A Modest Boost of Consumer Confidence

As we continue to sort out a tangle of conflicting economic signals, we received some heartening news on consumer confidence yesterday. The data from The Conference Board was compiled before Britain’s vote to leave the European Union last week, so it’s hard to know whether the vote will change things in the next reading.

The index increased from 92.4 in May to 98 in June.

“Consumer confidence rebounded in June, after declining in May,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers were less negative about current business and labor market conditions, but only moderately more positive, suggesting no deterioration in economic conditions, but no strengthening either. Expectations regarding business and labor market conditions, as well as personal income prospects, improved moderately. Overall, consumers remain cautiously optimistic about economic growth in the short-term.”

Bob Hughes, senior research fellow at the American Institute for Economic Research, said: “The assessment from The Conference Board is generally in line with our view of U.S. consumers and the U.S. economy overall. The slow-growth economy remains at a slightly elevated risk of recession and more susceptible to shocks such as the Brexit vote. Still, the U.S. economy is relatively insulated from the political events in Europe and recession is not the most likely outcome for the U.S. in the short term.”

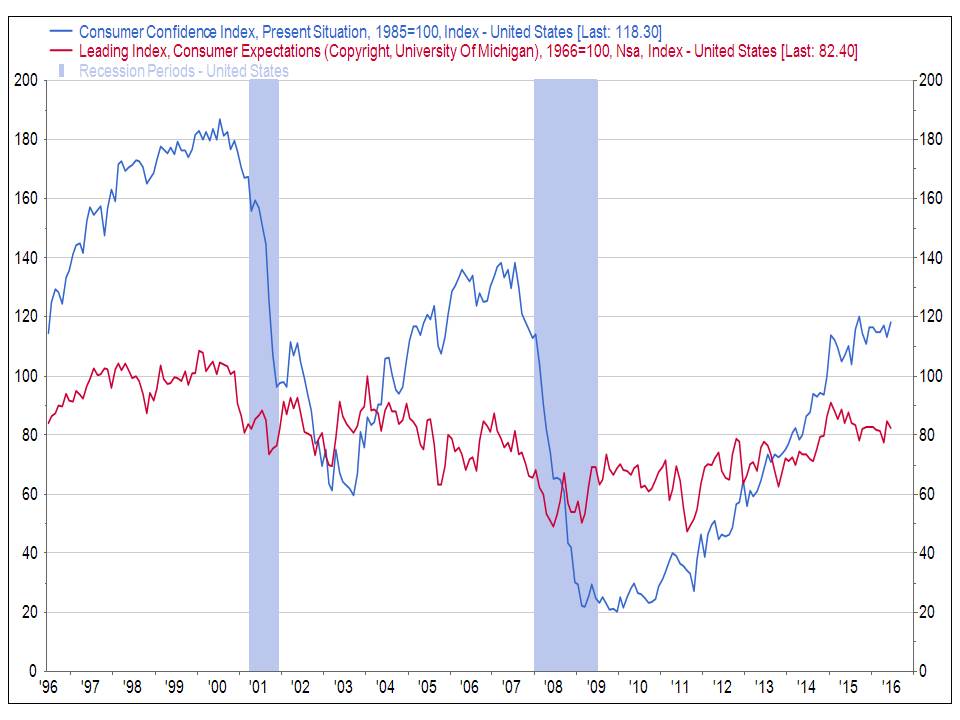

A component of the Consumer Confidence Index, the Present Situation Index is one of the coincident indicators we use as part of our Business Cycle Conditions model to help identify recessions. That component increased from 113.2 to 118.3 in June.

The Index of Consumer Expectations, a different index measured by the University of Michigan, is a leading indicator in our model. Last week we received the June reading of this index, which came in at 82.4, down from 84.9 in May.

Both of these indexes are well above their recessionary lows of six and seven years ago.

Click here to sign up for the Daily Economy weekly digest!