Third-Quarter Real GDP Rises 3.2 Percent; Profits Hit a Record

Revised estimates show real GDP grew at a 3.2 percent pace in the third quarter compared to a 3.1 percent pace in the second quarter. The latest report on the economy also provided a revised estimate for third-quarter corporate profits and prices. Most elements of the report suggest the economy remains in very good condition, with moderate real growth, continued gains in profits, and tepid price increases.

Most of the major components of GDP made positive contributions to growth in the quarter. Real personal consumption expenditures grew at a revised 2.2 percent pace, slightly below the 2.3 percent gain in the prior estimate and significantly below the 3.3 percent pace of the second quarter. Spending on the durable-goods component of PCE accelerated to 8.6 percent from 7.6 percent in the second quarter while spending on consumer services and nondurable goods decelerated — to 1.1 percent from 2.3 percent and 2.3 percent from 4.2 percent, respectively.

Business fixed investment in equipment jumped 10.8 percent after an 8.8 percent rise in the second quarter. Equipment spending has had four consecutive quarters of improving growth. Business investment in intellectual property products rose 5.2 percent in the third quarter after a 3.7 percent gain in the second quarter.

The two weakest components in the third-quarter report were nonresidential-structure investment, which fell 7.0 percent, and residential investment (housing), which posted its second consecutive quarterly decline, dropping 4.7 percent following a 7.3 percent drop in the second quarter.

Private domestic demand, which is the sum of PCE, business investment, and residential investment (housing), rose at a 2.2 percent pace, in the third quarter (below the 3.3 percent pace of the second quarter) despite the weakness in both residential investment and the nonresidential-structure component of business investment. Private domestic demand has been the main driver of growth for much of the current expansion. Despite the slowdown in the third quarter, fundamentals supporting private domestic demand remain very solid and are likely to support faster growth over the next several quarters.

Among the other major components of GDP, net trade, the difference between exports and imports, was slightly less negative in the third quarter, resulting in a positive contribution of 0.4 percentage points to overall GDP growth. Within net trade, exports rose 2.1 percent while imports fell 0.7 percent. Private inventories added $38.5 billion in real terms, much larger than the $5.5 billion rise in the prior quarter. The faster inventory accumulation added 0.8 percentage points to the final GDP growth rate. Finally, real government spending rose 0.7 percent versus a 0.2 percent decline in the second quarter. Federal spending rose 1.3 percent, led by a 2.4 percent rise in defense that was partially offset by a 0.2 percent decline in nondefense. State and local government spending rose 0.2 percent in the third quarter following a 1.5 percent decline in the prior quarter.

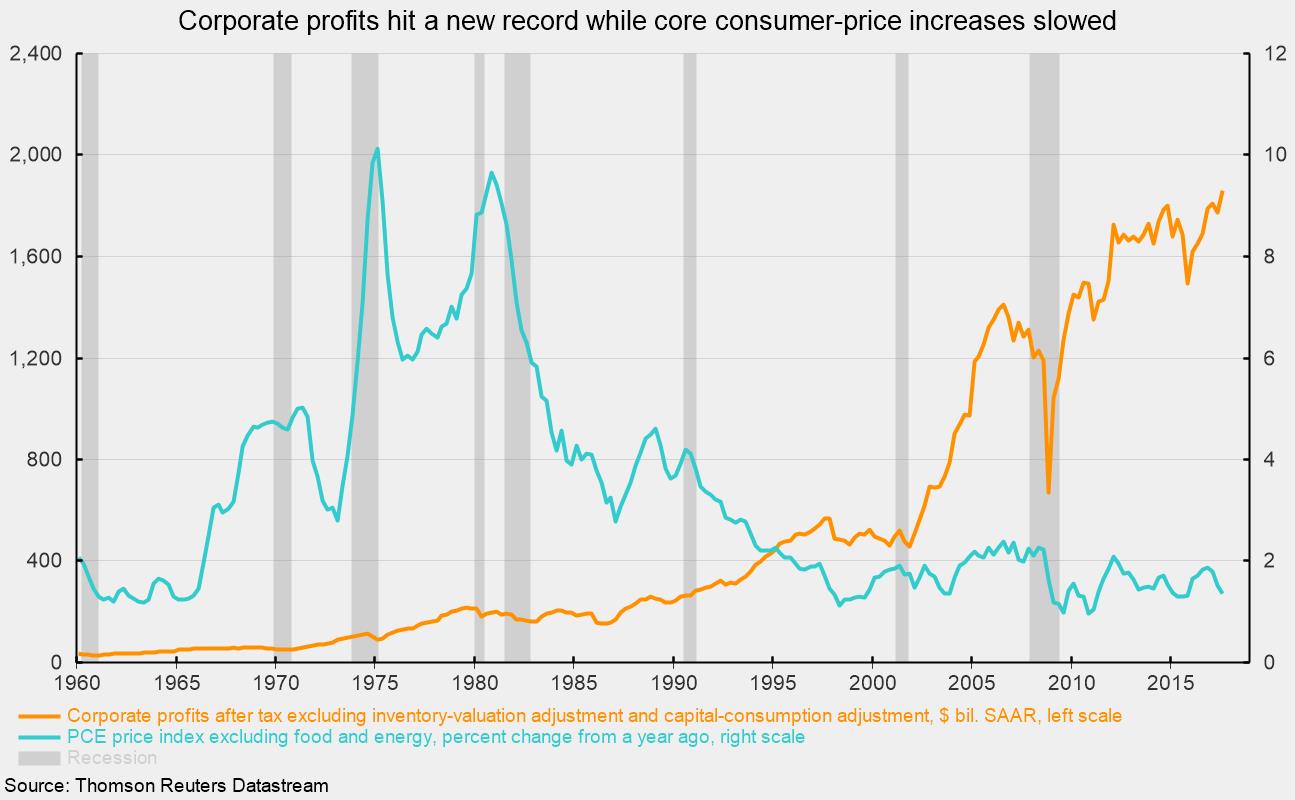

Solid growth from domestic demand combined with accelerating growth overseas has helped push U.S. corporate profits to a new record high. For the economy in aggregate, after-tax corporate profits excluding inventory-valuation adjustments and capital-consumption adjustments — both used in national income accounting — hit an all-time high of $1.86 trillion at a seasonally adjusted annual rate in the third quarter (see chart). That represents a 9.8 percent gain from the third quarter of 2016. These economy-wide measures corroborate public companies’ reports — followed closely by market analysts — of generally strong corporate earnings. Strong profits gains, solid growth in demand, low cost of capital, and generally healthy balance sheets for the corporate sector suggest a positive outlook for business fixed investment.

The third key aspect of the latest report on the broad economy is the continued tepid increases in prices. The overall GDP price index rose at a 2.1 percent pace compared to just 1.0 percent in the second quarter. Over the last four quarters, the GDP price index is up a more mild 1.8 percent. The largest price increases in the third quarter came from nonresidential and residential structures (increasing 4.5 percent and 4.4 percent respectively), services imports (up 5.0 percent), and state and local expenditures prices (rising 3.0 percent).

PCE prices, the measure preferred by the Fed, rose 1.5 percent in the third quarter. From a year ago, the PCE price index is up 1.5 percent while the core PCE price index, which excludes volatile food and energy items, is up just 1.4 percent. The core PCE price index has been rising at less than 2 percent for most of the past 20 years (see chart). That stretch of sub-2 percent increases is about as close to price stability as the United States has ever experienced.

Overall, economic data suggest an economic environment with solid growth and slow price increases that is likely to continue well into 2018.