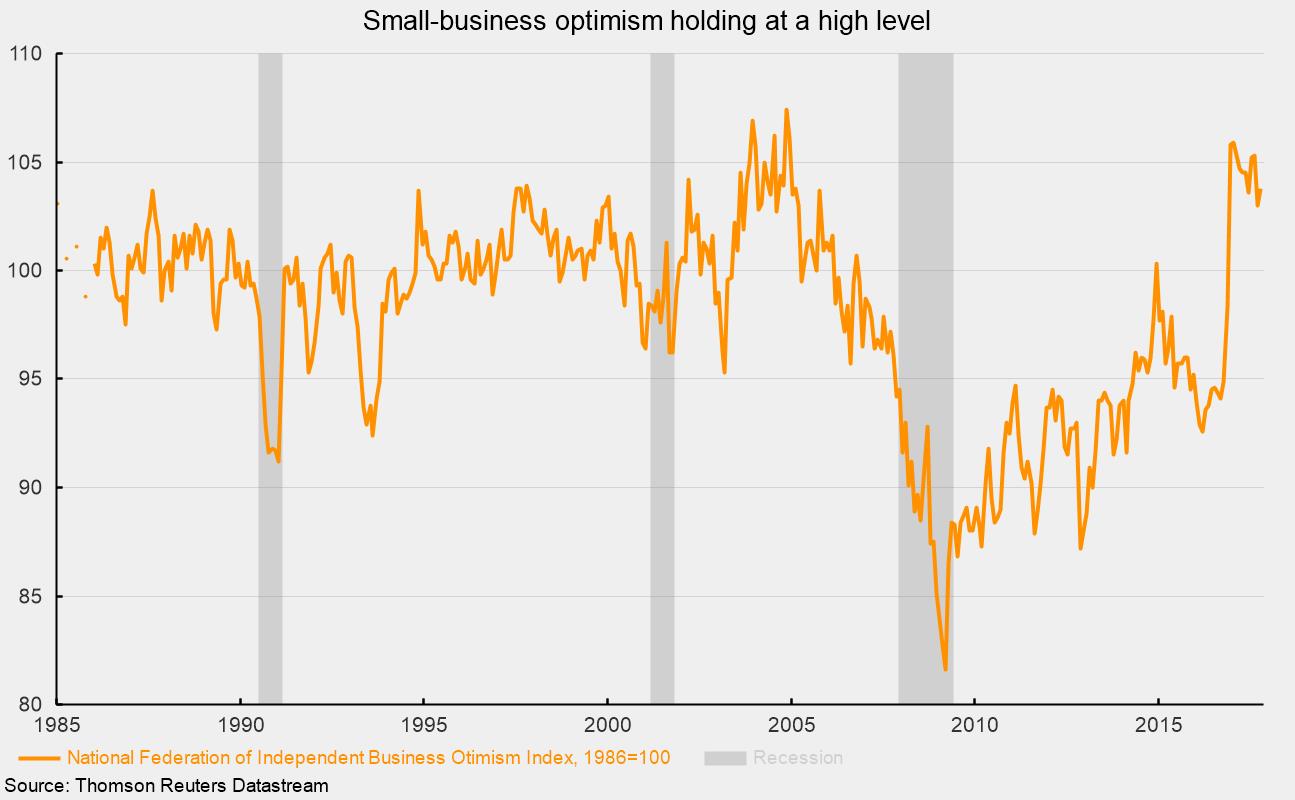

Small-Business Optimism Rose in October

The National Federation of Independent Business reported a small increase in its optimism index for October, rising 0.8 points to 103.8. The survey is taken monthly, covering some 10,000 small-business owners/members. Small-business optimism surged sharply after the November 2016 election, and while it has trended somewhat lower since, the overall level remains high by historical comparison (see chart).

The optimism index consists of 10 components. Of the 10 components, 7 showed net-positive movement. In net percentages, the strongest readings were for firms reporting open jobs (35 percent), firms expecting the economy to improve (32 percent), firms planning to make capital expenditures (27 percent) and firms believing “now is a good time to expand” (23 percent). The weakest responses were for firms reporting higher earnings (−14 percent), firms expecting credit conditions to improve (−5 percent) and firms reporting inventories were too low (−5 percent).

Compared to the previous month, five components decreased, one held steady and four rose. The largest increases in net percentage were in expected real higher sales, which rose 6 points to 21 percent, “now is a good time to expand,” also up 6 points to 23 percent, and current job openings, up 5 points to 35 percent. The largest declines were in the percentage of firms planning to increase inventories, down 3 points to 4 percent, and earnings trend, down 3 points to −14 percent. Most other changes were relatively small compared to the previous month.

Among the other survey questions, respondents are asked about the single most important problem. The two problems with the most responses were taxes (21 percent) and quality of labor (20 percent). Taxes have been one of the top responses throughout the history of the survey, with the percentage of responses ranging between 8 and 32. The quality-of-labor issue tends to be more cyclical and had been quite low for the first few years of the current expansion but began an upward trend around 2012, reaching its highest level since 2000 in the latest month.

Among the issues coming in at the bottom of the list of most important problems were inflation (2 percent), finance and interest rates (2 percent), cost of labor (6 percent) and competition from large businesses (7 percent).

Overall, small-business optimism remains at a high level, suggesting continued support for economic expansion.