Bankers have been steadily introducing cashless banks over the last few years in response to falling customer demand for cash. With fewer people wanting to withdraw or deposit cash, the cost of offering these services gets harder to justify to shareholders.

READ MORE

Complaining about injustice is cheap; bona fide progressives put their money where their ideals are, and reap as they sow.

READ MORE

Light, as we know it today, is a commodity. That would not have been possible without the institutional prerequisites — freedom to create, own, and exchange — that built the modernity we too often take for granted.

READ MOREEconomic Education Bulletin Vol. XXX, no. 6 | April, 1990 by Richard Salsman

READ MORE

Discretionary central banking has had its day. It’s time to insist on lawful money.

READ MORE

The knowledge required to maintain monetary equilibrium is tacit and dispersed. No centralized monetary system, no matter how smart or well-intentioned its leaders, has access to that knowledge.

READ MORE

Fintech solutions are here to stay, whether banks want them or not. They shouldn’t forget that while banking is necessary, banks are not.

READ MORE

A purely private banking system is impossible today. It is worth considering for tomorrow.

READ MORE

The future has a lot of potential awe-inspiring inventions coming down the pipeline. But while daydreaming about these, we shouldn’t forget to be in awe of the invention of fractional-reserve banking. Long before fancy apps, and indeed long before the internet even, it was solving our problems and making our lives better.

READ MORE

Cryptocurrencies are still quite new and seem to just be scratching the surface of their potential. If they are to succeed — not only as a fringe medium of exchange or speculative investment, but as real competitors with government currencies — some new programmers are going to have to come along and make currencies whose digital coins are created in a much different manner than the current ones. Perhaps digital coins whose supply is determined by demand will lower volatility enough to cut the future uncertainty of prices. Those may be adopted as true media of exchange. Until that time, Hayek’s vision of private currencies will not be quite realized.

READ MORE

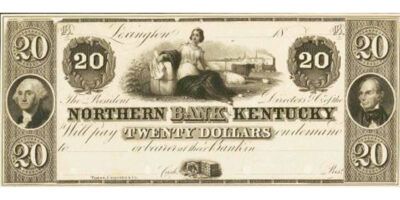

There were many problems with the state bank era. But that does not mean the suppression of state banknotes improved matters.

READ MORE

The previous post presented Hayek’s knowledge problem in the context of the economic calculation debate under socialism. We discussed the distinction (sometimes overlooked) between information and knowledge. To sum up, information is objective data suc …

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305