Follow the money… Why are we still using cash? Given the rapid advances we’ve enjoyed in digital payment technology thanks to debit and credit cards and apps like PayPal, Apple Pay and Venmo, many economists are puzzled that cash hasn’t already begun g …

READ MORE

A negative interest rate imposed by a central bank on reserve balances of commercial banks is not an interest rate at all. It is a tax. As such, like all taxes, it transfers resources from the private sector to the government sector and has a contrac …

READ MORE

By Dr. Lawrence White Let me welcome you all to the capital of Latin America. And when I say capital, I mean that much of the financial wealth of Latin America is held with banks and fund managers across the street, here in Miami. And therein lies a le …

READ MORE

The Fed should stop trying to do the impossible. It should, instead, take the more practical approach of targeting nominal income.

READ MORE

This article appeared in Globe Asia. Productivity and economic growth continue to surprise on the downside in most countries. While there is a great deal of handwringing over the so-called productivity puzzle, little attention is given to the real elix …

READ MORE

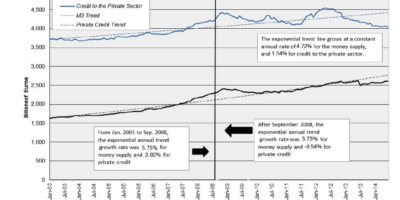

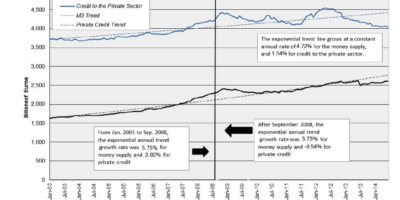

Many who are supportive of free markets blame central banks for the low interest rates that have prevailed since the end of the 2007-8 financial crisis. This is a mistake. Central banks can, in the short run and all else being equal, lower market inte …

READ MORE

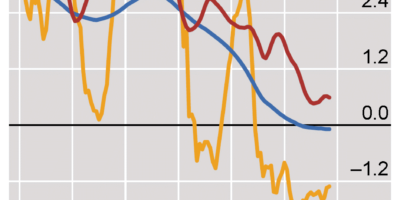

One of the open questions since the subprime crisis is whether or not the natural rate of interest is as low as the federal funds rate. The natural interest rate is the rate that equilibrates production over time. However, this concept is more subtle t …

READ MORE

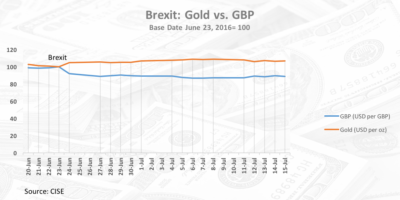

This article appeared in the June 2016 issue of Globe Asia. On June 23rd, the voters in the United Kingdom (UK) turned a collective thumbs-down on the European Union (EU). The Brexit advocates – the ones who had had enough of the EU’s mandates and regu …

READ MORE

June 23 will most likely be remembered as a turning point in Britain’s fate, as 17.4 million Britons expressed their desire to sever ties with the European Union (EU) in a historic referendum. The British, and global, economy is facing an imminent clou …

READ MORE

Bill Emmott at Project Syndicate claims that austerity is failing—just look at the poor European recovery after the financial crisis and the weak Japanese economy. Austerity is not working and therefore it is time to turn fiscal and increase government …

READ MORE

Thanks in part to high-profile and controversial public policy since the financial crisis, and to a lesser extent politicians such as Ron and Rand Paul, the monetary and financial arrangements of the United States have become a surprising source of pub …

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305