March Starts Off With Strong Economic Data

Initial claims for unemployment insurance fell to a 48-year low while personal income posted a solid gain in January and manufacturing-sector activity remained strong in February. Though a few indicators were softer, the overall message is that the U.S. economy appears to be growing at a very solid pace in the first quarter.

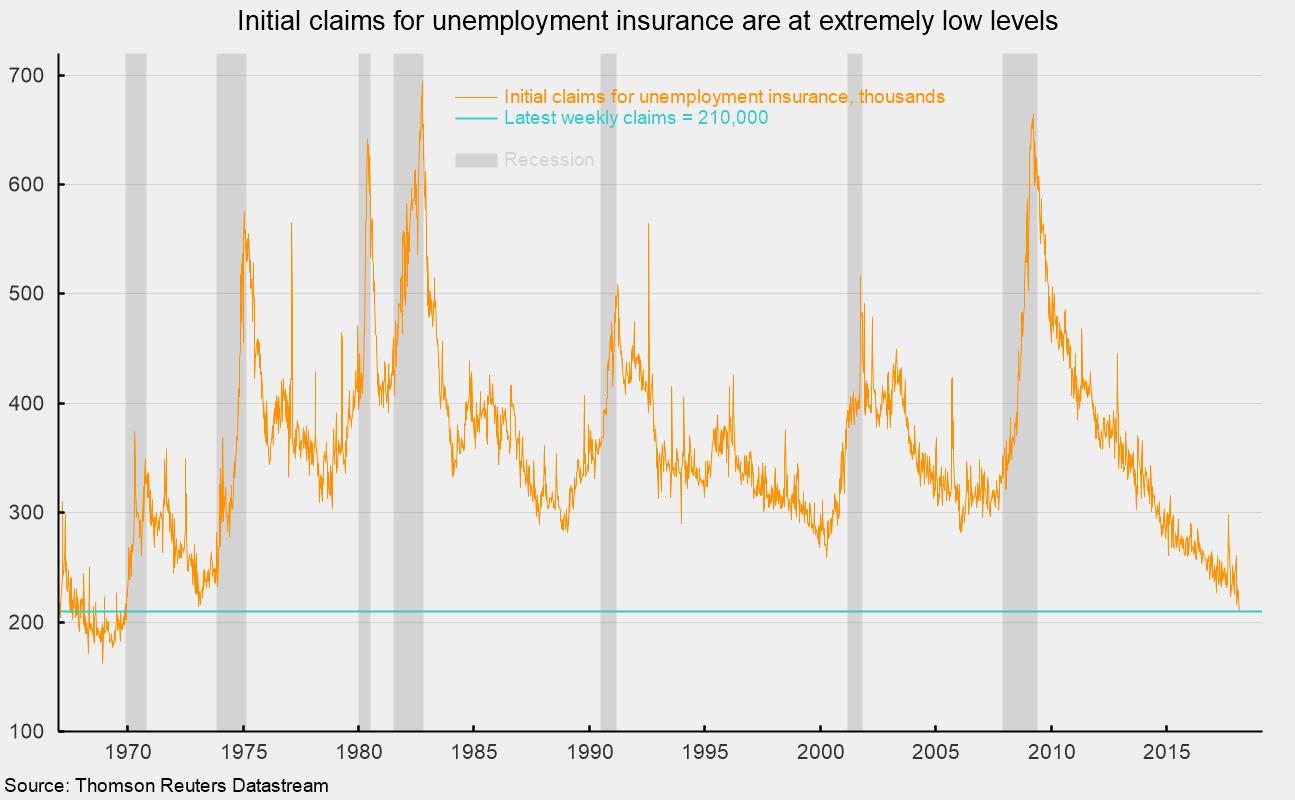

Weekly data on initial claims for unemployment insurance show the labor market remains robust. Claims fell to 210,000, a drop of 10,000 from the prior week. That is the lowest level since December 1969 (see chart). The four-week average fell to 220,500 from 225,500 in the prior week. The four-week average has been below 300,000 since September 2014, the longest run since the 1970s. As a share of payroll employment, claims continue to hit new record lows.

The Manufacturing Purchasing Managers Index from the Institute for Supply Management registered a 60.8 reading in February, up from 59.1 in January. For this index, 50 is neutral, with readings above 50 suggesting expansion in manufacturing and readings below 50 suggesting contraction. February was the 18th month in a row above the neutral 50 level and showed the highest reading since 2004. Typically, the Purchasing Managers Index ranges between 45 and 65. Historically, readings above 43.3 suggest expansion for the overall economy; February is the 106th month in a row above 43.3. Most components in the report posted gains in the latest month, with strong results coming in the employment index and the backlogs-of-orders index. The new-orders index and production index each declined in February, but both remain historically high, with readings above 60.

Pre-tax and after-tax personal income posted gains in January, rising 0.4 and 0.9 percent, respectively, according to data from the Bureau of Economic Analysis. The 0.4 percent gain in personal income was supported by a 0.5 percent increase in wages and salaries. Wages and salaries account for about half of personal income. Supplements to wages and salaries (primarily employer contributions to pension and insurance funds as well as government social-insurance programs) account for another 12 percent of personal income and posted a 0.3 percent rise in January. Proprietors’ income rose 0.2 percent while income on assets (interest and dividends) fell 0.4 percent. Personal tax payments fell 3.3 percent, reflecting recent tax-law changes. That drop helped push disposable income up by 0.9 percent, the largest monthly gain since December 2012. In real terms, personal income rose 0.6 percent for the month and is up 2.3 percent over the past year.

On the spending side, total personal consumption expenditures (PCE) rose a modest 0.2 percent in January. Among the components, durable goods fell 1.5 percent and nondurable-goods spending rose by 1.0 percent. Spending on services increased 0.3 percent for the month. After adjusting for price changes, real PCE fell 0.1 percent as a 1.6 percent decline in real durable-goods spending and no change in real nondurable-goods spending offset a 0.1 percent rise in real services.

The price indexes from the report on personal income and spending are the primary measures followed by the Federal Reserve. The total PCE price index jumped 0.4 percent in January as durable-goods prices rose 0.1 percent, nondurable-goods prices rose 1.0 percent, and services prices increased 0.2 percent.

Over the past year, the PCE price index is up 1.7 percent, the same rise as in December. Among the components, the core PCE index, which excludes food and energy prices, is up 1.5 percent from a year ago while the market-based PCE price index excluding food and energy is up just 1.1 percent. That measure has been running below 2 percent since April 2012.

Overall, gains in personal income should provide support for future increases in personal consumption. Healthy incomes, solid balance sheets, a tight labor market, and high levels of consumer confidence all suggest the outlook for consumers remains favorable. Given the tame increases in the price measures, the Fed is unlikely to significantly alter the current slow pace of policy normalization. Together, these suggest a positive outlook for the economy with a low probability of recession over the next several months and quarters.