Pulling It All together/Appendix

The Economy…

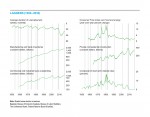

Our Leaders index continues to hover just below 50. The key takeaway is, slow growth is likely to continue, though the risk of a recession remains somewhat elevated. Home improvement spending has contributed to overall residential investment gains. The gains in home improvement are one of the areas supporting increases in retail sales.

…Inflation…

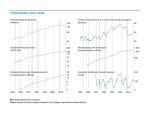

The outlook for inflation remains neutral overall, based on data through July. Out of 23 indicators tracked by the AIER’s Inflationary Pressures Scorecard, 11 point to rising inflationary pressure and 10 to falling, and two are neutral. Energy prices, an important part of consumer prices, reversed direction and fell after rising for four months. And with no change in food prices, another important component, the Consumer Price Index was unchanged for the month. Declining energy prices also contributed to the fall in AIER’s Everyday Price Index. Absent unexpected developments, inflation is unlikely to change significantly in the upcoming months.

…Policy…

Both presidential candidates seem to agree that corporate inversions present a problem, but they propose very different methods of dealing with it. The problem arises from the U.S. tax code creating an incentive for U.S.-based corporations to become foreign-based companies that pay lower taxes.

The outlook for inflation remains neutral overall, based on data through July. Out of 23 indicators tracked by the AIER’s Inflationary Pressures Scorecard, 11 point to rising inflationary pressure and 10 to falling, and two are neutral. Energy prices, an important part of consumer prices, reversed direction and fell after rising for four months. And with no change in food prices, another important component, the Consumer Price Index was unchanged for the month. Declining energy prices also contributed to the fall in AIER’s Everyday Price Index. Absent unexpected developments, inflation is unlikely to change significantly in the upcoming months.

…Policy…

Both presidential candidates seem to agree that corporate inversions present a problem, but they propose very different methods of dealing with it. The problem arises from the U.S. tax code creating an incentive for U.S.-based corporations to become foreign-based companies that pay lower taxes.

In general, there are only two ways to prevent corporate inversions. One is to remove the incentive by changing the U.S. corporate tax climate to match those of other countries. The other is to create disincentives for companies looking to invert, for example, in the form of an exit tax that they would have to pay if they chose to relocate.

Mathematically, the two approaches seem to be equivalent, but their consequences would be quite different.

…Investing

Extraordinary conditions in fixed-income markets in developed economies continue. Yields are extremely low by historical standards, including negative rates in Europe and Japan. Falling yields have boosted total returns in fixed- income securities, but further gains may be challenging.

A slow recovery in new home construction combined with solid gains in home improvement expenditures are likely supporting lumber prices.

U.S. equity performance in industries related to home improvement reflects a solid growth trend in spending on remodeling.

The U.S. equity market has been outperforming the global, non-U.S. equity markets overall. The performance is even more dramatic across the different sectors of the global equity market.

Next/Previous Section:

1. Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix