Dr. Jordan’s article appeared in the Spring/Summer 2015 edition of the Cato Journal. “I am convinced we shall never have good money again so long as we leave it in the hands of government. Government has always destroyed the monetary systems.” Friedric …

READ MORE

I am very excited to join the Sound Money Project and contribute to the understanding of monetary systems that are conducive to economic stability. To begin, I would like to describe how I think about monetary theory at a general level, and how this i …

READ MORE

It has truly been an exciting year for the Atlas Network’s Sound Money Project and Washington’s monetary policy community. From meetings with Federal Reserve Chairwoman Janet Yellen to the opening of new monetary policy centers, SMP has been at the for …

READ MORE

That was the topic of a conference organized by the Center for Free Enterprise at West Virginia University that took place on Saturday, April 25. The conference was divided in two sessions: one where theoretical aspects of NGDP were discussed and anoth …

READ MORE

This piece was originally published in Globe Asia, April 2015. By Dr. Steve H. Hanke Led by the charismatic Alexis Tsipras, the Syriza party took office in Athens on January 26th. The most prominent member of the new Prime Minister’s cabinet is Yanis V …

READ MORE

Monetary policy: it doesn’t make headlines like drone stikes or police militarization, but it really should. Considering how much the decisions of central bankers affect the global economy, it makes little sense that candidates and politicians are not …

READ MORE

The Atlas Network’s Sound Money Project is proud to announce that Dr. Thomas L. Hogan has accepted an appointment as Chief Economist of the Senate Banking Committee. Although this means that he will be stepping down from his role as a SMP Fellow, we co …

READ MORE

The following is an excerpt from a piece by Norbert Michel that was originally published by Forbes. The status quo. It’s a powerful force in Washington, D.C. No matter how destructive or inefficient an existing program, institution or system may be, it …

READ MORE

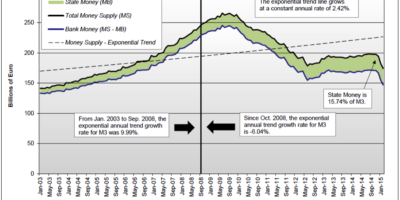

A few weeks ago I commented on whether or not the Market Monetarist position that a 5% growth rate of NGDP (before the subprime crisis) could have been too much. The main point was that other nominal variables did not behave in accordance to what would …

READ MORE

Today is Tax Day. Across the country, individuals are scrambling to file their tax returns, enjoying discounts from various restaurant chains and (if they’re libertarians) posting lengthy Facebook statuses that outline why taxation is theft. While it’s …

READ MORE

Changes in the price level driven by productivity provide valuable information over time. Trying to offset such changes requires a costly adjustment of prices with no offsetting benefit in terms of the degree to which prices convey information about relative scarcity.

READ MORE

Earlier today, George Selgin, Director of the Cato Institute’s Center for Monetary and Financial Alternatives announced the launch of the Center’s new blog, “Alt-M.” We at the Sound Money Project are excited to continue to work with Dr. Selgin and his …

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305