Ben Shapiro versus Lawrence Glickman on the New Deal

I am not fond of pundits. They are irritants in any serious conversation as everything is interpreted through the prism of the partisan politics to which they adhere. Nuances are for them, even if in the end it reinforces their viewpoint, that of hindrances in attempts to score points against political adversaries. Punditry is, for all intents and purposes, the pox of intellectual honesty. However, as they wield influence it is good to take account of what they say and then proceed to carefully craft an intellectual response that ignores them in name but not in substance.

As a result, I am always thrilled when a scholar tries to provide the nuanced and complete answer to a particular “talking point.” Unfortunately, this can sometimes turn out to reveal the inner pundit in some. This was the case a few days ago when Cornell University historian Lawrence Glickman decided to call out conservative pundit Ben Shapiro on a claim he made regarding the New Deal.

Shapiro pointed to an old article in the Wall Street Journal by economists Lee Ohanian and Harold Cole. Their op-ed summarized a peer-reviewed article they had published in the Journal of Political Economy that found that New Deal policies lengthened the Great Depression.

Glickman responded that Shapiro was merely reiterating the view of the “free enterprise critics” of the New Deal. This view, he further argued, was long dead but was resuscitated by conservative pundits. However, he then points out that it could not possibly be true because real GDP growth was faster than under Hoover. In a strange but inexplicable turn, Glickman then manages to rope in the current vice-president of the United States by highlighting a quote that taxes during the New Deal exacerbated the situation.

In an instance to illustrate the idiom that a broken clock is right twice a day, it seems that Ben Shapiro is actually closer to the truth than Glickman is.

Why is this? To answer, let us state clearly what is at stake: did the New Deal halt the slump or did it prolong the Great Depression? These interrelated questions are clear. The answers are less clear and an incredible number of nuances are necessary – nuances that Glickman failed to display (which he had a duty to display because unlike Shapiro he is an academic).

Insufficient numbers

First, citing economic growth rate is a poor measure of whether or not the New Deal improved the situation. By 1933, the breakthrough had been reached and a fast rebound was inevitable. In fact, it is a recurring feature of business cycles. The issue that macroeconomists tend to consider is whether the rebound was fast enough to return to the trendline.

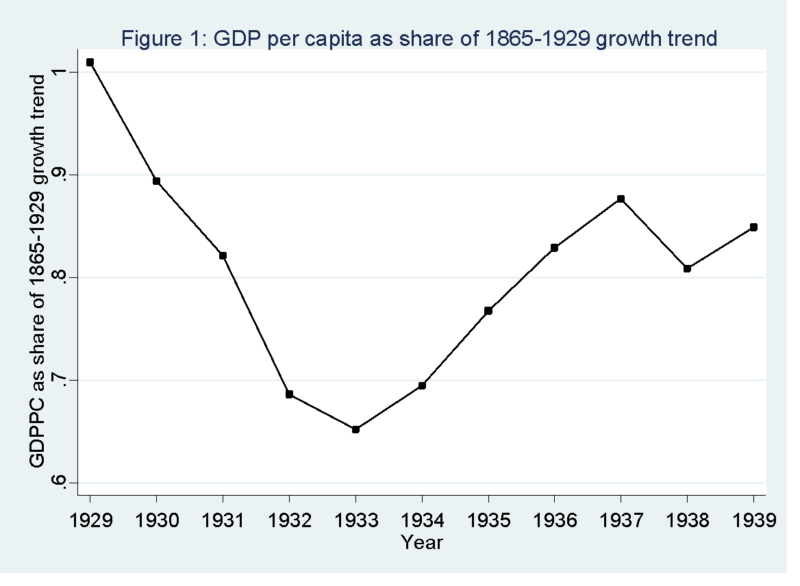

On that front, the answer is in the negative. The first figure below shows the observed GDP per capita between 1929 and 1939 expressed as the ratio of what GDP per capita would have been like had it continued at the trend of growth between 1865 and 1929. On that graph, a ratio of 1 implies that actual GDP is equal to what the trend line predicts. When the ratio is inferior to 1, actual GDP is below trend. As can be seen, by 1939, the United States was nowhere near the trendline.

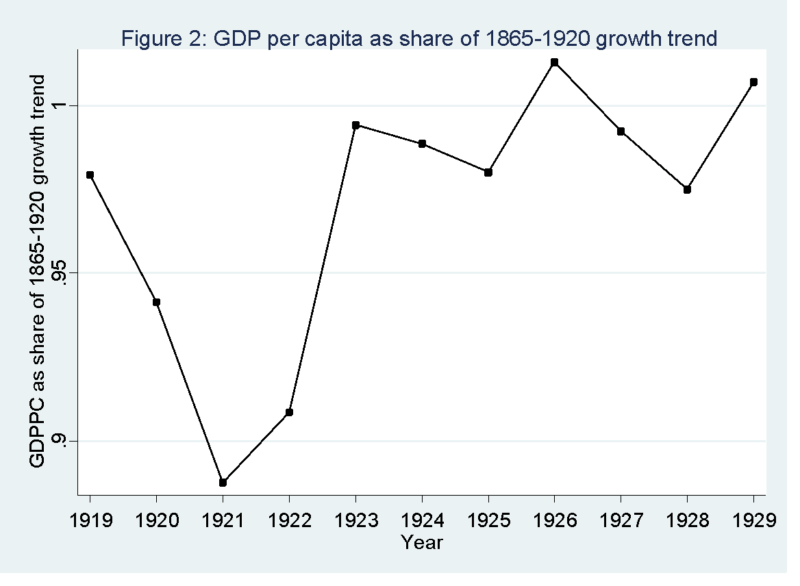

In fact, it is relevant to compare with the previous recession the United States had experienced to see how fast the rebound was relative to trend. That previous recession is that of 1921. As can be seen in the second figure of this article, after that recession, growth had rebounded rapidly enough to allow the United States to get back on trend after 3 years.

As such the evidence cited by Glickman is in no way suggestive of the point he tries to score against Shapiro. In fact, he should know better. Most of the economic historians who have written on the topic agree that the recovery was weak by all standards and paled in comparison with what was observed elsewhere. Anyone who has read on the topic is forced to agree on that basic fact, regardless of the interpretation made of the New Deal.

The New Deal is Hard to Define

Secondly, and Glickman knows this, the New Deal was not a “unified” set of policies. It was a strange mixture of policy improvements, policy blunders and downright regressive moves.

Some policy changes are widely lauded. One example is those which concern monetary policy which draw the highest level of consensus. One of the problems that plagued the United States was that the adhesion to the interwar gold exchange standard, at a time when France was sterilizing large quantities of gold, implied an overly restrictive monetary policy. Combined with bank failures causing reductions in credit and other monetary vehicles, this was a potent combination to create deflation as a result of a contracting money supply.

In the presence of price rigidities, the deflation forced adjustments to happen through quantities rather than prices – this meant firing workers and reducing output. Leaving the interwar gold exchange standard regime was a hugely beneficial force on which economists left and right appear to agree. Few disagree. In fact, I have been unable to find someone who said it was counterproductive. What appears to be debated is how beneficial it was: some say it didn’t do much while others consider that, had it not been for other policies, it would have been sufficient to bring the economy back on trend. If anything, it can be argued that FDR did not do enough in terms of monetary policy (for an example, see this work in the Journal of Economic History by William Lastrapes and George Selgin).

Another set of policies that probably helped were the attempts by President Roosevelt to reverse the tariff increases that had been adopted in 1929. The tariffs have been uniformly decried by economists (then and now) and some economists argue that their increase served to deepen the slump. Roosevelt, through his secretary of state Cordell Hull, attempted to pass some trade deals to reduce some key tariffs. While the changes were modest, no work of economic history appears to render negative judgment on these subsequent tariff reductions.

Some other policies tend to be the object of a wide level of agreement but not to the level of the changes in monetary policy. This includes the creation of federal deposit insurance and homeownership policies. Some research also indicates that other forms of financial relief (such as the WPA) did not cause large negative consequences.

However, there is also a wide level of agreement that other policies lengthened the depression. The one to receive the most flak from economic historians is the National Industrial Recovery Act (NIRA). The NIRA is a strange legislation: it legally incited firms to collude by setting codes of practices. In essence, it constituted a piece of legislation that encouraged cartelization. By definition, this would reduce output and increase prices. As such, it is often accused of having delayed recovery.

This is the main policy that allowed scholars like Ohanian and Cole to argue that the New Deal lengthened the Depression. Other scholars such as Richard Vedder and Lowell Gallaway also abound in the same direction. The best work on that front has been that of Jason Taylor in a 2019 book at the University of Chicago Press. Taylor highlights that NIRA was not a “one-size-fits-all.” There was a multiplicity of codes whose scope and scale varied. Some codes of practices were not restrictive enough to explain reductions in output for the industries they regulated. However, other codes were far more restrictive and explained very well the contraction in output. These codes, Taylor argued elsewhere, aborted the recovery that started in early 1933 (which was probably due to the monetary changes highlighted above).

Other legislations such as the National Labor Relations Act (and other labor policies) and the Agricultural Adjustment Act are also subjected to important criticisms. The former served to raise real wages in ways that were disconnected from productivity. This, in turn, forced industries to contract output and fire workers. The latter act paid farmers to not plant on their land in order to boost agricultural prices. It is thus unsurprising that Price Fishback, Shawn Kantor, William Horace and Valentina Kachanovskaya found that the Agricultural Adjustment Act ended up doing more harm than good. Elsewhere, Price Fishback also found strong econometric evidence that the agricultural legislation displaced tenant farmers and sharecroppers.

On the whole

To say whether, on net, the New Deal did more harm than good is probably even beyond our abilities. However, that does not preclude us from creating a range of plausible cases. The best-case scenario is that the programs that worked well (such as those pertaining to housing and deposit insurance) complemented the positive effects of the changes in monetary policy. The issue is “how much” good they produced relative to other sets of policies (such as the Agricultural Adjustment Act, the National Labor Relations Act and the National Industrial Recovery Act) that were very probably counterproductive.

In some ways, it is thus clear that the New Deal made things worse. In other words, it is Shapiro who is technically correct. However, I say “in some ways” because it allows me to introduce a key nuance. Had the New Deal not included the clearly bad components, the depression would have been shorter. By saying this, I implicitly allow the possibility that, on the whole, the positive policies overtook the bad ones. I personally doubt this possibility. However, there is no evidence allowing me to go beyond merely stating that prior and I admit that I am quite willing to be convinced by additional evidence. Glickman ought to adopt the same stance.