Foreigners are Reducing their Holdings of U.S. Treasury Securities

Federal government debt as a share of GDP is near an all-time high. In the third quarter of 2016, federal debt was 104.8 percent of GDP. In the first quarter of 2016, it reached a record 105.4 percent of GDP. Continuing federal deficits have required the U.S. Treasury to issue debt to cover government spending. Both domestic residents and foreigners purchase Treasury securities. Foreigners hold close to half of U.S. Treasury securities, but they have been steadily selling off their holdings.

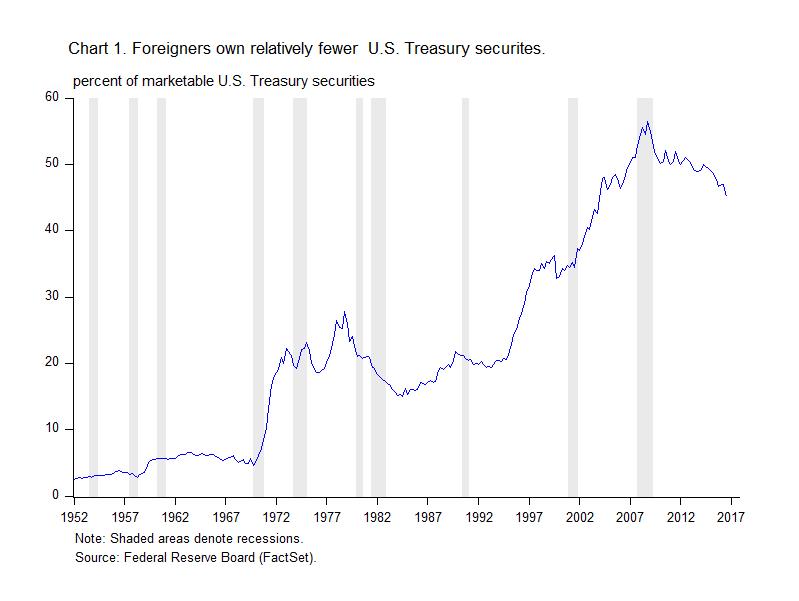

The share of Treasurys owned by foreigners has grown since the 1970s. Prior to the 1970s, foreigners held an average 4.7 percent of marketable Treasury securities. During the 1970s, foreign ownership averaged 19.5 percent. By the 1990s, it had jumped to 25.6 percent. Foreign ownership peaked in 2008 at 56.5 percent. In the third quarter of 2016, foreigners held 45.2 percent of marketable Treasury securities.

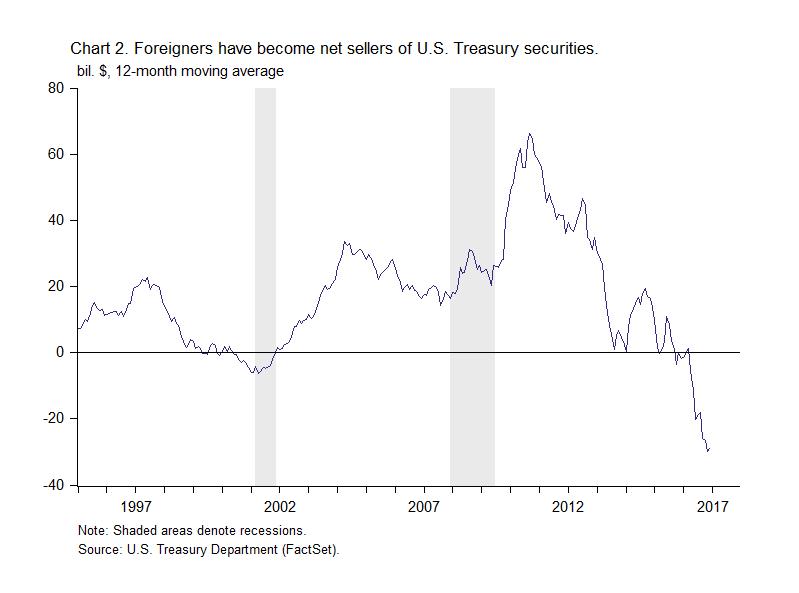

Foreign ownership of Treasurys has declined as foreigners have become net sellers. Since the Great Recession, foreigners have been reducing their purchases. In 2016, they became net sellers of Treasury securities for the first time since the early 2000s. A large deficit and debt will be difficult to sustain if they continue to reduce their holdings.

Click here to sign up for the Daily Economy weekly digest!