The Latest Labor-Market Indicators Suggest Continuing Strength

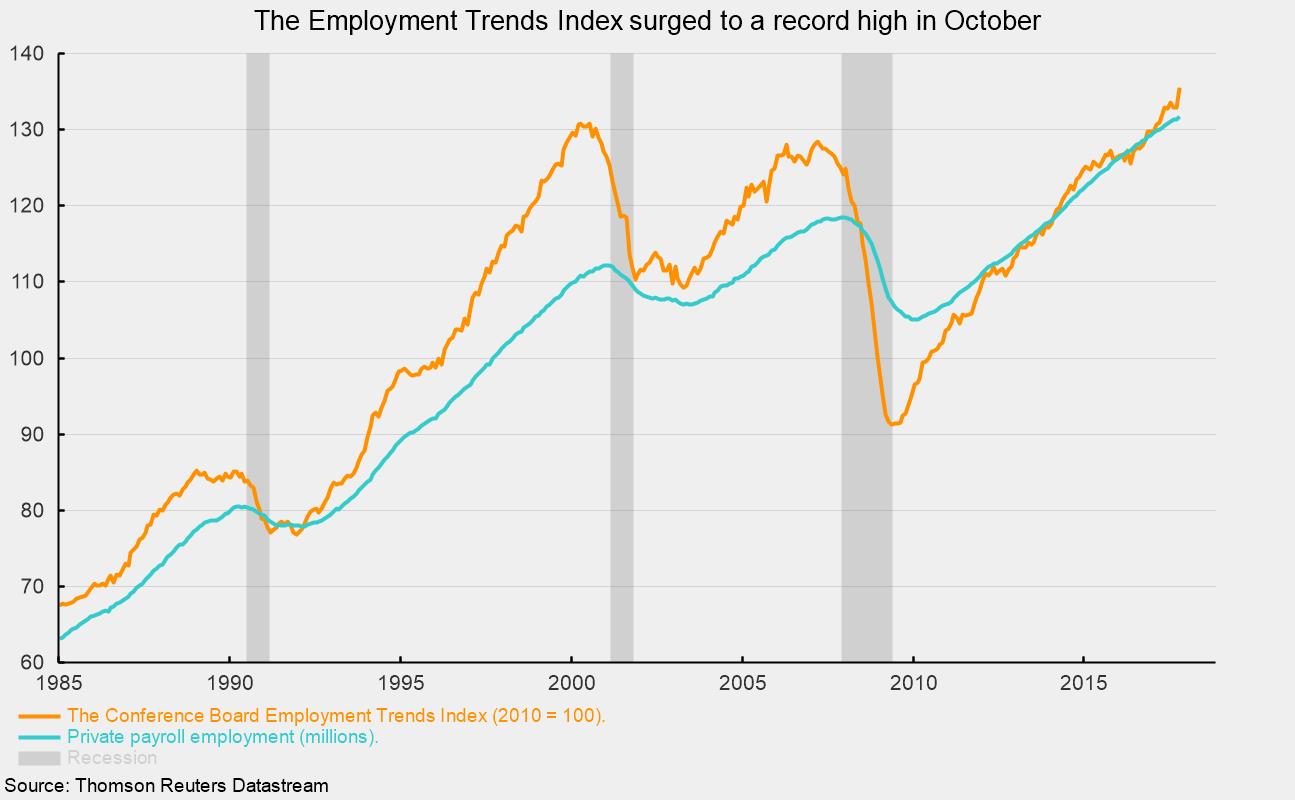

The Conference Board Employment Trends Index surged to a record 135.6 in October, a gain of 2.0 percent for the month and 5.4 percent from a year ago. The ETI tends to lead private payroll employment by about five months, suggesting further gains in payrolls in coming months (see chart).

The ETI is a composite index consisting of the percentage of respondents who say they find “jobs hard to get,” from The Conference Board Consumer Confidence Survey; initial claims for unemployment insurance, from the Department of Labor; the percentage of firms with positions they cannot fill right now, from the National Federation of Independent Business Research Foundation; the number of employees hired by the temporary-help industry, from the Bureau of Labor Statistics; the ratio of involuntarily part-time to all part-time workers, from the BLS; job openings, from the BLS; industrial production, from the Federal Reserve Board; and real manufacturing and trade sales, from the Bureau of Economic Analysis.

A separate report from the BLS confirms the continued strength in the labor market. Total job openings in the United States ticked down just slightly to 6.093 million, just 0.7 percent below the record high of 6.14 million in July. Jobs openings in the private sector totaled 5.563 million in September, or 1.1 percent below their all-time record. The jobs-openings rate, openings divided by the sum of jobs plus openings, held at record highs for both the total labor market and the private sector, coming in at 4.0 percent and 4.3 percent respectively. The highest openings rates were in professional and business services (5.4 percent) and health care (5.2 percent), while the lowest openings rates were in education (2.6 percent) and construction (2.8 percent).

Further signs of labor-market strength may be seen in the layoffs rate, which held at 1.3 percent for private employers, well below the 2.2 percent peak rate in 2009, and the quits rate, which remained at 2.4 percent in September, well above the 1.4 percent rate in 2009.

Overall, the data relating to the labor market continue to show strength. Payrolls are rising, layoffs remain low, and quits have risen. The fact that the number of open positions in the economy is substantial while the unemployment rate has fallen to a new cyclical low suggests wage gains may accelerate, but as of now, increases have remained quite moderate.

Accelerating wages gains are a double-edged sword: faster gains boost income and potential spending; however, they could also boost price pressures if employers try to pass higher labor costs on to consumers. The two wild cards are the low productivity rate and low participation rate. An acceleration in productivity could offset higher labor costs, while a rising participation rate could ease some of the tightness in the labor market and keep a lid on wage pressures.