Consumer Sentiment Shows Resilience in Early November

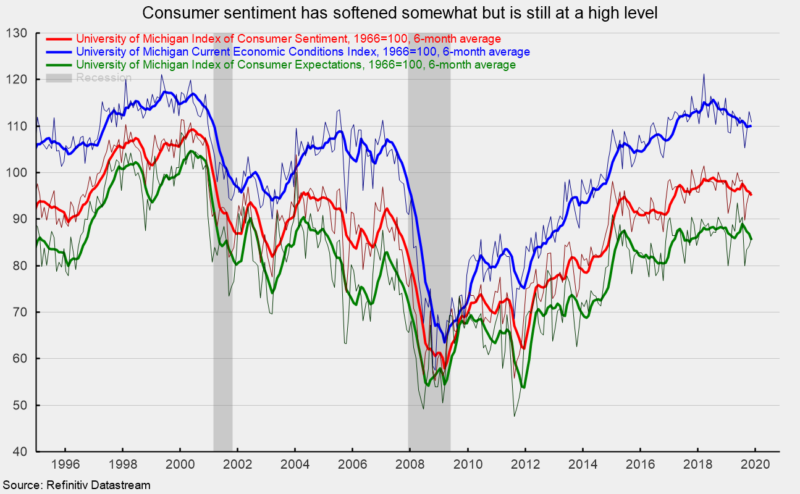

The preliminary November results from the University of Michigan Surveys of Consumer Sentiment show overall consumer sentiment improved from the final October result. Consumer sentiment increased to 95.7 in early November, up from 95.5 in October, a 0.2 percent gain. From a year ago, the index is off 1.8 percent. The 6-month average was 95.1, down from 95.9 in October and a recent peak of 99.0 in July 2018. Despite the modest downward trend, sentiment is holding at very favorable levels (see chart).

The two sub-indexes had mixed performances in early November. First, the current-economic-conditions index fell to 110.9 from 113.2 in October (see chart). That is a 2.0 percent drop for the first part of the month and a 1.2 percent decrease from November 2018. The 6-month average ticked up to 110.1 from 109.9 but is down 4.8 percent from the recent peak of 115.6 in July 2018.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — increased 2.0 percent for the month, to 85.9 (see chart), but was still down 2.5 percent up from a year ago. The 6-month average was 85.5, down from 86.8 in October and about the same level as early 2015.

According to Richard Curtin, Survey of Consumer Chief Economist, “Consumers did voice a slightly more positive outlook for the economy, which was offset by a slightly less favorable outlook for their own personal finances. Spontaneous negative references to tariffs were still mentioned by one-in-four consumers in early November. References to the impact of impeachment on economic prospects were virtually non-existent, mentioned by less than 2% in October and November.” He added, “The strongest aspect of the current economy has been job and wage gains. Although consumers have become somewhat more cautious spenders, they see no reason to engage in the type of retrenchment that causes recessions. While most consumers do not anticipate year-to-year increases in the unemployment rate, the majority of consumers expect the unemployment rate to remain largely unchanged at its lowest level in 50 years.”

Despite some softening, consumer sentiment remained at broadly favorable levels in early November, supported by a healthy labor market, income gains, and record-high net worth. Consumer spending remains the main driver of current economic growth and these results suggest growth is likely to continue, but the pace of growth remains uncertain.