How to Kick an Economy When It’s Down

The dubious contribution of protectionist policies in history has been to make a bad situation far worse. Choose your metaphor. It’s the gasoline added to the fire, the extra kick when the guy is down, the added infection contracted during surgery.

It has typically come along at the worst time, just when economic balances are vulnerable to tipping the other way. The paradigmatic case is the Smoot-Hawley tariff of 1930 but think also of the Tariff of Abominations of 1828 or the Morrill Tariff of 1861. Those didn’t end well.

The Lira Plunge

The doubling of U.S. tariffs against Turkey, just as its currency has plunged one third under the strain of debt and insolvency, shows precisely how this works. Donald Trump knows enough about currency valuations to see how a lower-valued currency makes its exports cheaper. What he doesn’t seem to understand is that this is not often an intended policy of a foreign country. It’s the result of a market assessment that runs 24/7 ever since the world left the gold standard and fiat currencies have floated against each other.

The usual role of the U.S. has been to keep an eye out for dramatic disturbances in currency markets and pursue means of stabilizing them. The point is to mitigate the possibility of contagion given how all major world banks live with risk exposure to each other. If one goes, the risk is a panic and the effective globalization of the bank run.

To be sure, you could argue that the U.S. shouldn’t attempt such de facto bailouts because they unnecessarily risk the soundness of the dollar and potentially expose American taxpayers (and dollar holders generally) to terrible liabilities. Maybe whole nations should be treated like businesses and be allowed to fail, like Lehman in 2008. That way we avoid the moral hazard of bailouts and investors learn their lesson.

War By Other Means

Maybe that is the right way. What’s surely not the right way is to do the opposite: kick the country when it is down. What happened in the case of the Turkish Lira is that Trump took the sudden fall in currency valuation personally. Based on a tweet he sent, he saw the major threat as a sudden flooding of imports to the U.S., which, as we know, he regards as the worst possible threat to America (because you wouldn’t want American consumers to save some money, now would you?).

With the stroke of a pen, he doubled tariffs: steel to 50% and aluminum to 20%. (I have a foreign friend who wrote me that surely the president alone cannot do that without Congressional approval. I explained that when it comes to trade policy, the U.S. lives under executive dictatorship not different from what prevails in a country like Venezuela and North Korea.)

How much does this matter? The International Trade Administration reports that

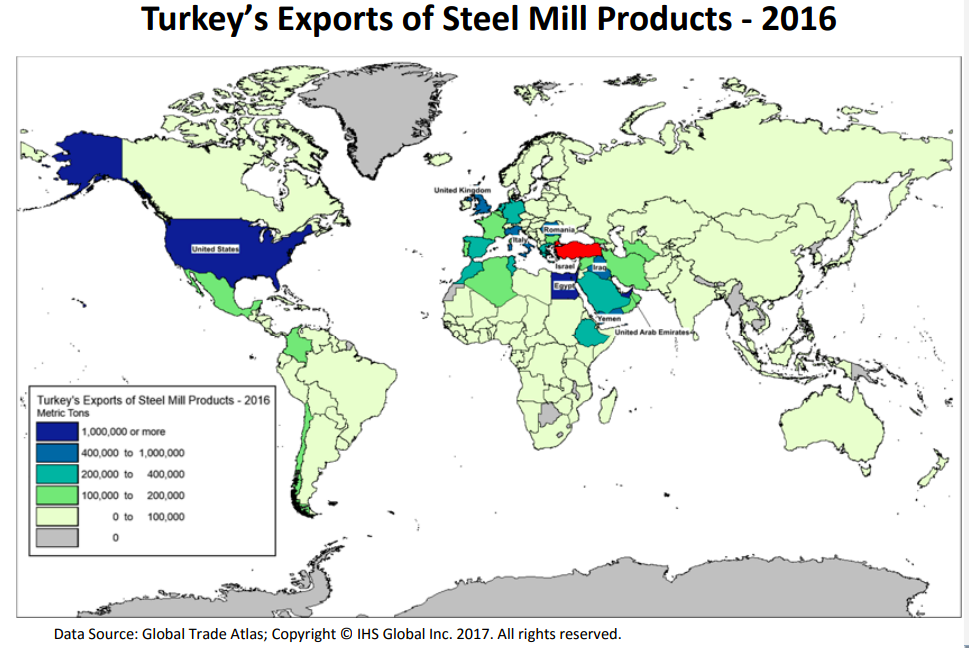

Turkey is the world’s ninth-largest steel exporter. In year to date 2017 (through September), further referred to as YTD 2017, Turkey exported 12 million metric tons of steel, an 8 percent increase from 11.1 million metric tons in YTD 2016. Turkey’s exports represented about 3 percent of all steel exported globally in 2016. The volume of Turkey’s 2016 steel exports was about one-seventh that of the world’s largest exporter, China. In value terms, steel represented just 4.8 percent of the total amount of goods Turkey exported in 2016.

So it matters for American consumers and producers who keep getting hit with these taxes but it really bites for Turkey, because the US is the largest destination for its exports.

There’s no question that Trump was setting out to harm the country politically, using trade policy as a way of browbeating foreign governments he finds personally uncooperative. And how? By forcing Americans to pay marginally higher prices. Thus do such actions come at the expense of…just about everyone except a handful of special interests.

The tariff move immediately tipped the currency into a free fall. For a day or two, it appeared there would be no contagion. But closer investigation showed major exposure by European banks in Turkey. The Wall Street Journal reported: “Other emerging markets, such as Indonesia and South Africa that are also heavily reliant on foreign investors, also were rattled. Shares fell across Asia and Europe and U.S. stock futures indicated a lower opening on Wall Street.”

Meanwhile, the president of Turkey Recep Tayyip Erdogan shares with Trump the view that market forces are really disguised personal attacks on a country’s leadership. This is “treason,” he said, “an economic war waged against Turkey” on social media and elsewhere. He urged his countrymen and women to dig out their dollars and gold from mattresses and turn them over to the banks in exchange for Lira.

It’s pretty doubtful that many citizens took him up on the idea. It’s a losing war to fight currency traders the world over. Nor is it “treason” to sell on signs of trouble. That said, it is incredibly reckless to double taxes on imports from a particular country with the stroke of a pen. As robust and well-capitalized as the US is today, such actions foment more conflict, feed resentment, fuel nationalism, and take unnecessary risks with the economic well being of people the world over.

As much as Erdogan and Trump seem to be at odds, however, they apparently agree on one point. They are now both on record in calling for a boycott of the iPhone.