Investing

Stronger dollar may be a headwind for commodity prices

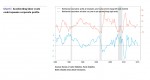

The real, Broad Dollar Index of the Federal Reserve rose almost 22 percent between December 2013 and December 2016 (Chart 7). A stronger dollar tends to make U.S. exports more expensive and imports cheaper, leading to fewer exports and more imports. That impact can be seen in the negative impact of net trade to real GDP growth (Chart 1, page 1). Dollar movements can also have broad influence on commodity prices. Two of the more actively traded commodities, gold and crude oil, have likely been pressured by the longer-term trend in the dollar. Though prices of each of those commodities can be heavily influenced by other forces, such as world supply and demand, major trends in the dollar should not be ignored.

Since 1995 there have been three major upward or downward trends in the dollar index. From mid-1995 through early 2002, the dollar generally strengthened (Chart 7; note the inverted index for the dollar). Over that time, the price of gold generally trended lower, while crude oil posted four distinct short-term trends, two up and two down. Between 2002 and 2012, the dollar generally weakened, while both gold and crude experienced major bull-market rallies, though these trends were disrupted during the Great Recession. Finally, in mid-2014, the dollar began another major strengthening trend. Crude-oil prices plunged between mid-2014 and early 2016, though they recovered significantly during 2016. Gold, however, remained relatively steady during much of the dollar’s bull trend.

As the dollar continues to strengthen, and additional strengthening is possible if the Fed continues to raise interest rates, commodities such as gold and oil may come under pressure. Offsetting this pressure may be stronger demand for all commodities as U.S. and global growth accelerate. Gold may also benefit from greater global uncertainty, as some investors increase their holdings as a hedge against unexpected developments.

Next/Previous Section:

1. Overview

2. Economy

3. Inflation

4. Policy

5. Investing