Empire State Manufacturing-Sector Expectations Remain Strong

The Empire State Manufacturing Survey from the Federal Reserve Bank of New York showed generally favorable results as expectations for conditions six months ahead improved while the current-conditions index fell but remained positive.

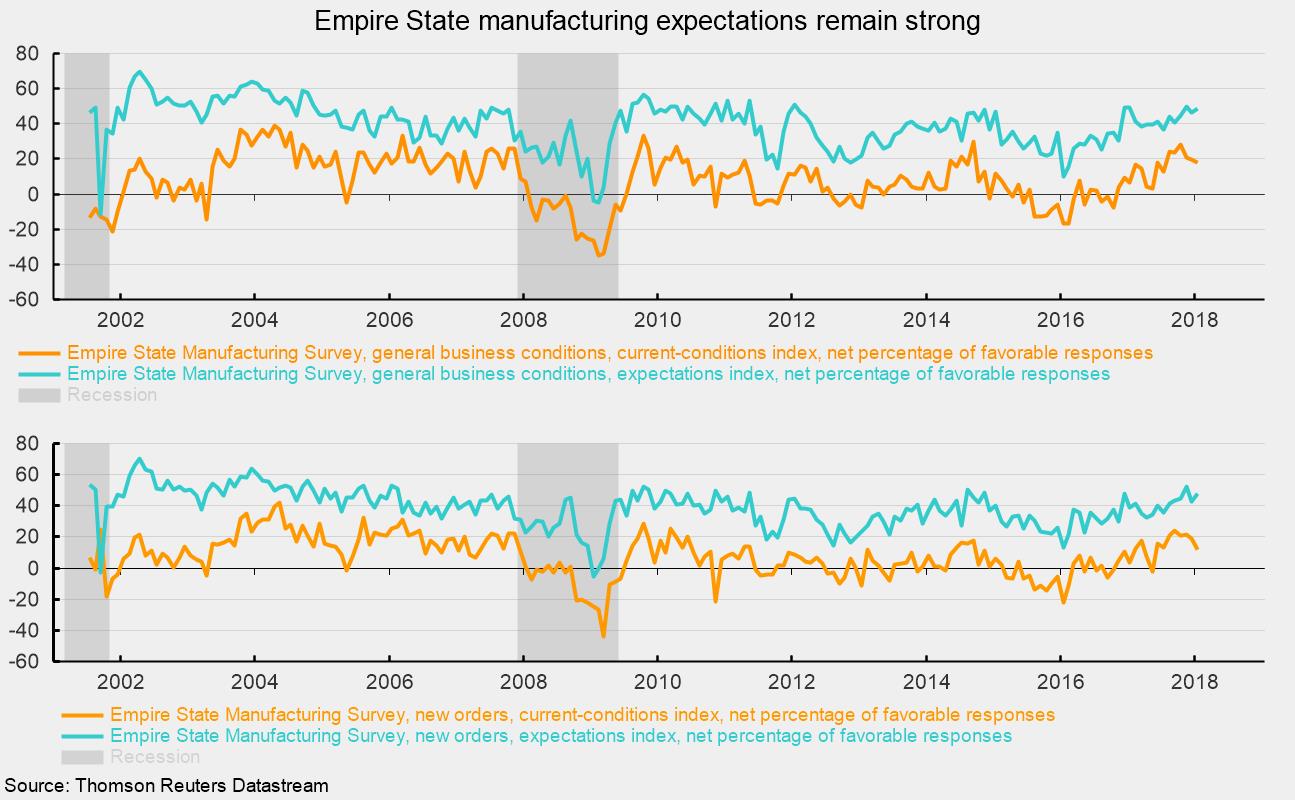

Among the forward-looking indicators, the general-business-conditions index rose 2.3 percentage points to 48.6 in January, up from 46.3 in December (see top chart). Readings above 40 are strong by historical comparison. The new-orders index rose by 4.9 percentage points to 47.6 versus 42.7 in the prior month (see bottom chart). Like the general-business-conditions index, readings above 40 are strong. Both measures have been above 40 for six consecutive months.

Every other index among the forward-looking survey questions posted a gain in January versus December. Particularly impressive were the results of the expectations for capital spending and expectations for technology spending, both of which hit their highest levels since 2007.

Among the current-conditions indexes, general business conditions fell slightly to 17.7 in January from 19.6 in the prior month while new orders fell to 11.9 from 19.0. Despite the drops, both indicators remain solidly above the neutral zero line. Other current-conditions indexes had mixed results for the month, but all remained above zero.

Two points of concern were the notable weakness in the labor-related indexes and the gains in the prices-paid index. The number-of-employees index plunged 19.1 points to 3.8 in January. Though the index is still above zero, that is a very sharp drop. The average-employee-workweek index fell a significant 8.5 points to a barely positive 0.8 reading in January. Combined, the two results could be a sign of trouble. The prices-paid index has been trending higher since early 2016, suggesting rising pressure on input costs.

Overall, the report tilts to the favorable side but raises enough concerns to warrant close monitoring of data related to the New York regional economy and the manufacturing sector nationwide.