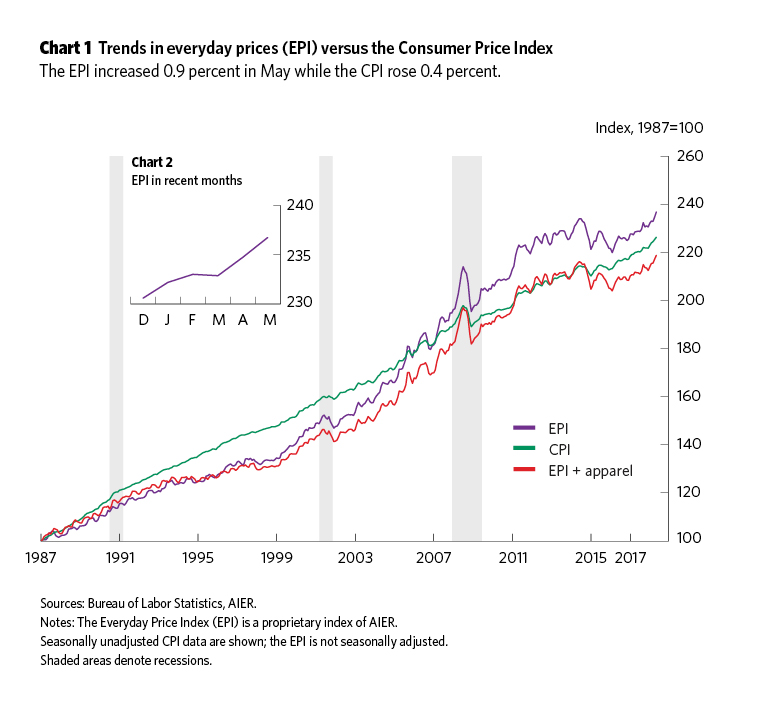

Energy and Prescription-Drug Prices Surge in the AIER Everyday Price Index

AIER’s Everyday Price Index jumped 0.9 percent in May, above the 0.4 percent gain in the Consumer Price Index. The EPI measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI. The EPI including apparel, a broader measure, gained 0.7 percent in May as apparel prices fell sharply after four consecutive monthly increases. Both measures exclude prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

Over the past 12 months, the EPI has risen 3.6 percent, the fastest pace since February 2012, while the EPI including apparel is up 3.4 percent, its fastest pace since March 2012. The more widely known price gauge, the Consumer Price Index, reported by the Bureau of Labor Statistics, includes less-frequently purchased items and everyday purchases. That measure is up 2.8 percent over the past 12 months. Over the last five years, the EPI is up at a 0.8 percent annualized rate compared to an average annual rise of 1.6 percent for the CPI.

From mid-2011 through mid-2014, West Texas Intermediate crude oil averaged over $96 per barrel. From mid-2014 through early 2016, crude prices collapsed to a low of just over $26 per barrel. Since the 2016 low, oil prices have trended higher, reaching $66.50 in early June. Those fluctuations cause tremendous volatility in the prices of finished energy products such as gasoline as well as putting pressure on some services such as utilities and transportation services, many of which are included in the EPI. In addition, normal seasonal price fluctuations such as increases in motor fuels during the summer driving season impact the EPI because it is not seasonally adjusted. In May, motor fuels jumped 5.8 percent on a not-seasonally-adjusted basis. That surge accounted for nearly the entire rise in the overall EPI.

Other significant contributions to the monthly change in the EPI came from prescription-drug prices, which jumped 1.0 percent on an unadjusted basis in May, and apparel prices, which fell 0.8 percent for the month. Among the two food categories, food at home (groceries) fell 0.4 percent in the month and is up just 0.1 percent over the past year while food away from home (restaurants) rose 0.3 percent in May and is up 2.7 percent.

Over the past year, about 80 percent of the categories that make up the EPI have shown higher prices while 20 percent have shown price declines. Approximately 46 percent of the categories have 12-month changes greater than 2 percent. Over the past five years, 8 of the 24 categories within the EPI have annualized price declines while 7 have annualized gains between 0 and 2 percent and 9 categories have gains above 2 percent. Among the categories with price declines are non-prescription drugs, telephone services, internet services, and pet supplies.

Among the components with the largest weights in the EPI, food at home (21.0 percent weight) is up 0.1 percent from a year ago, food away from home (17.1 percent) is up 2.7 percent, household fuels and utilities (13.3 percent) are up 1.8 percent for the year, and motor fuel (12.3 percent) is up 21.8 percent since last May. Combined, they account for 63.6 percent of the EPI.