Case Study: The 2007-8 Financial Crisis

In previous posts, I argued that discretionary central banking is plagued by a host of incentive and information problems. These problems make it systematically unlikely that discretionary central banking can deliver on its promise to maintain macroeconomic stability. These discussions may have seemed a bit abstract. Let’s make things more concrete by using our understanding of incentive and information problems to see how the Fed, rather than free markets, caused the 2007-8 financial crisis.

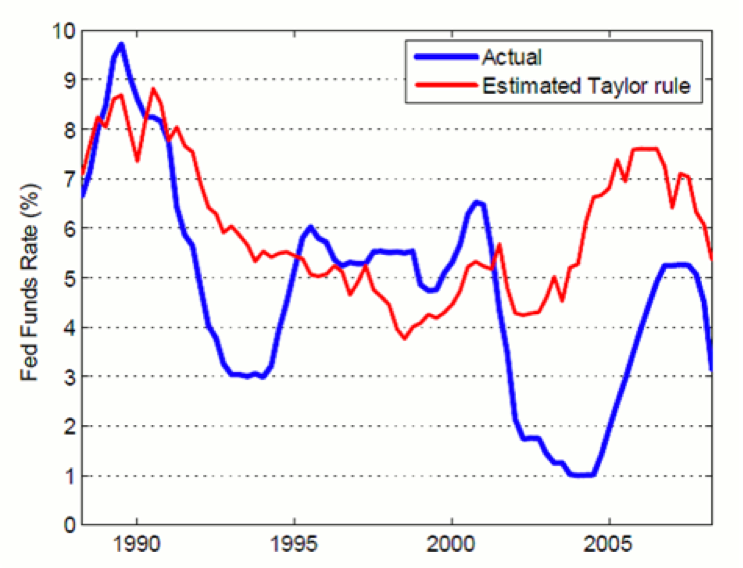

Tackling information problems first, we observe that a serious policy mistake in the years prior to the crisis helped inflate the bubble that eventually burst and temporarily crippled financial markets. Below is a graph comparing the federal funds rate — that is, the rate the Fed frequently tries to alter (at the margin) in pursuing monetary policy — to the rate prescribed by a Taylor rule. A Taylor rule is one way to estimate what the interest rate “should have been”: what rate would have equilibrated the market for saved capital over the time horizon in question. (Remember: monetary policy is about the money supply, not interest rates; yet monetary policy can and does affect interest rates, especially in the short run.)

Notice the divergence between the actual federal funds rate and the Taylor rule rate in the early 2000s. This occurred because the Fed under Alan Greenspan aggressively tried to stabilize markets following the dot-com crash. The approach seemed to make sense at the time. But it inadvertently caused capital to become artificially cheap: as the popular saying goes, interest rates were “too low for too long.” As John Taylor, the Taylor rule’s namesake, has argued, this was one of the policy mistakes that precipitated the crisis. The result was a classic boom-and-bust cycle due in part to unsustainable investments that seemed like good ideas at the time.

Figuring out the correct monetary policy is incredibly difficult, even if policy makers are following a rule such as the Taylor rule. In addition to trying to meet an excess demand for money with appropriate expansions in its supply, policy makers have to be sensitive to how their behaviors affect crucial market prices such as the interest rate. In trying to shield the economy from one crash, the Fed mistakenly set the stage for another. This is because of an insoluble information problem: it has no feedback telling it when it’s getting things right.

Now let’s consider incentive problems. The elephant in the room here is “too big to fail.” Policy makers are unwilling to let large financial institutions fail, because of the economic turmoil it may cause. Financial institutions, realizing this, take inordinately large risks in the marketplace, knowing profits will be kept private but losses will be passed on to the taxpayer. Too big to fail has been a problem for decades, and admittedly there are other regulators at fault besides the Fed. But the Fed does bear some of the blame.

A defining event was the 1984 Continental Illinois bank failure. Continental Illinois became insolvent, partly because of imprudent investments. Classical lender-of-last-resort theory argues that central banks ought to extend emergency loans to illiquid banks — those whose current liabilities exceed their current assets but are still solvent — but not to insolvent banks. The Fed promised to meet Continental Illinois’s liquidity needs anyway. This was the first indication that the Fed would insulate banks from the full costs of their actions. Central bankers aren’t willing to risk a financial crisis for which they may be held responsible.

Another noteworthy case was the bailout of Long-Term Capital Management, a hedge fund management firm, in 1998. With this event, the Fed showed it was unwilling to allow even nonbank organizations to fail if they were deemed sufficiently large and important. The New York Fed oversaw the emergency injection of liquidity by major private creditors. Although no public funds were used, the Fed’s active oversight of the affair signaled to markets that public authorities were unwilling to remain impartial as referees in times of turbulence.

Central bankers can’t be trusted to allow markets to perform the necessary social role of filtering out irresponsible financial firms. Financiers can’t be trusted not to take too much risk, given their recognition of central bankers’ unwillingness to remain referees. The incentive problems created by central banking, in both the public and private sectors, guarantee the too-big-to-fail problem as a result.

We now have a good theoretical understanding of why central banks can’t deliver on their promises as well as a historical appreciation for the ways central banking causes rather than prevents market turmoil. Admittedly, a full accounting of the financial crisis must incorporate many other factors, such as misguided federal housing policies, that have nothing to do with the Fed. But this doesn’t change the fact that the Fed’s mistakes did in part cause the crisis. Now that we know discretionary central banking can’t do what its adherents claim, we can explore alternative monetary systems that work better. Fortunately for us, there are several possibilities.