Existing-Home Sales Are Plateauing, Restrained by Low Inventory

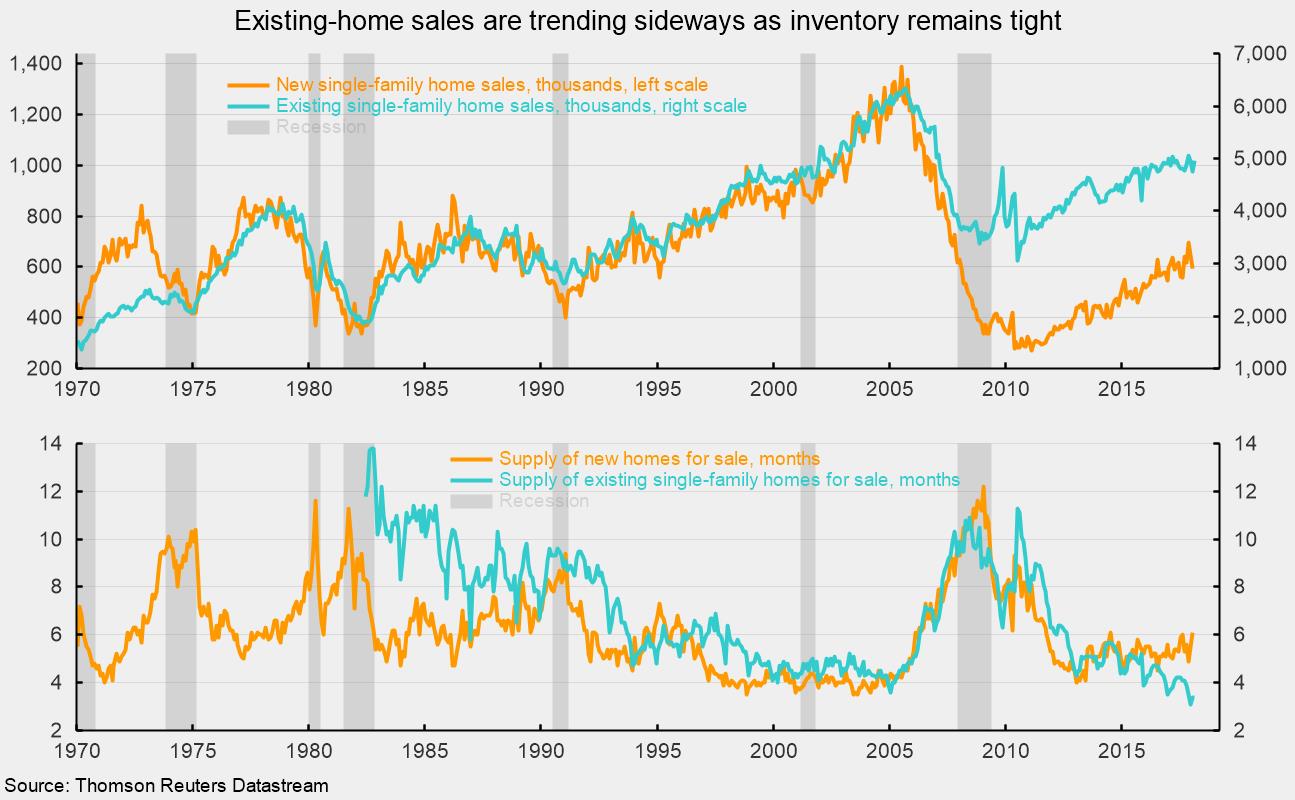

Existing-home sales rose 3.0 percent in February following a 3.2 percent drop in January. Compared to a year ago, existing-home sales were up 1.1 percent. Sales have bounced around in the range of 5.2 to 5.7 million for most of the past two years. One of the key reasons for the range-bound selling pace is the tight supply of existing homes for sale. The inventory of homes for sale rose 4.6 percent to 1.59 million, holding the months’ supply (the total inventory divided by the current selling rate) at 3.4. Months’ supply of homes for sale is just slightly above the all-time low of 3.1 hit in December 2017 but well below the post-recession peak of 11.3 in July 2010.

Broken down into single-family homes and condo/coop units, single-family homes sales rose 4.2 percent to 4.96 million at a seasonally adjusted annual rate, compared to a 6.5 percent drop for condos to a 580,000-unit pace. Among the major regions, the Northeast posted an 11.5 percent drop in single-family homes sales to a 540,000-unit rate while condos and coops dropped 16.7 percent to a 580,000-unit pace. Sales in the Midwest were off 2.6 percent for single-family housing while condo and coop sales were unchanged at 80,000. In the South, single-family homes sales rose 9.1 percent to 2.16 million while condo and coop sales fell 10.7 percent to 250,000. In the West, single-family homes sales jumped 12.0 percent in February and condo/coop sales gained 7.1 percent.

For all existing-home sales, the median prices rose 5.9 percent from a year ago while the average price increased 4.3 percent. Selling prices vary widely by region; therefore compositional bias can impact the overall selling-price figures.

A more complete picture of the housing market will be available with the release of home-price data from the Federal Housing Finance Agency on Thursday, March 22, and new-home sales data on Friday, March 23.

Consumer fundamentals — a strong labor market, a high level of consumer confidence, and relatively healthy balance sheets — remain positive factors for the housing market. However, the combination of tight supply, rising prices, and higher interest rates may restrain gains in the months and quarters ahead.