“Sellers at vintage markets and flea malls are creating value every bit as much as their friends and neighbors working in the coal mines or in the mills. They’re transforming lower-value assets to higher-value uses.” ~Art Carden

READ MORE

“We can’t say, ‘There is no point, because the average criminal won’t obey the law.’ Just because the average criminal doesn’t obey the law, that does not mean the marginal criminal won’t.” ~Art Carden

READ MORE

“Any decent student in a micro-principles class can tell you that interventions have unintended consequences. Here are some of the ‘protections’ from which I am suffering.” ~Nikolai Wenzel

READ MORE

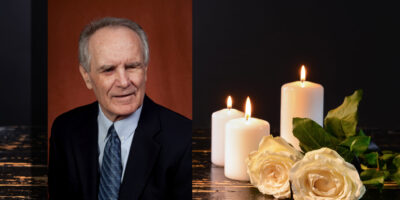

Gwartney will be remembered as a master economic educator and founder of the Economic Freedom of the World (EFW) index, which is published by Canada’s Fraser Institute.

READ MORE

“Nobody ever planned MRE cheese spread as the preferred medium of exchange between military service members. Cheese spontaneously emerged, again and again, in a process of competition between goods.” ~Emile Phaneuf III

READ MORE

“The current approach to mitigating climate change guarantees inefficiency and waste. No one knows which technologies and which companies will be most effective.” ~Paul Mueller

READ MORE

AIER’s Jason Sorens joins Kate Wand on Liberty Curious to discuss his book ‘Freedom in the 50 States.” In this 7th edition, New Hampshire, Florida, and South Dakota are the freest states in the country. Where does your state rank?

READ MORE

“Pull tabs and plastic bottles are among the innumerable wonders free people exercising free minds in free markets bring to us every day in exchange for progressively fewer fruits of our labors.” ~Art Carden

READ MORE

“Consider the choice Christmas tree farmers face. They can chop the tree and sell it, or they could let the tree continue to grow. Farmers maximize their profits and chop the tree when the tree’s yield falls below the market rate.” ~Byron B. Carson, III

READ MORE

“Adam Smith showed my students that they are constantly influenced for the better by the work of countless thousands of others whom they will never know.” ~Jeff Ziegler

READ MORE

“With limited world demand for music, the economic value of that creation, like oxygen, falls to zero. The same isn’t true for the earphones I’m using, since they can’t also be used by anybody else.” ~Joakim Book

READ MORE

“Politicians get the credit for creating the program, but bear only a small part of the cost of paying for it, leaving the vast majority of the costs to future generations.” ~Gary M. Galles

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305