Policy

Confidence, Caution, and Data Dependence at the Fed

Since their March 17–18 meeting, members of the Federal Open Market Committee (FOMC), the Fed’s policy-making arm, have put forth a few key messages. First, before any “liftoff” of interest rates, meaning before implementation of the first increase in short-term rates since 2006, they need to see steady improvement in the labor market. Also, they need to have “reasonable confidence” that inflation is headed for the central bank’s goal of a 2 percent annual rate. Second, they are likely to be cautious during the period of policy normalization, or as they raise rates. Third, they are data-dependent and not on a predetermined course, meaning that any decision to raise rates is not an indication that regular increases of 25 basis points will follow. Rather, rate decisions will be made at each meeting, based on current data.

The conditions for “liftoff” were stated explicitly following the March meeting. In part the FOMC’s post-meeting statement read:

“The committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.”

Improvements in the labor market have been a long-running goal for the Fed throughout the recovery. This is unsurprising given the severity of the job losses during the Great Recession and that the FOMC’s dual mandate includes achieving maximum employment. The challenge is the many measures for the labor market that FOMC members seem to focus on beyond payroll increases and the unemployment rate. This approach may stem from the long-standing criticism of using the reported unemployment rate as the only indicator of labor market conditions. Other indicators that policy makers consider include underemployment, which is captured by the Bureau of Labor Statistics’ (BLS) U-6 measure; wage rate increases; the “quit rate,” meaning the rate at which employees voluntarily leave jobs, presumably for better ones; the labor force participation rate; and the duration of unemployment. With so many measures, it’s difficult to anticipate when the FOMC members will be satisfied with labor market conditions, so close monitoring of all these indicators will be critical.

However, the concept of “confidence” in the outlook for inflation on the part of FOMC members as an explicit requirement is new. It has been repeated several times by Chair Janet Yellen, Vice Chair Stanley Fischer, and a number of Fed governors. Exactly how this confidence requirement translates into some type of stated or implied threshold is unclear, but one place we can look for guidance is in the quarterly FOMC projections.

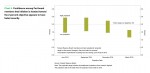

Over the past year, the FOMC members have steadily lowered their outlook for core personal consumption expenditure (PCE) inflation (Chart 4). If these projections are indeed a proxy for the confidence level that FOMC members have about inflation heading back toward the 2 percent goal, we should expect a very cautious approach to raising rates.

In a speech to a meeting of the Providence Chamber of Commerce in Rhode Island on May 22, Yellen reiterated the need for confidence in the inflation outlook: “For this reason, if the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy. To support taking this step, however, I will need to see continued improvement in labor market conditions, and I will need to be reasonably confident that inflation will move back to 2 percent over the medium term.”

Yellen also emphasized the likelihood of caution by policy makers. She continued, “After we begin raising the federal funds rate, I anticipate that the pace of normalization is likely to be gradual… which I expect would mean that it will be several years before the federal funds rate would be back to its normal, longer-run level.”

While Yellen spoke only for herself, we suspect her sentiment is shared by many, if not all, of her Fed colleagues.

Finally, noting the importance of fresh information and emphasizing that future rate moves have yet to be decided, Yellen added, “I should stress that the actual course of policy will be determined by incoming data and what that reveals about the economy. We have no intention of embarking on a preset course of increases in the federal funds rate after the initial increase. Rather, we will adjust monetary policy in response to developments in economic activity and inflation as they occur. If conditions improve more rapidly than expected, it may be appropriate to raise interest rates more quickly; conversely, the pace of normalization may be slower if conditions turn out to be less favorable.”

Fed officials are using communication as effectively as they can to explain their thinking and views. No one can be sure of the path for the economy, employment levels, and inflation, but the FOMC members are clearly laying out their framework for reaching rate decisions. Given this information and our view of the economy, we expect the first rate hike later this year but believe that further increases will occur only sporadically as a cautious Fed monitors conditions using the most current information.