Pulling It All Together/Appendix

The Economy…

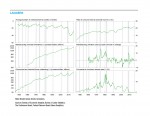

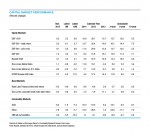

Despite some risks, the U.S. economic outlook for next year appears favorable. Consumer fundamentals continue to improve while household and corporate balance sheets are generally healthy. However, the prospect of rising interest rates poses a risk. Fed policy makers have indicated a gradual path is likely for future rate increases, suggesting a keen awareness of the risks to growth from overly aggressive tightening.

Global economic expansion is also a concern. While the U.S. depends less on exports than many other nations, the combination of slow growth and a strong dollar weighs on some sectors.

Our Leader’s index rose to 56 in the latest month from 50 in the prior month. Combined with our cyclical score of 70, we see the probability of recession in the next six to twelve months as relatively low.

…Inflation…

The CPI rose in October after falling in the previous two months, helped by a slight increase in energy prices. The latest AIER Inflationary Pressures Scorecard points to a neutral reading, with 10 indicators supporting rising inflationary pressure and 11 suggesting pressure is falling. Two are stable. The major change this month came from wages and productivity. Rising private compensation levels and higher labor costs, along with lower growth in productivity, put upward pressure on inflation. But this was offset by a decrease in other producer costs. Overall, there is no evidence that inflation will change significantly in either direction in the coming months.

…Policy…

The Fed is expected to raise its target for the overnight lending rate between banks by a small amount this month, the first increase in almost a decade. Since this move is widely anticipated, it is unlikely to have significant economic effect.

The Fed is expected to raise its target for the overnight lending rate between banks by a small amount this month, the first increase in almost a decade. Since this move is widely anticipated, it is unlikely to have significant economic effect.

At the same time, legislation pending before Congress would impose a new requirement that the Fed publicly disclose its interest-rate strategy and its reasons for any deviations. The bill, which has passed the House and is unlikely to pass the Senate, raised objections from the Fed, which is worried about its independence.

…Investing

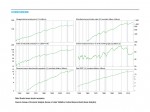

With bond yields near 60-year lows, it’s difficult to justify expected total returns in the high single-digit range, as we have seen since 1982 for this asset class. Investors should carefully review asset allocations and be prudent in estimating future gains.

U.S. equities have struggled this year as the effects of falling commodity prices and slow global growth weigh on the economy and earnings for some sectors. However, earnings are expected to rebound in 2016. Valuations remain close to the long-term average, especially given the low inflation environment. Overall, that suggests a neutral to slightly positive outlook for stocks. Investors may look to maximize exposure to domestic sources of growth such as consumer spending and capital investment outside of commodity-related industries.

Next/Previous Section:

1.Overview

6. Pulling It All Together/Appendix