the world were still so close to abject poverty – it is estimated that in 1820 the world population numbered barely one billion of which nearly 90 percent lived in serious or severe material want – that most people understood two centuries ago when reminded about the reality of their daily life, that production comes before plenty, that work is necessary if you are to have wealth. This is less the case today when out of over 7.7 billion people only about 10 percent are subject to the lowest of material circumstances, Far too many in 2020 think that the things of everyday life just “somehow” appear and are waiting and ready to be bought if you have but money in your pocket.

So, give people money and they can pay their rent or mortgage, buy food at the supermarket, and purchase medicines or shoes, because, well, all those things are just “there” every day when and as you want them. Oh, yes, there can be panic buying, as was commonly seen in February and March of this year when people went crazy purchasing huge quantities of toilet paper, hand sanitizers, protective masks, and a variety of storable food items.

But these concerns all had to do with presumed failures on the part of politicians and private enterprises to know way ahead of time that they should have made sure there were more of all these and other things readily available in any maximum quantity that consumers wanted right then and there. It was just supposed to be there. Clearly another “failure” of capitalism or inept government planning because the “wrong people” were in charge.

What the government lockdown policy response to the coronavirus has highlighted is the fundamental and inescapable truth of what the 19th French economist, Jean-Baptiste Say (1767-1832), called “the law of markets.” Contrary to the reawakened Keynesian mindset that all of our economic troubles are “aggregate demand failures” arising from a lack of spending due to people not having enough money in their pockets, the dramatic collapse in production, the massive rise in unemployment, and the falling off in people’s spending on final goods and services are all due to governments shutting down the “supply-side” of the economy.

Our Ability to “Demand” Arises from Our Capacities to “Supply”

As Jean-Baptiste Say, and those who followed his reasoning, argued, there is always work to be done, since there are always human wants that are as yet not fully satisfied; and as soon as one such human want has been significantly fulfilled to one degree or another, the human mind looks ahead and imagines other things that seem attractive and desirable to have. As a result, work merely of different sorts is there to be taken up in even greater amounts.

People may satisfy their wants and desires in one of two ways, Say explained. They may directly work and produce the goods they want for their own purposes. Few of our desires, however, can be fulfilled through our own personal efforts. So, the other way is to work and produce something that others might consider worth buying from us in exchange for what they can offer in trade; that is, goods that we want that either we do not have the ability to make for ourselves or only at higher costs than at which that potential trading partner can sell them to us.

Of course, in modern society rare are the occasions in which we directly trade what we have for sale in exchange for what we actually want from another person. Usually, we first sell what we offer to someone interested in our wares for an agreed upon price in the form of a sum of money, and having earned that money from partly fulfilling someone else’s wants, we use the money that we have so earned to then offer it to some other person in the market for that which we actually want that they are able to supply.

I trade my labor services to the institution of higher learning that hires me to teach economics, and I then turn around and spend the money I’ve earned on the goods and services I’m interested in buying from people who may have no interest in economics, and certainly not in accepting some economics lectures from me in direct trade for what they have that I want.

Money Earned Comes before Money to Spend

My ability to demand what others may have for sale is dependent upon my success in producing and supplying something that some of those others might be willing to purchase from me, and from which I earn the money income as a producer that enables me to demand the outputs of others as a consumer. In logical, sequential time, my ability to produce, supply and sell precedes my capacity to demand, buy, and consume.

“Today,” I may be both demanding and supplying. But my ability to demand (money earned in my pocket available to spend) has come from having sold something in the past and earned that money from prior sales (even if the past is merely a month or week, a day or a few hours earlier).

Of course, I may demand more goods in the present, in money terms, than I have earned from recently supplying in the past. But I can do so only if I draw upon my own savings from having spent less than I have earned in the past or by using the borrowed savings of others with the promises to pay it back with interest out of my current or future earnings.

In all of these cases of demanding out of what I have recently earned, or previously saved, or borrowed from someone else’s savings, what that sum of money will buy, in general, in the marketplace – a dollar’s purchasing power over goods available for sale – will depend on two things: how much of desired goods have been produced in the past and are available for purchase in the present, and the concurrent money demands of others also wishing to buy the same desired goods.

Speaking of the economy as a whole, if supplies in general decrease or total money demands increase, the prices of goods in general will tend to rise. Not all prices would rise at the same time nor proportionally with each other but based upon the relative greater scarcities of each of the fewer goods on the market as a whole, and the particular degrees of relative demands for specific goods out of the greater quantity of money in people’s pockets in general.

Shutdowns the Cause of Falling Output and Rising Unemployment

What we are witnessing at the present time has been a dramatic falling off in people’s ability to demand desired goods partly due to government decrees, especially imposed at the state levels in the U.S., that have prevented interested and willing buyers from demanding all that they would like to purchase, particularly in the retail and service sectors of the American economy. This has led to a huge rise in unemployment in these sectors of the economy. At the same time, the imposed halting of production except for what state governments have declared to be “essential” manufacturing and supplying has resulted in massive layoffs in, yet, other sectors of the economy.

In the Employment Situation report for April 2020, issued by the Bureau of Labor Statistics (May 8, 2020), the government’s official measured unemployment rate, for the economy as a whole, rose from 3.5 percent in February of this year to 14.7 percent in April.

However, there is another measurement used by the BLS known as “U-6,” which includes not only those currently unemployed and looking for work during the last four weeks, but also those considered as only “marginally” in the labor force, as those working part time but who want to work full time, and “discouraged workers” who want to work but have stopped looking for a job. Using this more inclusive measure, the BLS reports that unemployment rose from 7 percent in February to 22.8 percent in April.

It is difficult to demand the outputs of others, when (depending on the measure) between almost 15 percent and 23 percent of the labor force finds itself not fully employed in the U.S. economy. This is especially the case in what the BLS categorizes as the “hospitality and leisure” sectors of the market, in which the Bureau reports unemployment in April was 39.3 percent.

The government’s lockdowns have, on the one hand, induced declines in production and output, at least in the short run, resulting in reduced supplies of various (though not all) goods. The Bureau of Economic Analysis (BEA) in its estimate of the 2020 first quarter Gross Domestic Production calculates that GDP may have declined by at least 4.8 percent at an annualized rate.

The restrictions on retail shopping combined with the massive fall in employment has reduced the money demands for many goods and services, and the resources that are used in manufacturing. In the jargon of mainstream macroeconomics, the velocity of the circulation of money declined during the first three months of 2020 by nearly 15 percent (M-2) and by 9.6 percent (MZM), compared to the velocity of money in the fourth quarter of 2019.

If the lockdowns proceed to be loosened as they are in the various states, and if these trillions of dollars being created by the Treasury through massive deficit spending and through expansive “lines of credit” by the Federal Reserve to support financially ailing businesses proceed as announced, it is difficult not to expect significant price inflation looking to the end of 2020 and into 2021.

The Need for Coordinated Productions Through Time

Part of the illusion of just needing money to immediately assure and bring forth the goods wanted and desired arises from the failure to fully understand that all production takes time and any disruption of the processes and stages of production threatens the entire structure of investment and manufacturing.

The real time-structure of production has been implied in discussions concerning potential breakdowns in the interdependent global supply-chains connecting resources, manufacturing, transportation, and retail marketing to the ultimate consumer. All the stages of production through which goods sequentially pass, in their own required respective ways, rely upon intricate complementary coordination if those goods are to be continually forthcoming in the desired patterns and quantities, and when they may be wanted.

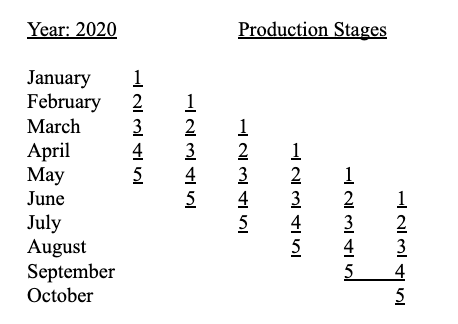

The nature and logic of these relationships may be captured in the following table:

In the table, above, the number of production steps to bring a particular good to market requires 5 interdependent stages of production, each of which takes one month to complete. Thus, if this good was wanted for consumer use in May of 2020, the production on it needed to begin at the start of the year, in January.

If the same good is wanted in the same quantity and quality in June of 2020, as well, its production process had to begin in February at the same time that the quantity of the good wanted in May was going through stage 2 of its production process. In March of 2020, the good wanted in May had to be going through stage 3 of its production process, while the good wanted in June had to be passing through its stage 2, and if this good is also wanted in its finished form in July had to be starting its stage 1 of production in March.

Any stoppage or disruption in manufacturing processes and employments in any one or more of these production stages threatens, in principle, the ability for production to continue smoothly through time so the final good is available in particular amounts to the consumers wishing to demand it, period-after-period.

This highlights another aspect of Say’s Law of Markets. If there are not to be “gluts” of some goods and shortages of others, each of these interdependent markets must be coordinated through the competitive interactions of supply and demand, in which prices serve as the guiding signals and incentives to direct people in the use of their resources, capital, and labor in the needed synchronized patterns both at a moment in time and through time as goods in process pass through their required stages of production.

The Fallacy of “Essential” and “Non-Essential” Productions

Government’s insistence on distinguishing between “essential” and “nonessential” productions and consumer goods are shown for the shallow misreading it is. Markets are interconnected and interrelated in such an inescapable way that what the government tags as “non-essential” may be crucial for the maintenance and operation of other production processes that are labelled as “essential” by those in political authority.

Market relationships are too complex and overlapping for any but those in the production processes themselves at each of the respective stages of production to fully and effectively know and understand what needs to be done in changing market conditions to substitute particular resources and types of capital and labor from some parts of the structures of production to others as communicated and discovered through the relative patterns of prices and wages that convey the needed knowledge to make informed decisions so to keep productions moving forward with minimal breaks and disruptions in and across markets.

This is also why all the talk about loosening the lockdowns in “steps” over time misses the central point that all markets and the actions of the people in them are interconnected in ways that releasing some while delaying opening others threatens a successful restoring of productions and employments as soon as possible to rapidly escape from the government-created economic chaos in the shortest possible period of time without introducing other imbalances and shortages that need not happen, if not for continuing government involvement.

What is needed, and now, is the freeing of all markets from the heavy-handed restrictive commands and controls of those in political authority, if we are to restore the economy and the employments it previously and presently could offer to all those looking for work at market-determined wages and prices. Any attempt by those in political power to guide and direct this process, regardless of the reason and rationale, only gets in the way of all the members of the society reestablishing their mutually serving productions as the means for acquiring the supply-side opportunities and capacities to demand the outputs of others.

Saving Livelihoods Is “Saving Lives”

In this discussion I might be accused of avoiding why governments have intervened so pervasively and intensely into social and economic activities: to slow down and maybe remove the danger from the coronavirus through society-wide restrictions and restraints on people’s freedom to move, work and earn. That is, “saving lives” by doing all that is possible to prevent or radically slow down the spread of the virus.

But “saving lives” is inseparable from saving livelihoods. The “supply-side” earning of livings is the only means of assuring that all the goods and services needed and wanted to meet all of our requirements are there when we want them. It enables us to earn the means for demanding what others are producing and offering on the market by having supplied some of what those others desire in reciprocal trade.

Maybe I lead an especially sheltered life, but it never entered my mind that beer producers might modify their manufacturing in such a way as to be making hand sanitizing liquids, instead, to meet a suddenly much higher demand for the latter product to fight getting or spreading the coronavirus. I had not expected to drop off some shirts at the dry cleaners and discover that the owners were now producing and offering multi-layered cloth face masks on the premises to partly compensate for a large falling off of their regular business.

An essential purpose of allowing markets to be free and open in all circumstances is precisely to take advantage of what people can imagine, create, and produce to meet changing patterns of demand in their respective corners of society in ways that others might not and, indeed, cannot anticipate. The sudden anxieties in February and March about there not being enough ventilators to meet hospital needs for potential cases of respiratory failures due to the virus, saw numerous improvisations of workable substitute ventilator devices of different types, if the need had fully arisen.

As Friedrich A. Hayek brought out in The Constitution of Liberty (1960), personal and economic liberty is crucial precisely because we cannot fully know or anticipate what creative minds might imagine, the results of which we will be glad to have and benefit from, but which might never emerge if people are not free to discover and try:

“Liberty is essential in order to leave room for the unforeseeable and the unpredictable; we want it because we have learned to expect from it the opportunity of realizing many of our aims. It is because every individual knows so little and, in particular, because we rarely know which of us knows best that we trust the independent and competitive efforts of many to induce the emergence of what we shall want when we see it.”

That is why we need markets to be open and free, now, for people be make their own best decisions about the trade-offs and risks to protect themselves and their loved ones from the dangers from catching the coronavirus, and in that process to free the supply-sides of the market from government shutdowns so people may earn the means of demanding what others produce for a return to the standards of living that are possible even in the face of the current health concerns.