The currency speculators are restless, again. Many, like George Soros and Kyle Bass, are reportedly taking aim at the Hong Kong dollar (HKD). HKD bear circles think China’s renmimbi (RMB) will lose value against the U.S. dollar (USD) as China’s economy …

READ MORE

For the first time in recent memory, politicians and candidates alike are talking about the importance of rules-based monetary reform and the public is shifting its attention (and ire) from the bankers on Wall Street to the central bankers at the Feder …

READ MORE

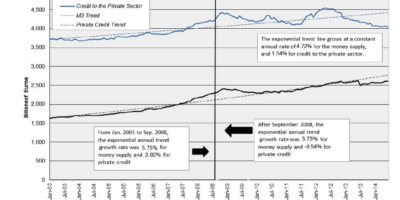

Although Austrian business cycle theory (ABCT) is a powerful price-theoretic explanation for monetary-induced booms and busts, it is not without critics. Indeed, many find ABCT implausible for two reasons. The first is that it seems to rely on indivi …

READ MORE

Ben Bernanke is obviously a very intelligent guy. And I am inclined to believe he is a good person (i.e., honest, well-intentioned, etc.). So it is a bit unsettling to find that we seem to disagree on so many fundamental issues.

READ MORE

This week, Sound Money Project fellow Nicolas Cachanosky appeared in an episode of Reinvent.Money and discusses free banking vs. central banking, competing currencies, property rights and his involvement with the Sound Money Project. Watch the intervie …

READ MORE

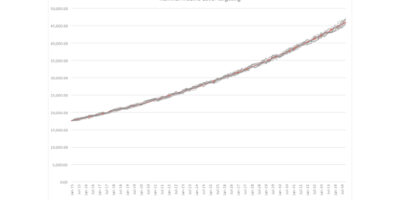

Under a level target, one can reasonably predict the level of nominal income at any point in the future. The same cannot be said for a nominal income growth target.

READ MORE

The following is an exclusive interview with Mike Gleason, Director of Money Metals Exchange and originally appeared on the Money Metals Exchange page. To listen to the interview, click here. Mike Gleason, Director, Money Meta …

READ MORE

As Steve Horwitz has shown, the insights of Austrian macroeconomics and monetary disequilibrium theory can be combined to yield a powerful paradigm for understanding how monetary policy affects the economy. Crucial to this synthesis is the neutrality …

READ MORE

In addition to turmoil in common stock markets around the world, the early weeks of the new year have been characterized by changes in—and much hand wringing about—exchange rates between currencies. Prospects for changes in currency exchange rates were …

READ MORE

Before we delve into the economic prospects for 2016, let’s take a look at the economies in the Americas, Asia, Europe and the Middle East/Africa to see how they fared in the 2014-15 period. A clear metric for doing this is the misery index. For any co …

READ MORE

Many people define sound money as being when a currency’s purchasing power is not declining, but stable. This isn’t quite right, so let’s drill down. Consider two relentless processes occurring in the economy. They are both happening at all times, but …

READ MORE

Many economists who have broadly free market views on money are sympathetic to the Austrian theory of the business cycle (ABCT). As developed in the early part of the 20th century by Ludwig von Mises and Friedrich Hayek, and further refined in recent …

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305