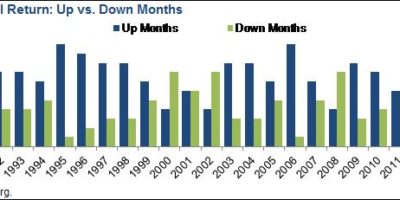

Markets go up and down daily. For every buyer, there is a seller. But there is a broader historical point here. Even during periods of relative growth, there are negative stretches.

READ MORE

It has been an uncharacteristically warm fall and early winter here in the Northeast, and I for one was very happy to forego a White Christmas in order to have a warm one. But how much does the weather matter to average Americans, and how does it affect the cost of living?

READ MORE

Here’s hoping that 2016 brings back an economy that relies more on business fundamentals, and less on the machinations of technocrats in Washington. With the drama of the first Fed rate hike behind us, perhaps business leaders and investors can focus on the things that make American companies competitive for the long haul.

READ MORE

From our top blogs of 2015: Nothing has risen more quickly than the cost of going to college, our visiting research fellow, Steven Pressman, wrote in August. He discusses whether it is still a worthwhile investment.

READ MOREFrom our top blogs of 2015: Is the middle class shrinking? That may not be possible, depending on what definition you use, says our Polina Vlasenko.

READ MOREOur best-read blog of 2015: Our Luke Delorme informed our readers about the changes that Congress made to Social Security as part of the budget deal with the president.

READ MORE

From our top blogs of 2015: The method that our data scientist, Theodore Cangero, used to buy a car.

READ MORE

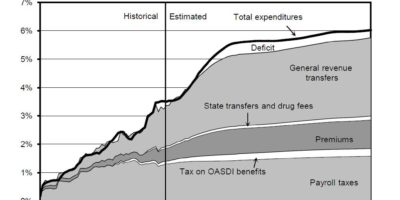

This week, as we recharge for the new year, we highlight a few of our best-read blogs of 2015. This piece originally ran in August. Many believe that Medicare (similarly to Social Security) does not add anything to the federal budget deficit because it is financed by dedicated tax revenue. This belief is one of the reasons for the outrage at the suggestion that Medicare needs to be reformed to prevent future budget deficits from spiraling out of control.

READ MORE

Americans have spent a lot of energy worrying about what might happen when the Federal Reserve Bank raised interest rates. They have worried that an increase could hurt economic growth, and could be a setback for investors. But a week after the increase, the effects have so far been pretty mild.

READ MORE

Although saving for the long-term future is important, you should also consider holding some share of your money in cash and similar short-term investments (sometimes called cash equivalents) such as CDs, money market funds, and short-term treasuries.

READ MORE

The most brilliant investment strategy in the world will not make up for a lack of putting money aside. How much you save versus how much you spend is the most important driver of whether you will succeed in having money for your future financial goals.

READ MORE

Throughout much of the later part of this year, our Bob Hughes has been saying the economy’s trajectory has been one of slow and steady growth. This morning, we have more evidence that this is the case.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305