Is the Growing Federal Debt a Recipe for Disaster?

Since the crisis in 2008, there has been much concern about the U.S. national debt. In March 2018, economists Michael J. Boskin, John H. Cochrane, John F. Cogan, George P. Shultz, and John B. Taylor, all fellows with Stanford’s Hoover Institute, wrote an op-ed for the Washington Post that voiced concern over the size of the national debt and the possibility of crisis. The authors note that interest payments would amount to “more than half of all personal income taxes” if rates paid on all government debt rose to 5 percent. As it stands, the Fed’s Federal Open Market Committee is expected to allow interest rates to rise to 3.4 percent by the end of the transition from a near decade of rates that hovered just above 0 percent.

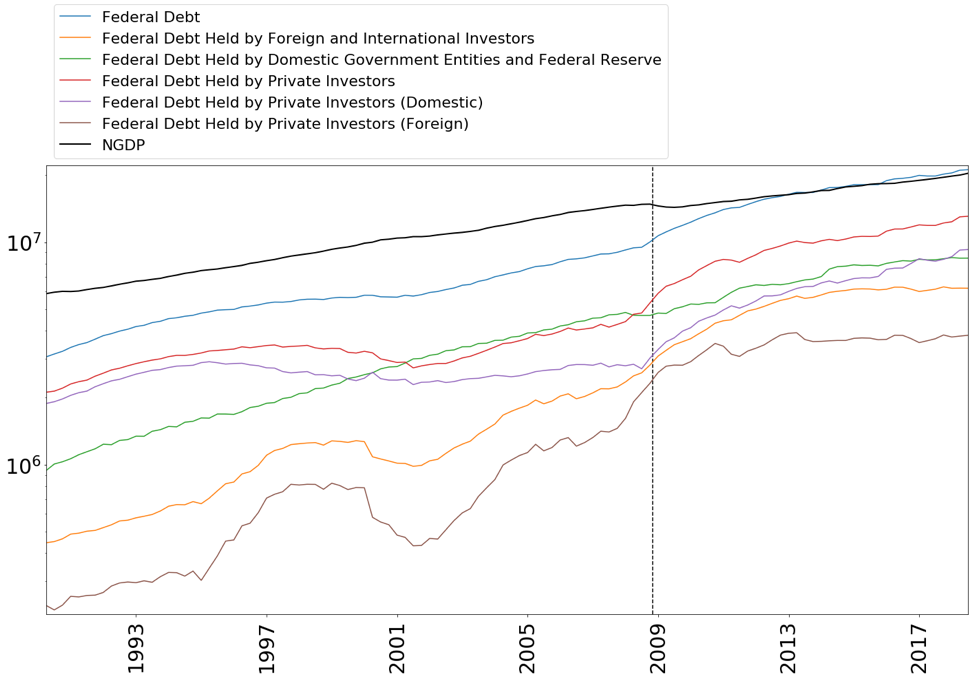

The danger is difficult to see as the fiscal situation has remained little changed since a few years after the crisis. Toward the end of President Obama’s first term, the debt surpassed GDP for the first time. Since President Trump began his term, the situation has not improved. Nor has it greatly worsened. The debt has yet to surpass 110 percent of the value of nominal GDP. The deficit has increased this year due to the recent tax cuts. Unless the new Congress demands that the federal government curtail its spending, we can expect this measure of indebtedness to continue increasing.

Foreign governments and government entities have leveled off their exposure to debt from the federal government. As a proportion of total lending, their exposure has fallen. Private foreign investors have also been less willing to cover recent increases in deficit spending than their domestic counterparts. Holdings of federal debt by private domestic investors have increased since the 2008 crisis, with private domestic investment picking up the slack where others’ investment has remained stable over the last five years.

At the start of the last recession, the proportion of federal spending to GDP was around 70 percent. Leading into the 2001 recession, this proportion was even lower as the United States had operated with a surplus that marked the final years of the Clinton administration. It is possible that in the next recession we will experience a continuation of this upward trend. The sustained flattening of demand by foreign investors, both public and private, is cause for concern. Fiscal expenditures have increased with the onset of the last two recessions. This has been aided by a flight to liquidity where an increase in investor demand to hold Treasuries during a recession has accompanied dramatic declines in rates.

An increase in demand for federal debt, triggered by demand for liquidity, sustained high levels of federal expenditures. Can we expect the pattern to continue with the next recession? Where private domestic investment cannot make up for this slack, either the rate paid to foreign investors must rise or the Federal Reserve and government entities must take up the slack. Raising rates required to attract foreign investment will make servicing the debt especially expensive, as noted by Boskin and coauthors. Increased support from government entities and the Federal Reserve, on the other hand, is far from a harbinger of confidence for investors as it may lead investors to expect inflation or, worse, default. If investors expect that the value of repayment is not guaranteed, they will demand higher rates to offset risk of inflation and default. Under this scenario, government debt cannot serve as a reliable source of liquidity.

If the confidence of investors in the ability of the government to repay debt without inflation wanes, interest rates can move quickly, leading to feedback that further degrades the ability of the government to pay its debts. This is the process that makes debt crises arise like an earthquake as opposed to a rising tide.

Crisis is not unthinkable. The size of the U.S. debt in terms of national GDP ranks 16th worldwide. Of those countries that rank ahead of the United States, few represent vibrant economies. (Japan is a notable exception.) The United States is the world’s largest economy, so it is difficult to imagine that the U.S. economy can simply grow out of the problem. As the problem looms, investors will surely have this in mind. Politicians must face these difficulties now if they are to defuse a financial crisis worse than the last.