Economy

Gradual Growth

Current business-cycle expansion posts slower output and employment growth

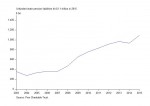

The current recovery, which started in June 2009, has lasted longer than the previous one. The last expansion continued for 73 months, from November 2001 to December 2007, ending with the onset of the Great Recession. The current expansion entered its 74th month in August.

By many measures, this recovery has been slower than earlier expansions of a similar length. Chart 2 compares the trajectory of GDP in the current cycle and in four others that have lasted as long or longer.

Output growth clearly has been slower in the current cycle, averaging 2.1 percent a year, compared with annual rates above 3 percent or even 5 percent in previous long expansions. Employment gains have been similarly gradual this time around. Since 2009, the economy has added jobs at an average annual rate of 0.8 percent. In earlier expansions, the pace often surpassed 2.5 percent, although in the 2001–2007 recovery it averaged only 0.7 percent a year. In the current cycle, job growth did not start until a year into the expansion, slowing the annual average rate.

This cycle is in many ways different from earlier ones. It does not have the stimulating effects of the credit and housing bubble, which seem to have driven the 2001–2007 expansion. It is also different from the 1991–2001 recovery, in which very rapid growth coincided with technological advances, a booming stock market, and the eventual dot-com bubble in share prices.

There does not seem to be an obvious, single driving force for the current expansion, as was the case for the previous two. This may be why growth has been more gradual and subdued. This is not necessarily a bad thing. Periods of more rapid growth, if driven by things like stock market or housing bubbles, seem not to have ended well.

More gradual growth might mean that the economy has a long way to go before the next recession strikes. There are no guarantees, of course.

Economic Outlook

The percentage of AIER’s primary leading indicators of business-cycle conditions determined to be expanding rose to 67 (eight out of 12) this month from 64 last month. One, the “three-month percent change in consumer debt,” moved up to probably expanding from neutral. This indicator has been improving for three months and we have been gradually upgrading its cyclical status.

Click for interactive Indicators at a Glance (on mobile device turn to landscape)

At the same time, the cyclical score of leaders, based on a separate, purely mathematical analysis, fell to 77 from 83 last month. Still, since both measures are comfortably above 50, our leading indicators suggest that the economic expansion, which started just over six years ago, is likely to continue.

Our coincident indicators support the determination of a continued expansion. We judged five out of six of these to be expanding, and all five reached new highs this month. This is a strong confirmation of an ongoing recovery. The only coincident indicator not determined to be expanding is the “index of industrial production.” It has fallen a bit from a December 2014 peak and is currently seen as probably contracting. The proportion of primary lagging indicators judged to be expanding remained unchanged at four out of five indicators with a discernible trend.

This pattern is what one would expect at the current stage of the business cycle. When the business-cycle expansion has lasted for a few years, most coincident and lagging indicators should be expanding. There is little doubt that an expansion is underway, while the focus is on spotting possible early signs of an approaching recession. The leading indicators should provide those signals. By their nature, the indicators start weakening several months before a decline in general economic activity. Currently we are not seeing any widespread weakness among our leaders. Both the percentage of those expanding and their cyclical score suggest that continued growth is more likely than a recession in the near future.

Next/Previous Section:

1.Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix