Inflation

Scorecard

The Consumer Price Index (CPI) in June exceeded its value from 12 months ago for the first time since the start of this year. This is consistent with AIER’s Scorecard analysis last month, which noted a rising inflationary climate. The latest Scorecard suggests increasing price pressures in the coming months as well. Out of 23 indicators we track, 17 point to rising inflationary pressure, compared with 15 last month. Three suggest falling pressure, and three indicate no change (Table 1).

Consumer demand continues to show strong growth, reflected by retail sales rising 3.2 percent in the past three months. Strong demand usually puts upward pressure on consumer prices. But this pressure was somewhat offset by disappointing wage growth in recent months. The growth of average hourly earnings slowed even though more payroll jobs were added.

The pressure on inflation coming from money and credit trended a bit higher compared with last month’s report, driven by solid growth in revolving consumer credit. The timing and pace of interest rate increases by the Fed remain unclear. The money supply growth rate has continued to moderate, however, offsetting inflationary pressures from other economic segments. On the costs and productivity front, all the indicators, except for private compensation, point to rising inflationary pressure in June.

Consumer Price Index Analysis

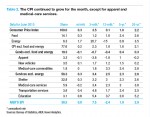

The Consumer Price Index advanced a seasonally adjusted 0.1 percent from a year ago in June. This is the first increase over a 12-month period since the beginning of the year. On a month-to-month basis, the CPI grew for a fifth consecutive month, posting a 0.3 percent gain in June. In a longer-term perspective, the CPI rose at an annualized rate of 1.9 percent in the past five years and 2.2 percent over 20 years (Table 2).

Food prices started rising again in June after falling 0.2 percent in March and staying unchanged in April and May. Households paid 0.3 percent more for food this month, the same pace of increase as the overall CPI. This contrasts with the past, when food prices usually climbed faster than overall consumer prices. In the past five years, for instance, food prices rose 2.4 percent a year while the CPI’s annual growth rate trailed at 1.8 percent. Over two decades, food advanced by 2.6 percent annually compared with the CPI’s 2.2 percent pace.

Energy, the most volatile component of the CPI, rose 1.7 percent in June from May and 4.8 percent from March, a 20.7 percent annualized rate over the three months. But it is still 15 percent below the year-earlier value. Over the past two decades, energy prices advanced by an average 3.5 percent a year, outpacing the overall CPI rate.

Excluding volatile food and energy prices, the core CPI inched up 0.2 percent from last month and 1.8 percent from a year ago. The annual growth rate of the core CPI in June slightly exceeded the May rate but remained below the Fed’s 2 percent target.

Prices of core goods (which exclude food and energy) continued to trend lower in June, mainly because apparel prices dropped. Apparel posted a third straight monthly decline, falling 3.8 percent over three months. Prices of core services, which exclude energy, rose 0.3 percent from the previous month and 3.4 percent from three months earlier. The cost of medical care slipped 0.2 percent; it was the only component of core services that declined in June. Education costs advanced 0.6 percent, the fastest growth rate among all core services.

Everyday Price Index

The AIER Everyday Price Index (EPI) increased 0.8 percent in June after rising 1.1 percent in May. The index is not seasonally adjusted. By comparison, the CPI rose 0.4 percent on a similarly unadjusted basis after climbing 0.5 percent in May.

Over the past 12 months the EPI dropped 2.4 percent while the CPI edged up 0.1 percent. The difference between the EPI and the CPI performance stems from energy prices, as AIER’s EPI assigns them a greater weight.

Energy prices climbed 3 percent in June, leading the EPI higher. Gasoline prices rose 2.5 percent in June after surging 10.5 percent in May. Still, gasoline prices have dropped 23.2 percent over the past year, reflecting a plunge in global crude oil prices.

Food prices increased 0.2 percent in June with both food-at-home and food-away-from-home rising 0.2 percent. A 1.4 percent gain in poultry and a 17.8 percent jump in egg prices drove food-at-home prices higher, as an outbreak of bird flu led to supply shortages.

Rounding out the EPI, personal-care prices were mixed in June, with a 0.3 percent decline in personal-care products and a 1.6 percent gain in personal-care services.

Next/Previous Section:

1.Overview

3. Inflation

6. Pulling It All Together/Appendix