What Should The Fed Do When It Hasn’t Done What It Should’ve Done?

The Federal Open Market Committee voted to hold its federal funds rate target range at 5.0 to 5.25 percent this week, while signaling further rate hikes to come. “Looking ahead, nearly all committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to 2 percent over time,” Fed Chair Jerome Powell said at the post-meeting press conference on Wednesday. The median FOMC member now projects rates will rise an additional 50 basis points this year.

Fed officials are in the unenviable position of balancing the risk of doing too little against the risk of doing too much. If they do too little, inflation will remain high and inflation expectations could come unanchored, making it even more difficult to bring down inflation in the future. If they do too much, however, they could cause a severe recession.

What should the Fed do? It is tempting to point to one’s general conception of optimal monetary policy. But doing so would ignore the particular situation we are in. Past mistakes alter the analysis. Today, we must ask: What should the Fed do when it hasn’t done what it should’ve done?

What the Fed Should Do

In general, the Fed should stabilize nominal spending. When nominal spending grows slower than expected, businesses tend to underproduce. When nominal spending rises faster than anticipated, businesses tend to overproduce. By credibly committing to stabilize nominal spending in advance, the Fed can anchor expectations on the future path of nominal spending. That, in turn, makes it easier to deliver the level of spending that is expected—because there is little doubt as to how much spending is expected.

When the Fed stabilizes nominal spending along some growth path, prices convey information about relative scarcity more effectively. If above-average rainfall increases agricultural yields, prices will temporarily fall below trend. These lower prices make everyone aware of the bonanza. Similarly, if a natural disaster disrupts transport networks, higher prices will inform people that they should try to get by with a bit less than usual. That’s how a well-functioning market economy works!

The goal is to deliver nominal spending in line with expectations. And, in general, stabilizing nominal spending meets that goal.

What the Fed Has Done

The Fed has failed to stabilize nominal spending. As David Beckworth shows, actual nominal gross domestic product (NGDP) exceeded expected nominal spending—what he calls neutral NGDP—beginning in 2021 and has remained elevated since. The surge in nominal spending largely explains why inflation has been so high. Beckworth’s NGDP gap shrank from 5.89 percent in Q4-2022 to 5.76 percent in Q1-2023, but remains large. My alternative measure, which assumes expected nominal spending adjusts more rapidly, suggests the gap has more-or-less closed.

Ideally, the Fed would have countered the surge in nominal spending in the second half of 2021. I recommended doing so at the time. But it didn’t. Instead, it drug its feet. The Fed didn’t acknowledge the problem in its post-meeting press release until December 2021. It raised its interest rate target range by 25 basis points in March of 2022, but didn’t really get going until May 2022. And, while there were exceptions in July and November 2022, the Fed permitted its real federal funds rate target to remain negative until February 2023.

The Fed has also made it clear that it wouldn’t be offsetting the surge in nominal spending—i.e., bringing the level of nominal spending back down to where it would have been had the surge never occurred. Instead, it will merely reduce nominal spending growth back to something close to its historical average.

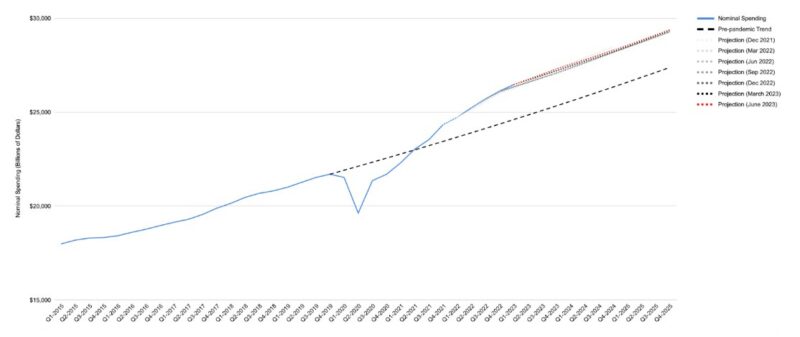

Actual nominal spending, the pre-pandemic trend level of nominal spending, and the implied level of nominal spending based on the median FOMC member’s projections are presented in Figure 1. Note that, while the growth of nominal spending is projected to decline, the level of nominal spending is projected to remain permanently elevated. Note further that projections have been very consistent since December 2021.

What the Fed Should Do Now, Given What It’s Done

Since the Fed has consistently signaled over the last year and a half that it will merely reduce the growth rate of nominal spending (and not the level), that’s exactly what it should do. Remember, the goal is to deliver nominal spending in line with expectations. Although it would have been best if the Fed had anchored nominal spending expectations on the pre-pandemic growth path and then brought nominal spending back down to where it would have been had the surge in nominal spending never occurred, the Fed did not anchor nominal spending expectations on the pre-pandemic growth path. Instead, it told market participants to expect a higher growth path. In this context, bringing nominal spending back down to the pre-pandemic growth path would be a mistake.

Nominal spending has slowed over the last year. The long and variable lags of monetary policy probably mean it will slow further even if the Fed holds its target rate range where it is. Inflation will continue to decline, eventually returning to 2 percent. And, as it does so, the Fed will need to reduce its (nominal) target rate range in order to keep real rates from rising.

We are likely at the point where the risk of doing too much exceeds the risk of doing too little. It makes sense for the Fed to hold for now, and see how the incoming data looks over the next few months.

What the Fed Says It Will Do

Alas, Fed officials do not see it that way. “I still think—and my colleagues agree—that the risks to inflation are to the upside still,” Powell said on Wednesday. That view may cause Fed officials to over-tighten monetary policy in the months ahead. God help us all if they do.