Strong Retail Sales Gains and Low Initial Claims Point to Robust Growth

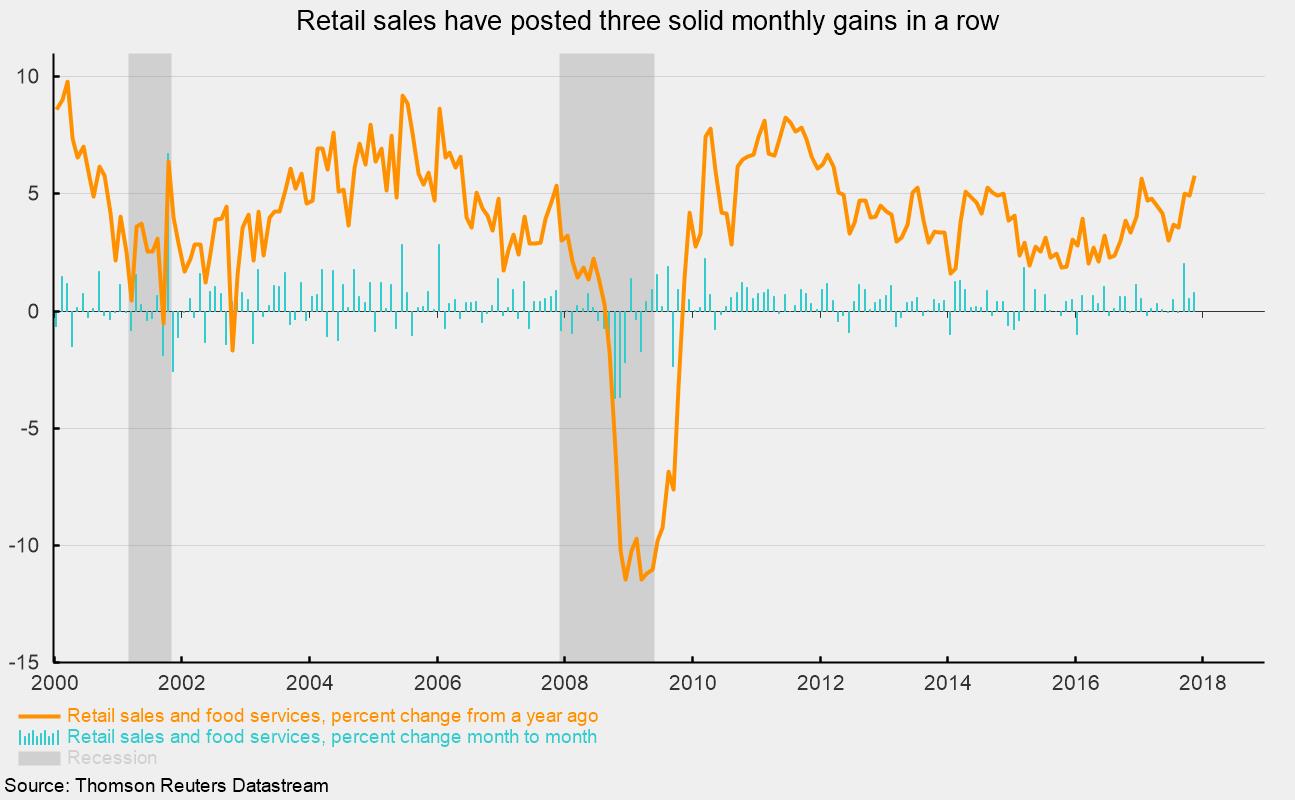

Retail sales jumped 0.8 percent in November, the third strong monthly gain in a row. Over the last three months, retail sales have risen at an 11.7 percent annual rate; over the past year, they are up 5.8 percent, the strongest yearly gain since March 2012 (see chart). The robust gains are consistent with the latest results of the AIER Leading Indicators index, which hit 92 (out of 100), the highest reading since 2014.

Gains in retail sales in November were widespread among the components. The only major component to show a decline for the month was motor vehicle and parts dealers. Sales for this category dropped 0.2 percent for the month following large gains in the prior two months. Over the last three months, sales are still up at an 18.2 percent annualized pace.

The AIER calculation of discretionary retail sales rose 0.5 percent in November, putting the yearly gain at 5.5 percent. Excluding the weak results from motor vehicles dealers in November, discretionary retail sales gained a full 1.0 percent for the month, putting the yearly gains at 5.1 percent.

Among the remaining discretionary categories, electronics and appliance stores rose 2.1 percent for the month (and 6.4 percent from a year ago), furniture and home furnishings increased 1.6 percent (7.5 percent from a year ago), building materials and supplies stores gained 1.2 percent (10.7 percent for the year), sporting goods and hobby stores added 0.9 percent (2.9 percent over 12 months), and clothing stores and restaurants both increased by 0.7 percent for the month.

Online retailers continued to register robust growth in November as sales rose 2.5 percent for the month and 10.5 percent from a year ago. Other mixed-goods retailers had less robust results. General merchandise store sales were flat for November (up 3.5 percent for the last 12 months) while miscellaneous store retailers had just a 0.1 percent gain (2.5 percent from a year ago).

Among retailers of consumer staples, sales rose 1.0 percent for the month overall and are up 5.9 percent from a year ago. The overall category was boosted by a 2.8 percent gain in gasoline station sales, which generally reflect changing gas prices. The average retail price of gas jumped 2.4 percent in November. Among the other staples categories, food store sales rose 0.2 percent while health and personal-care stores gained 0.4 percent.

Retail sales have been gaining momentum recently, aided by a strong labor market and high consumer confidence. Weekly data on initial claims for unemployment insurance show the labor market remains favorable. Claims fell to 225,000, a drop of 11,000 from the prior week. The four-week average fell to 234,750 from 241,500 in the prior week. The four-week average has been below 300,000 since September 2014, the longest run since the 1970s. As a share of payroll employment, claims continue to hit new record lows.

Overall, today’s data show the economy is gaining momentum, supported by the labor market and consumer spending. Combined with strong readings from the AIER Leading Indicators index, the outlook for the economy remains upbeat.