“If a large country like Argentina were to fare better under dollarization, economists would be forced to reconsider the role of central banks in monetary theory.” ~Nicolas Cachanosky

READ MORE

Argentina just elected Javier Milei, a boisterous, wild-haired economist with a pro-market agenda to transform the nation’s economy. After decades of Peronist rule, Argentina is now home to the first libertarian head of state in modern history, a feat …

READ MORE

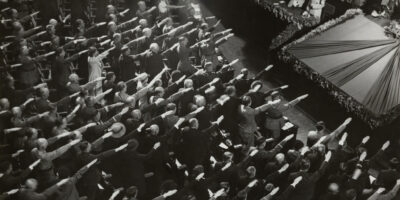

“After the First World War in Germany, peace came with hyperinflation, which obliterated all wealth. The bonds of civilization fray during hyperinflation.” ~Barry Brownstein

READ MORE

“Whichever definition one prefers to use — an expansion of the money supply which leads to price increases, or a broad and sustained increase in consumer prices — inflation is caused by the governments and central banks who control the money supply.” ~Jon Miltimore

READ MORE

“While we continue to impartially and vigilantly assess incoming data, our current analysis still points to a recession occurring before September 2024 as the most probable scenario.” ~Peter C. Earle

READ MORE

“The Fed will probably keep the fed funds target range unchanged in December. Officials previously signaled additional tightening, but things have changed.” ~Alexander W. Salter

READ MORE

“The Argentine peso has lost 93 percent of its value in just the past 4 years. Anyone who could carry out transactions using dollars always did so; holding pesos was little different from simply setting your wealth on fire.” ~Michael Munger

READ MORE

“The risk of hyperinflation in Argentina does not arise from the intention to dollarize but from a central bank that appears incapable or unwilling to exercise restraint. Argentina’s historical record shows that central bank independence is absent.” ~Nicolas Cachanosky

READ MORE

“Slowing down total spending growth (current-dollar GDP) by hiking interest rates and shrinking the balance sheet clearly mattered. Supply-side improvements do too, but they’re likely playing the role of the sidekick rather than the hero.” ~Alexander W. Salter

READ MORE

“Although Black Friday is a day of discounts, rebates, and other sales promotions, examining the price changes in the most-marketed merchandise categories may provide some insights as to what consumers face this year.” ~Peter C. Earle

READ MORE

“The constituents of the Thanksgiving Cost Index include turkey, sauces and gravies, bread, canned fruit, vegetables, and pies and cakes.” ~Peter C. Earle

READ MORE

“Most prices are higher today than they would have been had they grown at an average rate of 2 percent since January 2020. We oughtn’t pin a medal on an arsonist’s chest for putting out a fire he started.” ~Alexander W. Salter

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305