Best of 2016: Eight Market Predictions

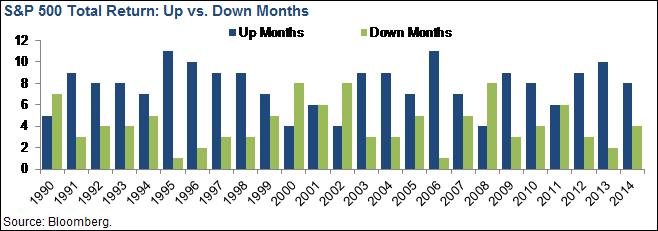

You know this, but it is worth repeating for the sake of your sanity. Markets go up and down daily. For every buyer, there is a seller. But there is a broader historical point here. Even during periods of relative growth, there are negative stretches. Likewise, during downturns there are upswings. Since 1990, there has never been a calendar year during which all 12 months were all up or all down for the S&P 500. 2013 was a great year for stocks and still saw two down months. 2008 was a terrible year and still saw four up months. Historically, stock markets tend to trend upward, but we should certainly expect that markets will go up AND down.

2. An investment advisor or financial planner will try to sell you something with the term “downside protection” immediately after a short-term drop in markets.

Going back to my first point, at some point during the year it is likely that markets will fall. It is precisely this time that we’ll see articles about pension funds considering more hedge fund exposure. We’ll start hearing our friends talking about “downside risk” and hedging against market losses. Naturally, these conversations crop up AFTER the market has dropped. Do yourself a favor and allocate to a portfolio that is comfortable BEFORE the market drops. This could mean significant “downside protection” (e.g., a position in cash, bonds, Treasuries, TIPS), or it could mean minimal downside protection if you are insensitive to short-term performance.

3. People will predict rising interest rates. It’ll happen someday!

For four straight years, we’ve heard that interest rates have “nowhere to go but up.” And yet, they were stable in 2012, up slightly in 2013, down in 2014, and flat again in 2015 (despite the Fed raising rates). On Christmas Eve 2014, the 10-year yield was 2.26 percent. This year, it was 2.24 percent. So much for a guarantee of rate increases. The funny thing is that now people are starting to say that they don’t expect increases in interest rates this year…A few years of bad predictions makes you start to question your assumptions. So maybe this will be the year that rates really start to rise.

Theoretically, there is a lower bound of zero percent on interest rates, even though Europe has negative interest rates. This lower bound and predicted Fed rate hikes are the reasons that economists and prognosticators keep saying that rates have nowhere to go but up, but they’ve been wrong for four years in a row. Every reasonable prediction is right so long as you don’t provide a time frame.

Whether or not interest rates rise, the purpose of bonds in your portfolio is usually to provide stability in the event of stock market turbulence. A small expected decrease in the value of your bonds is the price you pay for protection against large swings in overall volatility.

4. Apple will be an outsized driver of how we perceive market performance but may or may not be a big driver of how our portfolios actually perform.

People tend to perceive performance based on what they hear on the radio during their daily commute. The radio tells us what the S&P 500, NASDAQ, and Dow Jones did during the day. Apple Computer comprises about 3.7 percent of the S&P 500. Microsoft and Exxon, the next two largest companies as of this writing, comprise about 2 percent of the Index each. This means that the performance of these companies will have an outsized impact on how we perceive markets to be doing.

The radio does not tell us what our investments did during the day. For investors who are diversified across a range of markets and asset classes, daily reporting may not be a reflection of performance. I maintain a significant share of my portfolio in small caps, value stocks, international stocks, emerging markets, and bonds. The performance of the S&P 500 is important, but I should not expect to match its performance.

5. Emerging market stocks will provide a different return than U.S. stocks.

Another obvious point that almost certainly can’t be wrong! Emerging markets will have a different return from U.S. stocks, which will be different from small caps, different from European stocks, different from Value, different from commodities… you get the idea. You’ll see some people saying emerging markets will outperform, or Europe will underperform, or U.S. stocks are the place to be. Someone will be right, and someone will be wrong. Different markets provide different performance over different periods of time. The central idea of diversification is to dilute these differences.

6. Some funds will beat their benchmarks, some will underperform. Some funds will even have their 3rd or 5th straight year of outperformance.

Individual mutual fund families (e.g., T. Rowe Price, Vanguard, Fidelity) have hundreds of individual funds. By chance alone, some share of them will outperform. For example, if you had 100 different funds, you could expect 50 to outperform in any given year by chance alone. Half of those would outperform a second year and half of those a third year in a row. At the end of 3 years, you’d have about 12 funds that had three straight years of outperformance – but that would be indistinguishable from luck.

If anything, excellent five-year performance of a fund might predict lesser subsequent returns as its performance reverts to the mean. Take the story of Bill Miller. Miller was a fund manager that worked at Legg Mason and was referred to as a stock guru. The fund he managed (Legg Mason Capital Management Value Trust) outperformed the S&P 500 for 15 straight years from 1991 through 2005. Miller was crowned as one of the best stock pickers of the generation and graced the cover of countless magazines and newspapers. Investors couldn’t get into his fund fast enough.

What happened next was nearly as impossible: The fund bombed. Over the most recent 10 years (ended November 2015) the fund has returned a paltry 0.99 percent per year as compared with 7.48 percent for the S&P 500. In November 2011, Miller turned over management of the fund to his co-manager. Miller exemplified that excess fund returns simply don’t last.

7. Investors will continue to move toward passively managed funds, and assets under management by “robo-advisors” will continue to grow.

Over the last year, about $175 billion flowed out of “active” funds, while $435 billion flowed into “passive” funds (Source: Morningstar Direct Asset Flows, December 2015). This continues a trend that has active managers scurrying to stop the bleeding.

The problem is that actively managed funds continue to underperform the market. This isn’t going to turn around because it is mathematically impossible for active managers to beat passive ones over the long term. You’ll see a lot of articles about why now is the time to be with active managers because the market is tough right now and good active managers are going to be especially valuable. Guess who’s writing those articles?

I took a look at nine funds from a 2011 article titled “Best Large Blend Funds for the Long Term” from U.S. News. Ending November 2015, those funds had returns that averaged 11.29 percent. Compare that with S&P 500 index funds that returned 14.36 percent (Vanguard), 14.27 percent (SPDR), and 14.30 percent (Fidelity Spartan). Investors are going to continue to recognize the underperformance of actively managed funds.

8. Oil prices will change, labor market results will fluctuate, geopolitical events will arise, global economies will do better and worse than expected, the Fed will have meetings. All of these will be used as reasons that the market fell or rose on many occasions throughout the year.

Markets fluctuate. I just sold some Apple stock because I wanted to raise cash in order to do some work on my kitchen. Countless other people are buying or selling stocks and bonds every day for all different reasons. There is an entire industry dedicated to analyzing the broad market movements every day. It’s easy to ascribe a narrative to price fluctuations after the fact, but it’s impossible to truly assess the impact of millions of market participants on a daily basis.

It’s a lot harder to predict what will happen in advance. Granted, some prognosticators will be correct. By virtue of having so many predictions—like mutual funds—some will inevitably look prescient. The narrative at the end of the year will look well-reasoned, but it won’t tell the whole story. Stick to your plan and ignore prognosticators and market fluctuations from week to week.

Happy New Year!