Hawks, Doves, and Swingers on the FOMC

Contrary to many macro models and what rule-oriented economists may prefer, central banking as a job is not simply about following an equation to set monetary policy. Actual central bankers come into the job with all sorts of beliefs, experiences, and insights that shape how they conduct monetary policy.

Michael Bordo (who has two other interesting recent papers I’ve discussed) and Klodiana Istrefi have a new NBER working paper that looks at what makes FOMC members hawkish (supporting tighter monetary policy and concerned with inflation) or dovish (supporting looser monetary policy and concerned with unemployment).

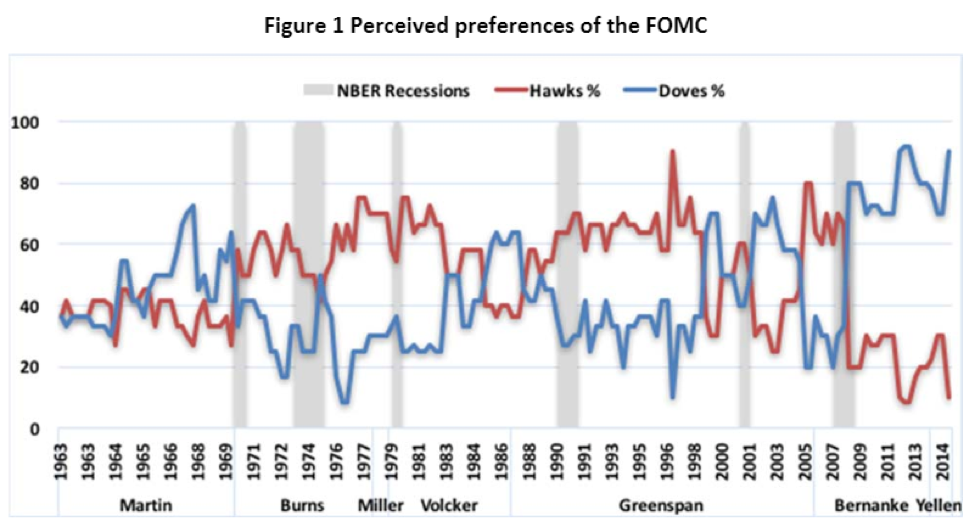

Using data on media coverage and business writings from an early paper by Istrefi, the paper first classifies the 130 members of the FOMC from 1963 to 2015 into hawks, doves, swingers (those who change positions over time), and those who do not fall into a particular category. Figure 1 (reproduced from the paper) shows the aggregate hawk-vs.-dove balance on the FOMC over time.

Bordo and Istrefi touch on a variety of causes but focus on two main causes explaining why members become hawks or doves: education and life experience.

Education influences FOMC members’ stances in two ways. First, those members with a Ph.D. in economics have tended to be more hawkish compared to those without a Ph.D., who have tended to be more dovish.

Second, for the 60 percent of members with a Ph.D. in economics, the source of their Ph.D. is informative. In particular, the old divide between freshwater (Chicago, Carnegie Mellon University, UCLA, Johns Hopkins, Minnesota) and saltwater (Harvard, Yale, MIT, Berkeley) lines up fairly well with the hawk-vs.-dove divide. Almost 70 percent of members from freshwater schools have been hawks, while only 28 percent of members from saltwater schools have been hawks. This should not be shocking to anyone who follows discussions of monetary policy, but it is interesting to see the exact numbers.

Besides members’ education, general life experience also influences their stances. Going through an event like the Great Depression is sure to have an influence on a person. Bordo and Istrefi find that the most important economic events are those during one’s formative years of 18–25. For example, 71 percent of members whose formative years were during World War I, a period of high inflation, became hawks.

Combining the two main causes, education and formative life events, the picture painted is one in which most of an FOMC member’s position is staked out before they are 30. The Fed is currently transitioning to members who came of age during the Great Moderation, in which neither inflation nor unemployment was a major problem. We will see what that implies for the next generation of central bankers in the United States.