“Bank capital punishment and other nostrums”

Across the globe, governments and their central banks have embarked on a witch hunt against bankers, imposing new capital requirements, regulations and even launching investigations against them. While policy makers need scapegoats to blame for the financial crisis of 2009, targeting bankers creates a problem as it “constrains the growth of money broadly defined.” This could explain the downward growth trends in the United States, Europe, Japan and even China (as recently forecasted).

In a piece published in the January 2015 issue of Globe Asia (article here), Professor Steve Hanke explores the implications of the attacks on bankers on the global money supply and provides some valuable insight to the matter, reminding us that there are various components that appear on a bank’s balance sheet that should be taken into account, but are often forgotten (i.e. credit).

When talking about the United States, Professor Hanke notes that:

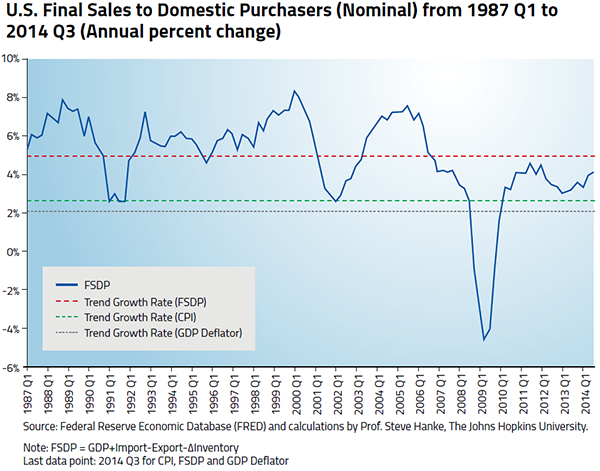

Even though the Fed has been pumping out State Money at a super-high rate since the crisis of 2009, it hasn’t been enough to offset the anemic supply of money produced by banks — Bank Money. Even after six years of pumping, State Money still only accounts for 21 percent of the total money supply broadly measured. In consequence, the Divisia M4 money supply measure is growing on a year-over-year basis at a very low rate of only 1.7 percent. And that’s why nominal U.S. aggregate demand measured by final sales to domestic purchasers is still growing at below its trend rate of 5%.

Clearly, proponents of sound money must be alarmed by such figures.