Conservatives and the Laffer Curve: An Ugly Love Affair

It may sound as a crude joke today that once upon a time David Frum — an ex-G.W. Bush speechwriter who coined the phrase “axis of evil” — was the most perceptive libertarian-leaning critic of the Reagan revolution. In his wonderful book, Dead Right, he wrote that the source of the failure of the Reagan revolution was the cowardly abandonment of the limited-government agenda for the fiction of painless tax cutting. According to Frum, this was an aspect of their broader ambition “to use the government for conservative purposes rather than to push it back within its proper limits.”

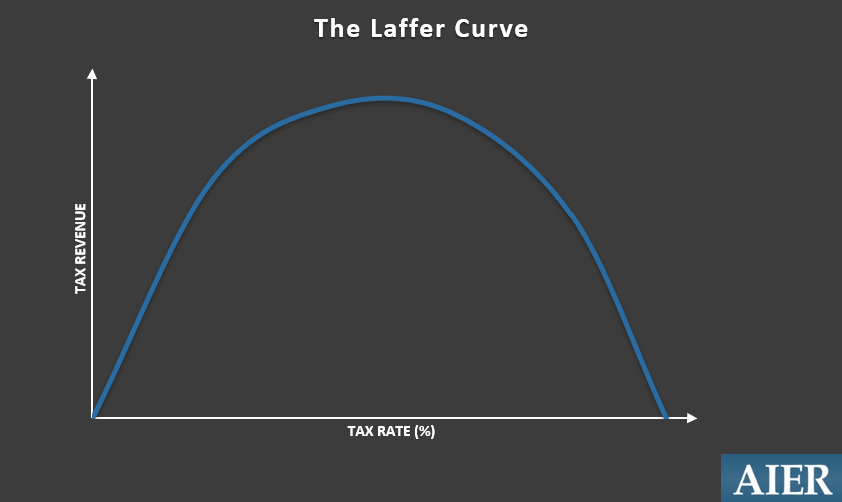

At the center of this betrayal was the doctrine of “supply-side economics” and its iconic “Laffer curve,” which showed how you can cut taxes and increase tax revenue at the same time. When the creator of this idea, Arthur Laffer, drew this famous picture on a napkin to Donald Rumsfeld and Dick Cheney during a lunch in 1974, the reaction was ecstatic: that’s exactly what they needed, some justification for doing what politicians are best at doing anyway: giving away the goodies that don’t cost anything. The best of both worlds!

From the 1930s until the 1970s, left-wing politicians and economists thought they had found the Holy Grail of fiscal alchemy: deficit spending funded by a combination of money printing and future generations. However, in the 1970s the machine ground to a screeching halt: double-digit inflation coupled with high unemployment put an end to alchemy. Keynesians run out of luck. It seemed that an opening for a small-government alternative was clear.

But, it was not to be. Convincing Ronald Reagan to accept supply side economics not as a temporary fix (which it is, in the conditions of very high marginal rates), but as a governing philosophy, represented a faithful derailment of such hopes. It provided a convenient “free-market” smokescreen for the indefinite abandonment of the agenda of rolling back the federal government, at the highest point of the conservative ideological ascendancy, while giving an ideological imprimatur to opportunism and status quo.

It relieved the pressure off the GOP to actually do anything about the bloated federal budget and entitlements, tying the conservative orthodoxy not to rolling back the government (hard, unpopular) but to cutting taxes (easy, popular). They could now put up great ideological fireworks of phony “free-market” rhetoric while permanently entrenching the state behemoth created by Presidents Franklin Roosevelt (D, 1933-1945) and Lyndon Johnson (D, 1963-1969). Once again, the conservatives played wonderfully their assigned role of “useful idiots,” serving just to consolidate previous progressive leaps forwards.

Nothing has changed in the meantime. If anything, things have gotten worse. The election of Donald Trump to the presidency represents the entrenchment of the once fringe Pat Buchanan/Ross Perot “populist” wing of the GOP, which embraces protectionism, nationalist spending, and right-wing cultural grievances. His promises not to do anything about entitlements — to “take care of everybody” — are one of the key hallmarks of this ideological persuasion (together with trade protectionism). Unlike the Phil Graham/Jack Kemp wing (represented by Paul Ryan), Trump is not afraid to take on big spending; he positively likes it. His quick deal/capitulation to Pelosi and Schumer in budget negotiations is a clear sign of this.

In this environment, the appeal of “Lafferism” in both wings of the GOP, as well as on conservative intelligentsia, is ever more alluring. The newly proposed tax cuts are sadly reflective of this, set to add $1.5 trillion to the federal debt over the next decade. At one point the idea was met by a proposal given by the House Budget Committee to cut $200 billion of mandatory spending (mostly entitlements) over the same period of time. Senate colleagues were horrified by this civilization-ending calamity and proposed instead to cut $1 billion (!) over the next decade (approximately 12 hours worth of Medicare spending). No need to stress: the House “fiscal hawks” caved in in a matter of hours, without a peep from the Heritages and AEIs of this world.

Public-choice theory describes the democratic voter, rather cynically but truthfully, as a person wanting as much free stuff from the government as possible, paid for by someone else. The GOP elite (from Trump to the “establishment” and back) have learned this lesson all too well. Their master plan is to cut some taxes, make government spending grow at an ever so slightly slower rate than under Obama, and market this as “cutting spending,” — while they wait for the minimal tax cuts to usher in endless 4 percent economic growth, making everyone happy and keeping them in office. Progressives will have their big government untouched, and we will have our “free-market” and “pro-growth” economic policies. A win-win, reality be damned.

Images: Ronald Reagan Foundation.