Consumer Confidence Falls in December as Short-Term Expectations Drop

The Consumer Confidence Survey from The Conference Board shows consumer attitudes pulled back slightly in December relative to November but overall remain at historically favorable levels. The Consumer Confidence Index fell to 122.1 in the latest reading, down from 128.6 in November.

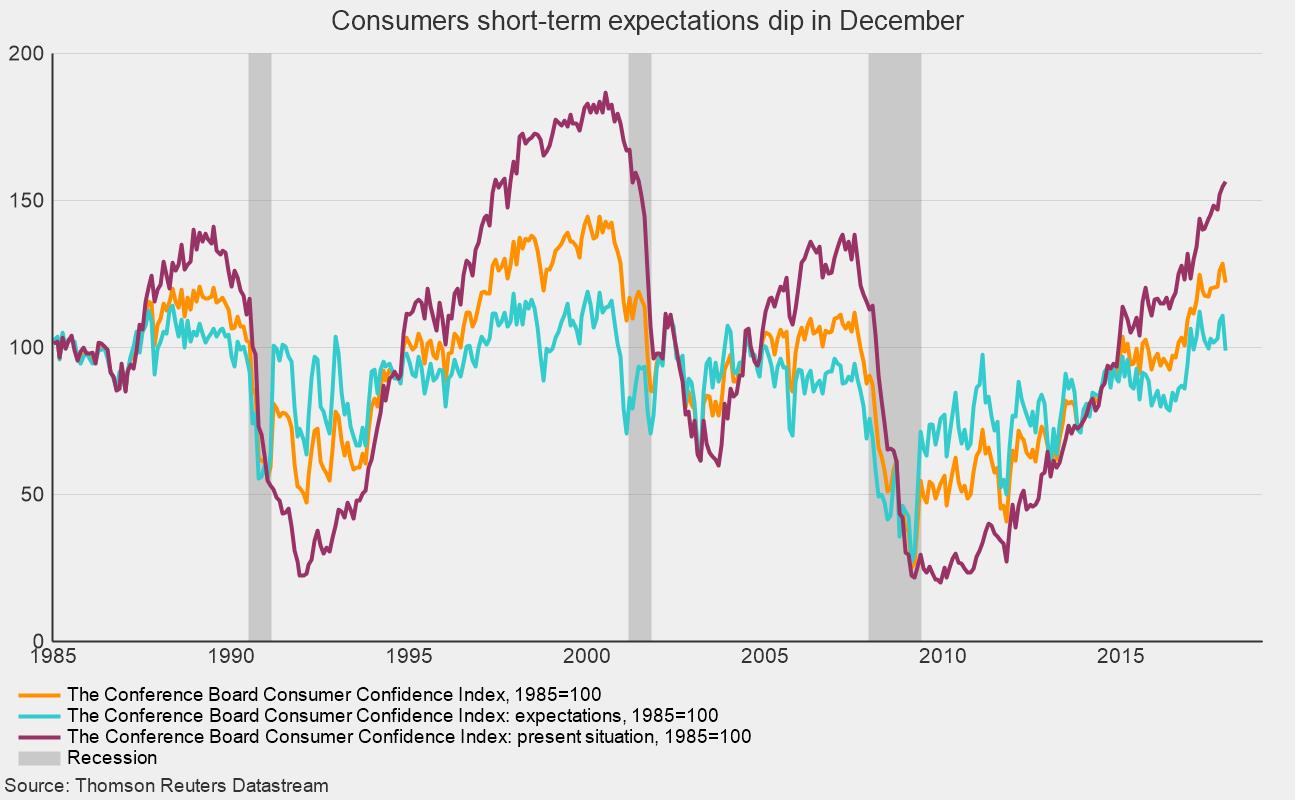

Among the two major components, the present-situation index rose again to 156.6 from 154.9 in November while the expectations index fell to 99.1 from 111.0. Despite the decline, the expectations index is about in line with previous expansions, ranging from 100 to 120 over the past several months. The present-situation index continues to move to new cycle highs and is at the highest level since June 2001 (see chart).

One key source for the strong levels of confidence in the present-situation index is the robust labor market. According to the survey, the net percentage of respondents reporting jobs are hard to get fell from 16.8 in November to 15.2, the lowest since July 2001, though it is still above the all-time low of 9.6 in 2000. Conversely, the percentage of respondents saying jobs are plentiful came in at 35.7, down slightly from 37.5 in November but still significantly higher than the peak of 30.3 from the prior expansion. The positive view of jobs is still below the all-time peak of 55.8 in 2000. Overall, consumer confidence remains at historically favorable levels, supported by a robust labor market, suggesting support for ongoing economic expansion in the short term.

Weakness in expectations came from a slightly less upbeat assessment about future job opportunities. The net percentage of respondents expecting more jobs in the months ahead decreased from 21.3 percent to 18.4 percent, while those anticipating fewer jobs rose from 12.1 percent to 16.3 percent. Coinciding with the drop in optimism about future job-market conditions were mixed expectations regarding short-term income prospects. The net percentage of respondents expecting an improvement in income increased from 20.3 percent to 22.3 percent, while the proportion expecting a decrease also rose, from 7.6 percent to 8.9 percent.

The robust views of current conditions along with more reserved views of the future are fairly typical even in strong expansions. The strong results from the current-conditions index are also consistent with the early positive anecdotal stories regarding consumer spending for the holiday season. Overall, the current economic expansion continues to look quite solid with a low probability of recession in the coming months.