Pulling It All Together/Appendix

The Economy…

Business cycles matter. The economy matters. As our Leaders index falls to the neutral 50 level, close monitoring of economic conditions becomes critical. Our analysis suggests that core economic growth is supported by solid consumer fundamentals, but given the slow pace of growth and strong crosscurrents from slow global growth and a strong dollar, the outlook remains fragile.

…Inflation…

Inflationary pressures have firmed and prices rose a bit faster in January led by a jump in core consumer goods prices. However, our Scorecard is closely balanced, and significant inflation remains a low probability in the current economic environment.

…Policy…

Several central banks around the world already have negative interest rates. Only a significant deterioration in the U.S. economy would make the Fed consider taking interest rates into negative territory as a means to boost lending. Negative interest rates would penalize banks for holding on to reserves, thereby giving them incentives to lend money. This would stimulate lending but would raise the danger of inducing banks to engage in risker lending.

…Investing

Treasury yields remain very low despite Fed tightening and net selling by foreign investors over the past year. It’s impossible to know when or if yields will rise, but with the 10-year Treasury under 2 percent, the expected risk-to-return profile should be reviewed carefully.

Inflationary pressures have firmed and prices rose a bit faster in January led by a jump in core consumer goods prices. However, our Scorecard is closely balanced, and significant inflation remains a low probability in the current economic environment.

…Policy…

Several central banks around the world already have negative interest rates. Only a significant deterioration in the U.S. economy would make the Fed consider taking interest rates into negative territory as a means to boost lending. Negative interest rates would penalize banks for holding on to reserves, thereby giving them incentives to lend money. This would stimulate lending but would raise the danger of inducing banks to engage in risker lending.

…Investing

Treasury yields remain very low despite Fed tightening and net selling by foreign investors over the past year. It’s impossible to know when or if yields will rise, but with the 10-year Treasury under 2 percent, the expected risk-to-return profile should be reviewed carefully.

Treasury yields remain very low despite Fed tightening and net selling by foreign investors over the past year. It’s impossible to know when or if yields will rise, but with the 10-year Treasury under 2 percent, the expected risk-to-return profile should be reviewed carefully.

Gold prices have risen recently, somewhat offsetting equity declines. Including gold in a portfolio is wholly appropriate for some investors depending on their risk and return objectives.

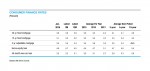

U.S. consumer discretionary stocks across the market-cap spectrum have outpaced the broader markets. These results fit with our analysis of the business cycle. However, caution would guard against unsupportable future expectations.

Global markets and economies in different regions are following very different paths. Recognizing the differences within this category can help investors more precisely manage risk exposure and tailor asset allocation.

Next/Previous Section:

1. Overview

6. Pulling It All Together/Appendix

Click here to receive email notifications when the latest Business Conditions Monthly is available.